(Bloomberg) — Asian stocks gained the most in a month on Monday, helped by a rally in technology shares and data showing regional manufacturing activity picking up the pace.

Most Read from Bloomberg

Equities in Australia, Japan and Hong Kong advanced, pushing the MSCI Asia Pacific Index to its biggest increase since early May. India’s stock futures jumped as exit polls indicated a resounding victory for Prime Minister Narendra Modi’s party.

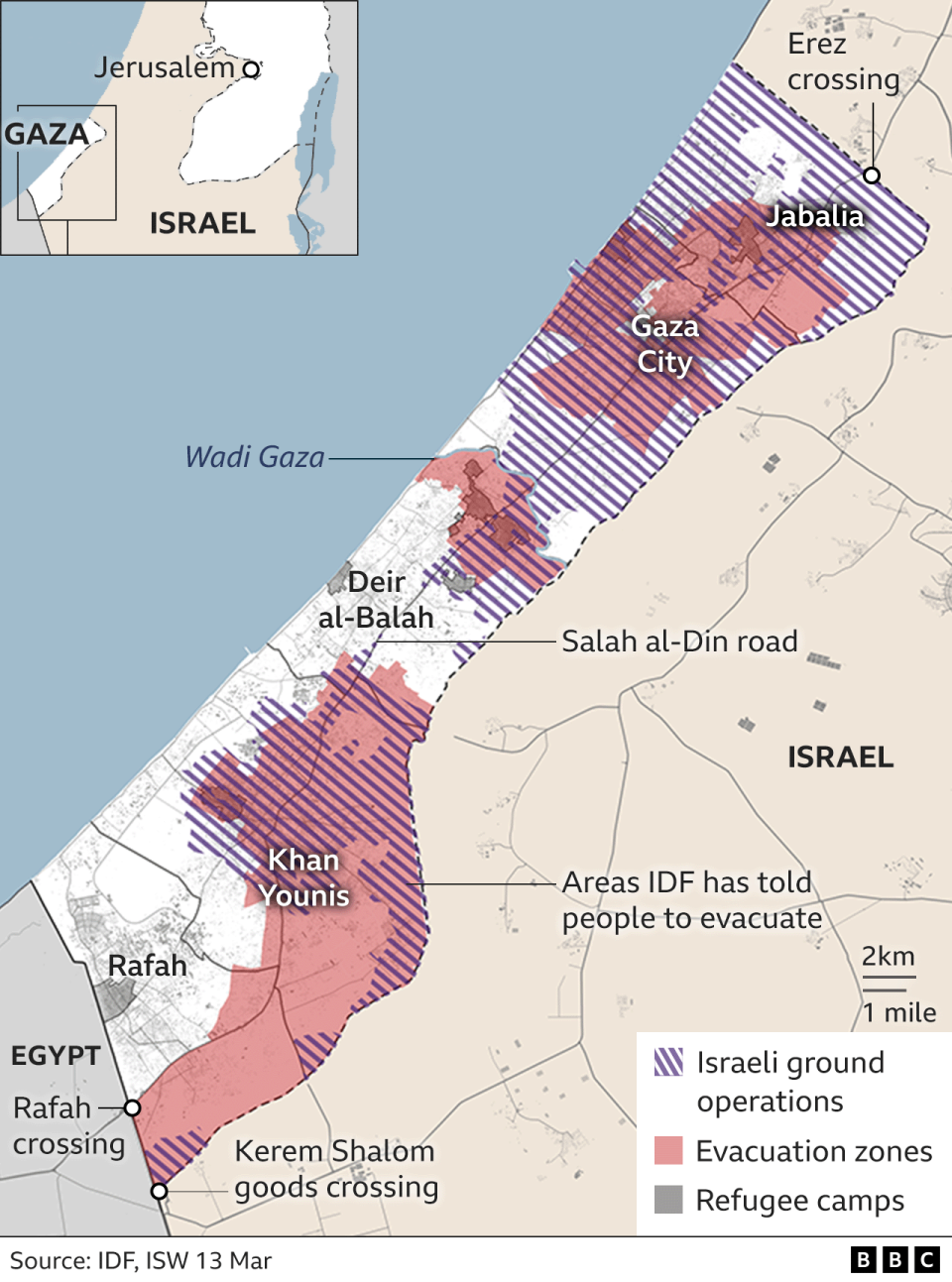

Adding to the impetus on Monday was data showing the outlook for Asia’s manufacturing sector is improving, with Japan’s factory reading rising above 50.0 for the first time in a year in May, and data from Korea and Taiwan showing gains also. But politics may inject volatility, with tensions surrounding the Middle East and the US election simmering.

Sentiment has gotten a boost from a weaker dollar in recent weeks, as investors hope the Federal Reserve will finally begin to ease policy. Friday’s reading of core personal consumption expenditures — the Federal Reserve’s preferred measure for inflation — showed the smallest increase this year.

“We are starting to see some softer data come out” in the US, Naomi Fink, a strategist at Nikko Asset Management, said on Bloomberg Television. “If we can kind of see a gradual disinflation then I think we will probably have a pretty good outcome for global markets.”

Follow Bloomberg’s Mexico election live blog here for the latest results

Australian bond yields edged lower, while those on 10-year Treasuries were little changed.

“While this is unlikely to be enough to justify an imminent Fed rate cut, we think recent data continue to underpin our base case soft landing scenario,” Solita Marcelli, chief investment officer for the Americas at UBS Group AG’s wealth management unit, wrote in a note. “This should allow the US central bank to start policy easing later this year, most likely at its September meeting, in our view.”

Oil fluctuated after OPEC+ set out a plan to restore some production as early as October, despite concerns over the demand outlook and robust supply from outside of the group.

Meantime, Saudi Aramco’s $12 billion share sale sold out shortly after the deal opened on Sunday, in a boon to the government that’s seeking funds to help pay for a massive economic transformation plan. While it wasn’t immediately clear how much of the demand came from overseas, the order book reflected a mix of local and foreign investors, people familiar with the matter told Bloomberg News.

In Mexico, Claudia Sheinbaum is set to become the country’s first female leader in a landslide victory, capitalizing on outgoing President Andres Manuel Lopez Obrador’s popularity while also inheriting rampant criminal violence and a large fiscal deficit left by his government.

This week, traders will be closely watching inflation prints across emerging markets including Indonesia, South Korea and Chile, as well as growth data in Australia and Europe. The European Central Bank may open the door to a weaker euro on Thursday as its first interest-rate cut of the cycle. A US jobs report is released on Friday.

Some key events this week:

-

Indonesia CPI, Monday

-

India S&P Global Manufacturing PMI, Monday

-

Eurozone S&P Global Manufacturing PMI, Monday

-

UK S&P Global / CIPS Manufacturing PMI, Monday

-

US construction spending, ISM Manufacturing, Monday

-

International Atomic Energy Agency board meets in Vienna, Monday

-

South Korea CPI, Tuesday

-

Germany unemployment, Tuesday

-

South Africa GDP, Tuesday

-

Brazil GDP, Tuesday

-

US factory orders, JOLTS, Tuesday

-

Australia GDP, Wednesday

-

South Korea GDP, Wednesday

-

China Caixin services PMI, Wednesday

-

Eurozone S&P Global Services PMI, PPI, Wednesday

-

Canada rate decision, Wednesday

-

Eurozone retail sales, ECB rate decision, Thursday

-

China trade, forex reserves, Friday

-

Eurozone GDP, Friday

-

Mexico CPI, Friday

-

Chile copper exports, trade, CPI, Friday

-

US unemployment rate, nonfarm payrolls, wholesale inventories, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.2% as of 12:32 p.m. Tokyo time

-

Nikkei 225 futures (OSE) rose 0.9%

-

Japan’s Topix rose 0.7%

-

Australia’s S&P/ASX 200 rose 0.8%

-

Hong Kong’s Hang Seng rose 2.1%

-

The Shanghai Composite fell 0.5%

-

Euro Stoxx 50 futures rose 1%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0853

-

The Japanese yen was little changed at 157.24 per dollar

-

The offshore yuan was little changed at 7.2605 per dollar

Cryptocurrencies

-

Bitcoin rose 0.8% to $68,351.35

-

Ether rose 0.3% to $3,795.55

Bonds

Commodities

-

West Texas Intermediate crude was little changed

-

Spot gold fell 0.1% to $2,323.99 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Matthew Burgess.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Signup bonus from