The booming demand for Nvidia‘s (NASDAQ: NVDA) artificial intelligence (AI) chips has sent shares of the chipmaker soaring in 2024. The stock has jumped an impressive 115% so far this year and that’s not surprising considering the pace at which its revenue and earnings are increasing quarter after quarter. For instance, Nvidia’s revenue in the first quarter of fiscal 2025 (for the three months ended April 28) increased by 262% from the year-ago period to $26 billion. Additionally, its adjusted earnings shot up a stunning 461% to $6.12 per share. Nvidia’s guidance of $28 billion in revenue for the ongoing quarter, up from $13.5 billion in the year-ago period, indicates that its outstanding growth is here to stay.

One AI stock has upstaged Nvidia’s recent phenomenal stock price performance: Super Micro Computer (NASDAQ: SMCI) (which is also known as Supermicro). Shares of the company are up 211% so far in 2024, nearly double the returns of Nvidia.

Let’s see why that has been the case and check if this tech stock is capable of delivering more upside.

Supermicro stock has been rewarded handsomely for its terrific growth

Just like Nvidia, Supermicro benefits greatly from the adoption of AI as this technology has accelerated the demand for its server solutions. Super Micro manufactures modular servers used for deploying the AI chips that Nvidia and its peers produce.

The company jumped ahead of bigger, more established rivals such as Dell Technologies in the production of AI servers by quickly churning out products designed specifically to incorporate popular AI graphics cards such as Nvidia’s H100 and Nvidia’s upcoming (and highly sought after) Blackwell processors. This explains why Supermicro’s revenue and earnings increased at such a tremendous pace.

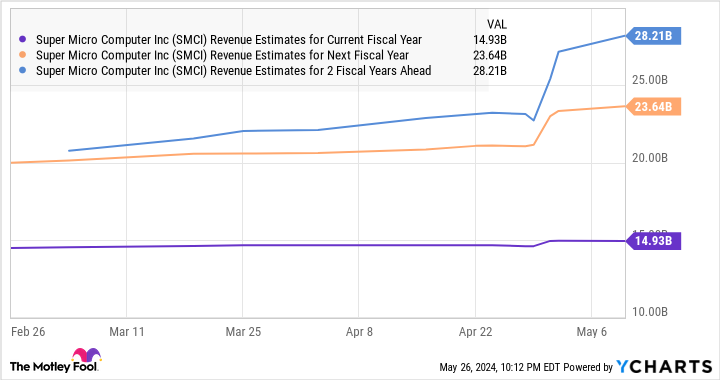

In the third quarter of fiscal 2024 (which ended on March 31), Supermicro’s revenue increased to $3.9 billion from $1.3 billion in the year-ago period — tripling year over year. The company’s non-GAAP (generally accepted accounting principles) earnings increased fourfold to $6.65 per share. The full-year revenue guidance of $14.9 billion is more than double Supermicro’s fiscal 2023 top line of $7.1 billion, while the adjusted earnings guidance of $23.69 per share is also double the reading of $11.81 per share in the year-ago period.

More importantly, Supermicro could finish 2024 with a 23% share of the AI server market, according to KeyBanc analyst Thomas Blakey. The analyst points out that the company has built a solid competitive moat that could allow it to at least sustain — if not gain — its share of the AI server market in the long run.

According to third-party estimates, sales of AI servers could jump from $40 billion in 2024 to $430 billion in 2033. Even if Supermicro manages to maintain a 20% share of this market in the long run, its top line will increase substantially over the next decade. However, it won’t be surprising to see the company cornering a bigger share of the AI server market in the long run thanks to its focus on increasing its production capacity.

The KeyBanc analyst points out that Supermicro has a monthly production capacity of 5,000 server racks, and its capacity utilization stands at 60%. However, management pointed out earlier this year that its utilization rate is climbing quickly, which is why the company is looking to increase its production capacity by investing in new facilities.

Blakey estimates that Supermicro’s capacity expansion moves in Texas, Malaysia, and Mexico could help double its production capacity. This could pave the way for solid top-line growth at Supermicro and is probably the reason why analysts are expecting its revenue to almost double over the next couple of fiscal years.

Another big reason why buying this stock is a no-brainer

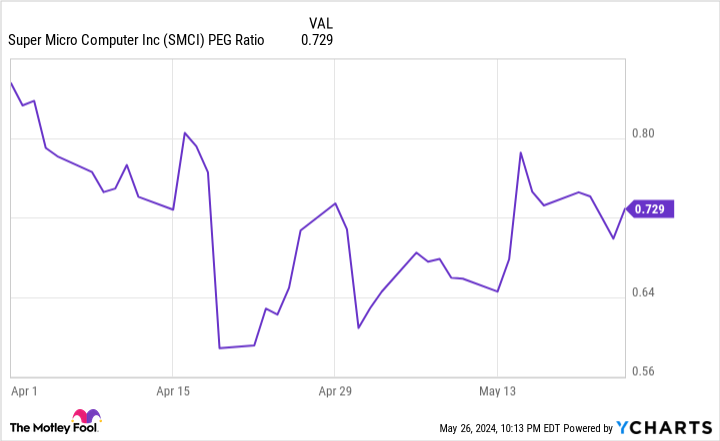

The good thing for investors is that they can buy Supermicro stock at just 24 times forward earnings despite its 2024 rally. That forward earnings multiple is lower than the Nasdaq-100‘s forward earnings multiple of 27 (using the index as a proxy for tech stocks). Even better, the stock’s price/earnings-to-growth ratio (PEG ratio) further shows that it is undervalued.

The PEG ratio helps us understand how expensive a stock is with respect to the growth that it is delivering. It is calculated by dividing a company’s trailing earnings multiple by the potential earnings growth that it is expected to clock, and a reading below 1 means that a stock is undervalued.

Given that Supermicro’s earnings are expected to clock a compound annual growth rate of over 60% for the next five years, investors are getting a good deal on this growth stock that has outperformed Nvidia this year, and they would do well to buy Super Micro Computer before it soars higher.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $677,040!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

This Artificial Intelligence (AI) Stock Has Outperformed Nvidia in 2024 was originally published by The Motley Fool

Signup bonus from