Amazon (NASDAQ: AMZN) stock has been a fantastic long-term performer. Over the last decade through May 31, shares of the e-commerce and cloud computing giant have soared 1,030%, about four and a half times the S&P 500 index’s 230% return.

Given Amazon’s huge size (it’s the fifth-largest company on the S&P 500 index), many investors probably wonder whether it’s too late to buy its stock. Below are five reasons Amazon stock is a buy now.

1. Amazon’s e-commerce business still has much growth potential

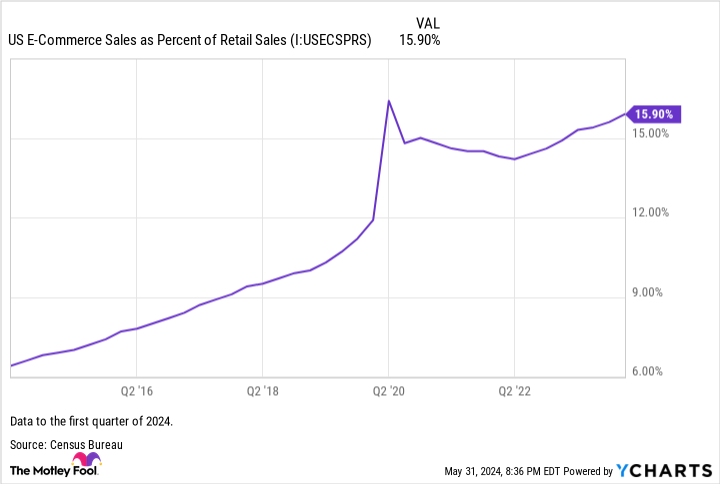

Consumers continue to increase the amount of spending they do online relative to their overall retail spending. In the first quarter of 2024, e-commerce sales accounted for 15.9% of all U.S. retail sales, according to the U.S. Census Bureau. In 2023, e-commerce sales accounted for 19.4% of total retail sales worldwide, per Statista, which predicts this percentage will rise to 20.1% in 2024.

With e-commerce sales only accounting for 15.9% of U.S. retail spending and about 19% to 20% of global retail spending, there is still much room for these percentages to grow. And Amazon should continue to be the biggest beneficiary of this secular trend because it’s the world’s largest e-commerce company. In 2023, Amazon had a nearly 38% share of the U.S. retail e-commerce market, according to Statista.

2. Its cloud computing service still has strong growth potential

Amazon Web Services (AWS) is the world’s largest cloud computing service. In the first quarter of 2024, it had a 31% share of the cloud infrastructure services market, according to an estimate by Synergy Research Group. This business — which is highly profitable — has significantly benefited from the industry’s strong growth.

AWS still has much growth potential because the industry’s long-term growth projections are robust. This is thanks in large part to the surging interest among entities of all kinds to obtain generative artificial intelligence (AI) capabilities. Synergy Research projects that the industry, which had an annualized revenue run rate of about $300 billion as of the first quarter of this year, will double in size in four years. That equates to a compound annual growth rate (CAGR) of about 19%.

3. Amazon Prime keeps getting better and adding new members

Amazon keeps adding members in the U.S. and internationally to its Prime subscription loyalty program. The company only very rarely shares its Prime membership numbers, but research firm Consumer Intelligence Research Partners (CIRP) regularly tracks U.S. Prime membership.

Prime membership grew to a record high of 180 million U.S. consumers in March, according to an estimate by CIRP. This number represents an 8% increase over the firm’s estimate for March 2023. (CIPR’s estimates represent the number of individual consumers who are Prime members, not the number of subscriptions, as members of a household often share a subscription.)

Amazon continuously adds free benefits to Prime to keep current members happy and to entice others to subscribe. The most noteworthy sweetening of the Prime program in recent years was the company transitioning its standard free delivery benefit from two days to one day for numerous items. Some items are also available for same-day free delivery.

Just this past week, Amazon added another goody to Prime: Members can get a free ongoing Grubhub+ membership (worth $120 a year) and order Grubhub restaurant deliveries directly on Amazon.com and in the Amazon Shopping app.

Amazon benefits from growth in its Prime program in two ways. First, it generates more subscription revenue. A standard membership in the U.S. costs $139 per year or $14.99 per month. Second, Prime members have been found to spend more money than nonmembers on Amazon’s e-commerce site. A 2021 survey by CIPR revealed that members spent just over twice as much as nonmembers on Amazon’s site.

4. Numerous other avenues for growth, particularly in advertising

Amazon has countless other businesses with growth potential: digital advertising, healthcare, Prime Video, and smart-home gadgets, to name a few.

The company’s advertising business is particularly noteworthy because it’s been growing rapidly and is presumably quite profitable, as is the overall industry. In the first quarter of 2024, Amazon’s advertising revenue jumped 24% year over year to $11.8 billion. This business accounted for 8.2% of the company’s total quarterly revenue of $143.3 billion.

5. Amazon stock is reasonably valued

Wall Street analysts expect Amazon’s earnings per share (EPS) to grow at an average annual rate of 28.2% over the next five years. The company’s shares are currently priced at 37.9 times its projected forward earnings. While this isn’t a cheap valuation, it’s reasonable for a stable company like Amazon that generates strong cash flows from operations.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Beth McKenna has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

Is Amazon Stock a Buy Now? was originally published by The Motley Fool

Signup bonus from