Amidst a backdrop of fluctuating European markets and rising inflation concerns, France’s CAC 40 Index recently experienced a notable decline. In such an environment, growth companies with high insider ownership in France may offer unique stability and commitment, as insiders’ substantial equity stakes often align their interests closely with those of shareholders.

Top 10 Growth Companies With High Insider Ownership In France

|

Name |

Insider Ownership |

Earnings Growth |

|

VusionGroup (ENXTPA:VU) |

13.5% |

24.4% |

|

Groupe OKwind Société anonyme (ENXTPA:ALOKW) |

24.8% |

30.6% |

|

WALLIX GROUP (ENXTPA:ALLIX) |

19.8% |

101.4% |

|

La Française de l’Energie (ENXTPA:FDE) |

20.1% |

37.7% |

|

Adocia (ENXTPA:ADOC) |

12.4% |

104.5% |

|

OSE Immunotherapeutics (ENXTPA:OSE) |

24.9% |

92.9% |

|

Icape Holding (ENXTPA:ALICA) |

30.2% |

26.1% |

|

Arcure (ENXTPA:ALCUR) |

21.4% |

41.7% |

|

Munic (ENXTPA:ALMUN) |

29.4% |

150% |

|

MedinCell (ENXTPA:MEDCL) |

16.4% |

68.8% |

We’ll examine a selection from our screener results.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Believe S.A. operates as a digital music service provider for independent labels and local artists across various regions including France, Germany, Europe, the Americas, Asia, Oceania, and the Pacific, with a market capitalization of approximately €1.48 billion.

Operations: The company’s revenue is primarily generated through two segments: Premium Solutions, which brought in €825.12 million, and Automated Solutions, contributing €55.19 million.

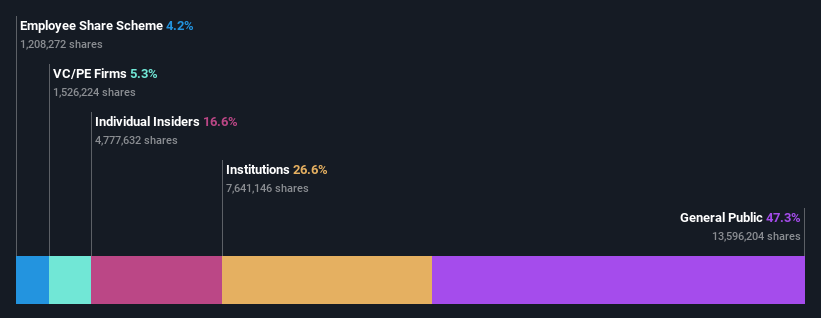

Insider Ownership: 10.4%

Believe S.A. has recently seen significant interest from potential buyers, including a failed bid by Warner Music and an accepted lower offer from a consortium led by its own CEO, indicating strong insider commitment. Despite reporting a substantial reduction in net loss to €5.48 million for 2023 and promising revenue growth of 14% per year, which outpaces the French market average, Believe is still navigating towards profitability with expected earnings growth of 74.2% annually over the next three years.

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a French pharmaceutical company that specializes in developing long-acting injectable medications across various therapeutic areas, with a market capitalization of approximately €475.34 million.

Operations: The company generates its revenues primarily from the pharmaceuticals segment, which amounted to €14.13 million.

Insider Ownership: 16.4%

MedinCell, a French biotech firm, is trading at 64.9% below its estimated fair value and is poised for significant growth with revenue expected to increase by 40.1% annually. Despite recent challenges in clinical trials, such as the Phase 3 trial for F14 not meeting its primary endpoint, there were promising improvements in secondary outcomes. The company’s high insider ownership aligns with its aggressive growth forecasts, including becoming profitable within three years amidst a volatile share price.

Simply Wall St Growth Rating: ★★★★★★

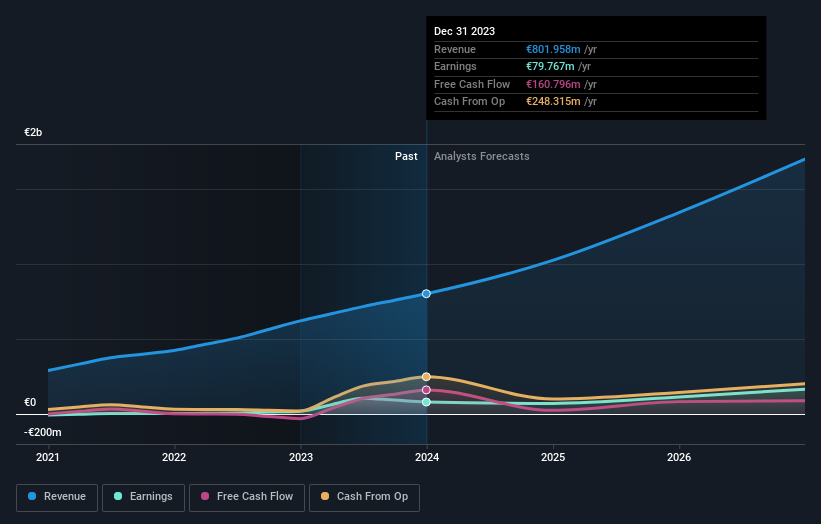

Overview: VusionGroup S.A. operates in Europe, Asia, and North America, offering digitalization solutions for commerce with a market capitalization of approximately €2.32 billion.

Operations: The company generates revenue primarily through the installation and maintenance of electronic shelf labels, totaling approximately €801.96 million.

Insider Ownership: 13.5%

VusionGroup S.A., a French growth company with high insider ownership, reported a substantial increase in full-year sales and net income for 2023, achieving EUR 801.96 million in sales and EUR 79.77 million in net income. This marks significant earnings growth from the previous year. Analysts forecast robust future growth with expected annual revenue and earnings to outpace the French market significantly. However, the company’s share price has been highly volatile over the past three months.

Turning Ideas Into Actions

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:BLV ENXTPA:MEDCL and ENXTPA:VU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Signup bonus from