The semiconductor market has returned to growth of late following a tough 2023 when the industry’s revenue fell 8% to $527 billion thanks to the weak demand for smartphones and personal computers (PCs). Semiconductor sales increased 11.6% in the fourth quarter of 2023, driven mainly by the strong demand for chips needed to train and deploy artificial intelligence (AI) models.

More specifically, the AI chip market generated almost $52 billion in revenue in 2023, accounting for almost 10% of the overall market based on the total revenue the industry logged last year. The AI chip market is projected to clock an annual growth rate of just over 40% through 2032, generating annual revenue of $1.11 trillion at the end of the forecast period.

So, the solid demand for AI chips is going to be a huge growth driver for the semiconductor market over the next decade. However, chipmakers haven’t been able to keep up with the booming demand. Nvidia (NASDAQ: NVDA), for instance, saw such huge demand for its popular H100 AI graphics card that customers were waiting for as long as 11 months to receive the chip.

On its recent earnings conference call, Nvidia management said the supply for its new flagship AI GPU (graphics processing unit), the H200, and the next-generation Blackwell chips that are set to hit the market is behind demand. Management added that “demand may exceed supply well into next year,” suggesting that AI chips are going to be in short supply.

This bodes well for Nvidia. Let’s look at the reasons why.

An AI chip shortage is good news for Nvidia investors

Nvidia is the leading player in the AI chip market with an estimated share of 95%. The impressive thing is that Nvidia has managed to nearly monopolize this fast-growing niche despite supply shortages. Rivals such as Intel and AMD are currently bit-part players in this space, chiefly because Nvidia is exercising solid control over the AI chip supply chain.

More specifically, Nvidia reportedly consumes 60% of the chip-on-wafer-on-substrate (CoWoS) packaging capacity of its foundry partner Taiwan Semiconductor Manufacturing (NYSE: TSM), popularly known as TSMC. CoWoS packaging is playing a central role in the manufacturing of AI chips as it allows chipmakers to stack multiple silicon dies into a single platform to produce high-performance chips capable of tackling AI workloads.

It is the shortage of CoWoS packaging that’s keeping Nvidia from meeting the huge demand for its AI chips. Not surprisingly, TSMC is rapidly ramping up its CoWoS packaging capacity. The Taiwan-based foundry giant ended 2023 with a monthly CoWoS capacity of 15,000 units. That number is expected to triple in 2024 to a range of 45,000 to 50,000 units.

Considering that Nvidia is projecting a supply shortage to persist into next year despite TSMC’s capacity increase indicates demand for Nvidia’s chips is extremely strong. That’s not surprising, as the company revealed that all the major cloud service providers are in line to buy its chips when it announced the Blackwell chips earlier this year.

What’s more, supply chain rumors suggest that shipments of Nvidia Blackwell chips could jump by three to four times in 2025 as compared to this year’s levels. All this suggests that Nvidia could capture a bigger share of TSMC’s CoWoS packaging capacity and may leave little for its rivals. So, even a shortage of AI chips and long waiting times is unlikely to cause Nvidia to lose customers, as they may not have alternative avenues to turn to when looking to buy AI chips.

The company could maintain its immense pricing power

Nvidia’s dominance of the AI chip supply chain and its technological advantage over rivals in this market explains why it is able to charge a hefty premium when compared to rivals’ products. For instance, its H100 GPU reportedly costs four times as much as AMD’s flagship MI300X AI accelerator.

Meanwhile, Nvidia’s upcoming Blackwell systems are expected to start from $70,000 for a single GB200 Superchip (which combines a GPU and a central processing unit) to a whopping $3 million for complete server systems. This probably explains why KeyBanc analyst John Vinh is expecting Nvidia’s data center revenue to shoot up to a whopping $200 billion next year, which would be a massive increase over the $47.5 billion revenue it generated in the previous fiscal year.

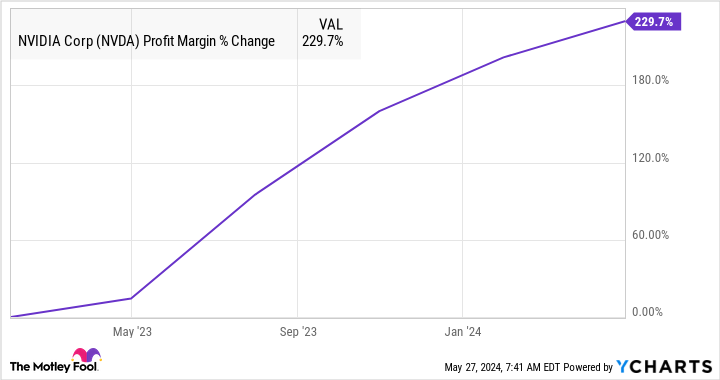

More importantly, Nvidia’s outstanding pricing power has led to a huge jump in its margins in the past year-and-a-half.

NVDA Profit Margin data by YCharts

And now, the arrival of Blackwell chips should continue to boost Nvidia’s top and bottom lines nicely thanks to a combination of strong volume and pricing. That’s why investors looking to capitalize on the terrific demand for AI chips would do well to buy Nvidia, as the supply shortage in this market is all set to work in its favor.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

1 Monster Opportunity in the Global Chip Shortage was originally published by The Motley Fool

Signup bonus from