Electric vehicle (EV) demand continues to rise markedly. Last year, nearly 1 in 5 vehicles sold globally was electric. In the U.S., EV sales are expected to pop by almost 20% this year.

Most investors are familiar with Tesla. The company sold 1.8 million vehicles last year and has a $568 billion market capitalization. But there are some smaller EV stocks with significantly cheaper valuations that you should be paying attention to. They’re not without risk, but if their vehicle sales take off like Tesla’s did, there could be significant upside potential for both stocks.

This EV stock could be the next Tesla

When Rivian Automotive (NASDAQ: RIVN) went public in 2021, the market loved the stock. At the time, most companies related to a low-carbon future were seeing their valuations soar.

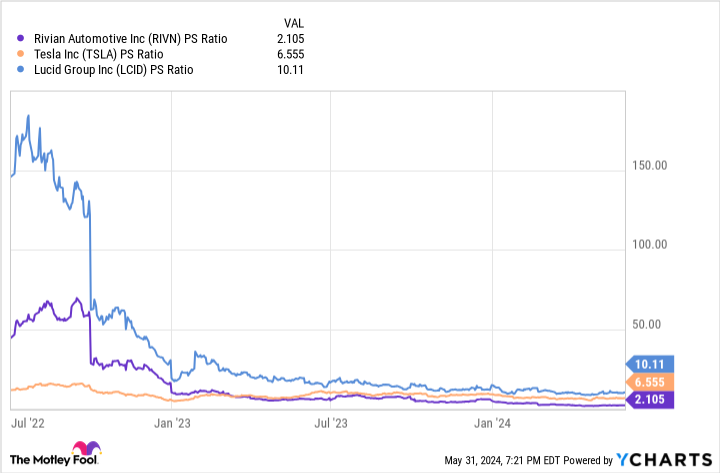

With heavy investor interest, Rivian shares debuted with a price-to-sales (P/S) ratio of around 50. Tesla, for comparison, traded at roughly 15 times sales.

Rivian’s valuation soon collapsed. As of Friday’s close, shares traded at just over 2 times sales. Tesla’s valuation came down sharply, too, but it’s still priced at 6.6 times sales. Tesla does benefit from some higher-growth business segments like its robotics and artificial intelligence (AI) divisions, but it’s also exposed to lower-multiple businesses like its charging and solar divisions. Nearly 90% of Tesla’s revenue still comes from vehicle sales, however, making it a reasonable comparable to gut-check Rivian’s depressed valuation.

Rivna also has a lot going for it among customer sentiment. Its R1T pickup earned the highest J.D. Power satisfaction ranking of any electric vehicle in 2023. And the company came out on top in a recent Consumer Reports survey, with 86% of Rivian owners saying they would buy another for their next purchase. Tesla came in at fifth place, with 74% of customers indicating that they would buy another one.

Rivian has spent the last few years laying the groundwork for its future growth runway. In March, the company unveiled its midsize R2, R3, and R3X models, with entry pricing as low as $35,000. These are the models that could make Rivian a household name over the coming years given their affordable price points. The company expects to begin shipping the R2 by 2026.

So if Rivian has such a bright future, why are shares so cheap?

As with Tesla, the company needs to prove it can significantly scale up its production and sales. While Tesla delivered 1.8 million EVs last year, Rivian delivered only around 50,000. Its 2024 production levels will actually be slightly down from last year, due in part to recently completed modifications of its plant in Normal, Ill., that forced it to be taken offline for a few weeks. The company expects the overhaul to improve efficiency and profitability, resulting in positive gross profit in the fourth quarter. And in more good news, the company recently received an $827 million grant from the state to expand the factory.

As is the case with any early-stage capital-intensive business, Rivian will also require continued access to billions in capital to realize its long-term potential. There’s no guarantee that investors will remain willing to backstop losses until that point.

But with a solid early track record of producing great cars that customers love, and a stock trading at just 2.1 times sales, Rivian should be the top choice for investors looking for the next Tesla.

RIVN PS Ratio data by YCharts

Looking for maximum upside? Consider Lucid.

With just a $10.9 billion market cap, it’s not hard to imagine the upside for Rivian when compared to Tesla’s $568 billion valuation. Lucid Group (NASDAQ: LCID) is valued at even less: just $6.6 billion. So for total upside, Lucid beats Rivian.

But there’s a catch: Lucid stock trades at 10.1 times sales versus Rivian’s 2.1 multiple. That’s mainly driven by the fact Lucid shipped only 6,000 vehicles last year, about a 10th of what Rivian accomplished. In 2024, the company expects to deliver only 9,000 vehicles.

Meager sales aren’t Lucid’s only problem. The company is burning cash at a high rate, and it doesn’t have a clearly defined path to tapping the massive midsize market.

Its new Gravity model, for instance, is expected to debut either late this year or early next year at around $80,000. Rivian’s R2 model is expected to have a base price of just $45,000. If Tesla’s history is any indication, reaching the sub-$50,000 price point is when sales figures start to take off in a meaningful way.

Lucid stock does provide investors with the most upside on paper. If it does manage to scale sales in the way Rivian has, its valuation premium could quickly prove justifiable. For example, the stock would trade at just 1.5 times sales if you assume it reaches Rivian’s 2023 revenue of $4.4 billion. Still, that’s not much cheaper than Rivian’s current 2.1 times sales multiple. Plus, Rivian is simply much further ahead when it comes to hitting an inflection point for mass sales.

Lucid stock is cheaper if you believe its growth trajectory will eventually outpace Rivian’s. But Rivian’s track record and current valuation discount make it the smarter bet today.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

2 Incredibly Cheap Electric Vehicle (EV) Stocks to Buy Now was originally published by The Motley Fool

Signup bonus from