If you like dividend stocks you will probably dislike Annaly Capital Management (NYSE: NLY), even though it has a huge 13%+ dividend yield. But that doesn’t mean that the mortgage real estate investment trust (REIT) is a bad investment, just that it lacks some of the key attributes that make dividend stocks attractive (beyond a big yield, that is). Here’s who should buy Annaly and who shouldn’t.

Buy Annaly Capital Management

Annaly Capital is a mortgage REIT, which is a unique subset of the REIT sector. Property-owning REITs do similar things to what you would do if you owned a rental property, just at an institutional level, usually generating a reliable stream of income to support dividends. Mortgage REITs, on the other hand, usually buy mortgages that have been pooled into bond-like securities. This is very different from owning physical property, and the company is probably best looked at as a mutual fund-like investment focused on the mortgage sector.

That said, Annaly is a good way to get direct exposure to mortgage securities. REITs like Annaly usually use leverage, as well, in an attempt to enhance returns. In that way, it is like mortgage exposure on steroids. There are investors who are actually looking for just such exposure, but they tend to be institutional investors that use asset allocation models and focus on total return and not income. Total return, importantly, assumes the reinvestment of dividends.

Institutional investors tend to be in the category of pension plans, endowments, family offices, and insurance companies. Most investors will not fall into this group.

Hold Annaly Capital Management

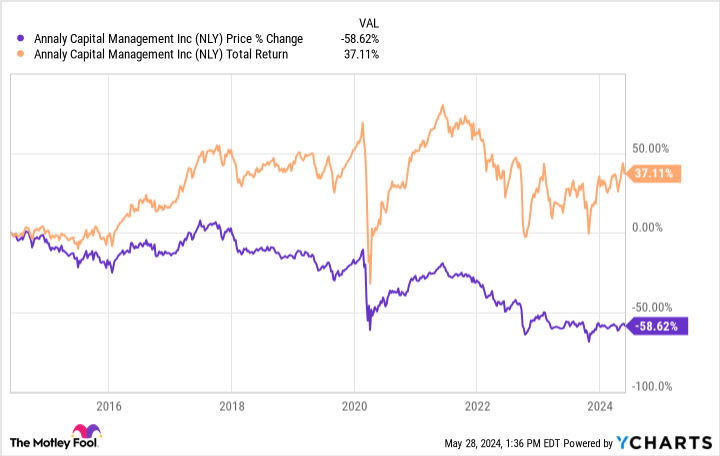

If you own Annaly and think of it as a way to get exposure to mortgage securities, then there are two important issues for you to consider — total return and dividend reinvestment. You really shouldn’t own Annaly if you don’t have a grasp on what to expect with regard to these two things. The graph below will explain a lot.

Over the past decade Annaly’s share price, the purple line, has fallen nearly 60%. However, because of the huge dividend yield, dividend reinvestment over that time would have turned that loss into a nearly 40% gain. Don’t underestimate the importance of that — the percentage point difference between a loss of 60% and a gain of 40% is 100%! If you plan to hold Annaly, you should be keyed in on the power of dividend reinvestment.

Sell Annaly Capital Management

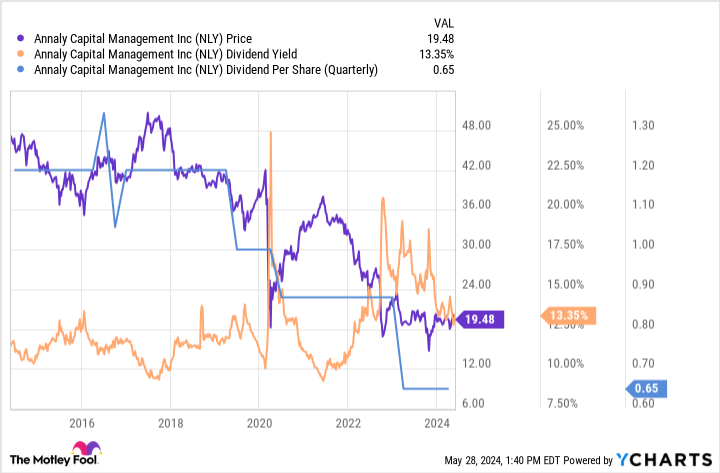

One more graph, however, will explain why buying Annaly because of the yield will likely leave you disappointed. The first thing to notice in the graph below is the orange line, which represents dividend yield. It has been roughly 10% or higher for the vast majority of the last 10 years. In other words, Annaly has shown up on dividend yield screens for a long time.

The problem is that the purple and blue lines, which represent the stock price and the quarterly dividend, respectively, are both heading steadily lower. Basically, investors looking for income would have been left with less income and less capital, which is the exact opposite of what any investor trying to live off of the income their portfolio generates would want. Thinking back to the first chart, showing total return, reinvesting Annaly’s dividends is the difference between positive returns and negative returns.

If you need to use the income your portfolio generates to pay the bills, you will want to avoid Annaly. It just isn’t a reliable income stock. In fairness, though, it isn’t really meant to be a reliable dividend stock.

Don’t be tempted by Annaly’s huge yield

At the end of the day, Annaly Capital isn’t a yield story. It is a total return story and an asset allocation story. That changes the type of investor that should consider buying or holding it. And, perhaps most important, it means that income-focused investors should either sell it or, better yet, just avoid it in the first place.

Should you invest $1,000 in Annaly Capital Management right now?

Before you buy stock in Annaly Capital Management, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Annaly Capital Management: Buy, Sell, or Hold? was originally published by The Motley Fool

Signup bonus from