Nvidia (NASDAQ: NVDA) has capitalized on the rapid proliferation of artificial intelligence (AI) technology like no other company, grabbing an almost monopolistic position in the booming market for AI chips and witnessing phenomenal growth in its revenue and earnings that has been rewarded handsomely by the market.

Shares of the graphics card specialist have shot up 115% in 2024 as of this writing. More importantly, Nvidia’s rally seems here to stay, as the company’s latest results for the first quarter of fiscal 2025 tell us. The company’s dominant position in the AI chip market helped it crush Wall Street’s expectations and deliver super guidance for the current quarter.

More specifically, Nvidia’s $28 billion revenue guidance for fiscal Q2 means that its revenue could double once again in the current quarter as compared to the year-ago period. The company is clocking such roaring growth because of its 90%-plus share of the AI chip market, as well as its terrific pricing power.

But are there any other stocks that may be able to replicate Nvidia’s stunning AI-fueled stock market performance? Are there any other companies that could start dominating the markets they operate in like Nvidia does right now? Here are two possibilities.

1. Broadcom

Just like Nvidia, Broadcom (NASDAQ: AVGO) is a semiconductor company. However, it serves a different niche. Nvidia’s graphics processing units (GPUs) can help train large language models (LLMs) because of their powerful parallel computing abilities that help perform a huge number of calculations simultaneously.

Broadcom, meanwhile, designs application-specific integrated circuits (ASICs), which, as the name suggests, are manufactured for performing specific tasks. They do not perform general computing tasks that GPUs can execute. However, as ASICs are tailored for specific purposes, they are deemed to be more efficient and powerful for the tasks they are designed to perform.

The good news for Broadcom is that the demand for ASICs for tackling AI workloads is increasing at a healthy pace. Morgan Stanley forecasts that the demand for AI-focused ASICs could increase at an annual rate of 85% through 2027 and generate annual revenue of $30 billion at the end of the forecast period.

Broadcom’s 35% share of this market puts it in a solid position to make the most of this fast-growing opportunity. It is also worth noting that the chipmaker has already built a solid base of customers who are using its custom chips for AI applications. Meta Platforms, for instance, is expected to become a significant customer for Broadcom’s custom AI chips.

JPMorgan expects Meta to be a multibillion-dollar customer for Broadcom on an annual basis, and the good part is that it isn’t the only major tech company in line to buy the latter’s chips. Alphabet is another tech titan that’s set to deploy Broadcom chips for AI workloads. Together, Alphabet and Meta are expected to deliver $9 billion worth of AI chip revenue for Broadcom in 2024, which would be triple last year’s level.

What’s more, Broadcom is forecast to sell AI chips worth $10 billion to $12 billion this year. That number could keep heading higher in the future as the adoption of custom chips for AI increases. According to an estimate by Japanese investment bank Mizuho, Broadcom’s AI-related revenue could spike to $20 billion in 2027.

Analysts are currently predicting Broadcom’s earnings to increase at an annual rate of 15% for the next five years. However, don’t be surprised to see it grow at a faster pace as its AI business gets better. With Broadcom stock currently trading at 29 times forward earnings, as compared to Nvidia’s forward earnings multiple of 43, investors can buy it at a relatively cheaper valuation right now.

That could turn out to be a smart move in the long run, as the market may reward Broadcom with a higher multiple thanks to its AI-fueled growth, which could lead to healthy stock price gains.

2. The Trade Desk

The adoption of AI in the digital advertising market is forecast to grow rapidly. By 2033, AI is predicted to account for $214 billion in annual spending in marketing, up from $20 billion last year, translating into an annual growth rate of 27%. The digital ad market is expected to grow at an annual rate of 14.5% through 2030, generating $1.04 trillion in annual revenue.

Therefore, companies that are leveraging AI to capture a bigger share of the digital ad market should ideally grow at a faster pace than the industry. The Trade Desk (NASDAQ: TTD) is one such name. The company’s revenue increased 23% in 2023 to $1.95 billion, and it started the first quarter of 2024 with stronger year-over-year growth of 28% in revenue. That was an improvement over the 21% growth it clocked in the same period last year.

For comparison, the digital ad market grew 10.7% last year, and it is forecast to notch 13.2% growth in 2024. The Trade Desk’s growth rate indicates that it is gaining more share of the lucrative market it operates in, and AI is playing an important role in this growth.

The company has been leveraging AI since 2018 to help advertisers buy the right ads and deliver them on the right platforms to ensure a stronger return on spending. It upgraded its AI tools last year with the launch of a new platform known as Kokai, claiming that it can process 13 million advertising impressions each second so that advertisers can “buy the right ad impressions, at the right price, to reach the target audience at the best time.”

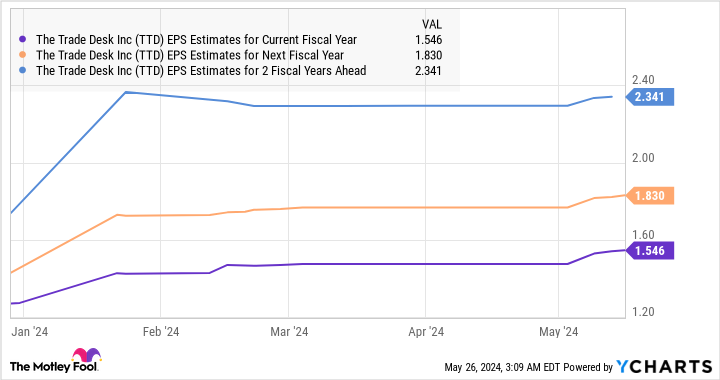

It won’t be surprising to see more advertisers turning to The Trade Desk’s programmatic ad platform to help improve audience targeting and conversion and increase their returns on ad dollars spent. Not surprisingly, analysts are forecasting a nice acceleration in The Trade Desk’s earnings growth.

This potential improvement in The Trade Desk’s earnings power because of its AI-focused ad tools could continue for a long time. Even though The Trade Desk doesn’t dominate the digital ad market, it could become a bigger player, considering that it is taking share away from larger players.

The Trade Desk may or may not end up with Nvidia-like dominance in the digital ad market, but the stock could become a long-term winner thanks to AI.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, JPMorgan Chase, Meta Platforms, Nvidia, and The Trade Desk. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Could Be the Next Nvidia was originally published by The Motley Fool

Signup bonus from