Shares of UiPath (NYSE: PATH) crashed after the robotic process artificial intelligence (AI) automation software company saw its CEO resign following the company’s issuance of disappointing guidance.

The string of bad news has some investors re-evaluating their investment thesis for this AI stock. Let’s look at UiPath’s most recent results, its change of leadership, and whether or not it’s time to buy the stock.

A disastrous outlook

For its first quarter, UiPath’s revenue rose 16% year over year to $335 million, which was slightly ahead of analyst expectations. Its annualized renewal run rate (AAR) climbed 21% year over year to $1.51 billion and is a key indicator for UiPath.

The company defines ARR as annualized invoiced amounts from subscription licenses as well as maintenance and support obligations. ARR does not include invoiced amounts associated with perpetual licenses or professional services. On a basic level, ARR is similar to what most companies would call bookings. UiPath management claims it is a good predictor of future revenue, although lengths of contracts do impact the number. “[ARR] illustrates our ability to acquire new subscription customers and to maintain and expand our relationships with existing subscription customers,” management explains in earnings releases.

Dollar-based net retention was 118%, once again showing solid growth within the customer base. The quarter ended with 10,800 customers, which was a decline of 30 from the fourth quarter. The company said it continues to see attrition among smaller customers. Gross retention was 98%.

Customers with $100,000 or more in ARR increased by 38 to 2,092 in the fourth quarter, while those with $1 million or more in ARR stayed at 288 quarter over quarter. Meanwhile, the company said it added a record number of customers with $5 million in ARR.

Looking ahead, UiPath said it expects increased deal scrutiny from potential customers and a longer sales cycle as large multiyear deals become the preferred option. This also means that revenue-recognition accounting rules could impact revenue growth rates far more than ARR growth rates. The issue with how revenue is recognized is something that other software companies have had to deal with, including Veeva Systems.

For the second quarter, the company expects revenue in the range of $300 million to $305 million, which was well below the $340 million analysts were expecting. ARR was forecast to be between $1.543 billion to $1.548 billion.

For the 2025 fiscal year, UiPath forecast revenue in the range of $1.405 billion to $1.410 billion, which was well below the $1.56 billion analyst consensus. It is looking for ARR between $1.660 billion and $1.665 billion.

In conjunction with its earnings report, the company announced that CEO Rob Enslin was stepping down and that founder Daniel Dines would retake the reins of the company. Dines had been serving as UiPath’s chief innovation officer.

The most recent quarter was OK, but the company once again showed that while it has been doing a good job of expanding business with existing customers, it continues to struggle to add new customers. The quarter reversed the recent revenue growth acceleration, and management’s outlook was very poor.

The company said the macroeconomic environment played a role in its guidance, but it also admitted some errors, including how it had structured the compensation for its sales force. It said it will look to fix those issues while trying to become more customer-centric and innovating with customers.

It also plans to continue to leverage partnerships to help drive customer growth. However, it is disappointing that its partnerships have still not resulted in adding more net customers.

Is it time to buy the dip?

When a company runs into growth issues like UiPath is experiencing and changes leadership, the smartest thing it can do is reset expectations to very low levels. The reason is that in the near to medium term, stocks are often driven by expectations. Shareholders will feel pain in the immediate aftermath, but setting a low bar and then proceeding to jump over it during the next year will often lead to a nice rebound in the stock.

Given the company’s still-solid net dollar retention rate, there is enough reason to believe this is what the company has done.

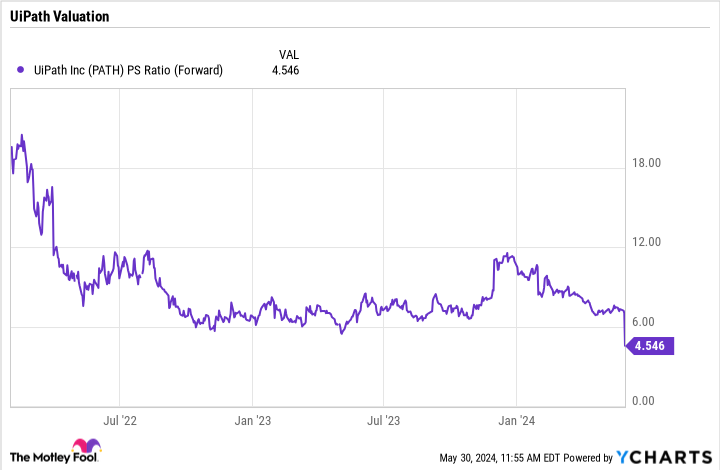

Meanwhile, from a valuation perspective, UiPath’s forward price-to-sales ratio sits at 4.5. Some estimates have likely not been updated yet, which might take the P/S closer to 4.8. Either way, that is an incredibly cheap valuation for a high-margin software company with a strong balance sheet and that generates cash.

Take out its $1.9 billion in cash and marketable securities, and the stock trades at an enterprise-value-to-forward-sales ratio of under 3.5 based on its current revenue guidance.

Right now, UiPath has been thrown into the bargain bin, and if the company can leap over its reset expectations, there could be a lot of upside in the stock from here over the next year. There appears to be low-hanging fruit that the new CEO can pick to help turn around its performance, including improving incentives to its sales force.

Over the longer term, though, the company needs to show that AI is a tailwind for its business and not a potential disruption to it. The new CEO has been involved in the innovation part of the business, so he will need to execute on this front.

Given its valuation and likely low bar, I’d be a buyer of the stock on this dip.

Should you invest $1,000 in UiPath right now?

Before you buy stock in UiPath, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UiPath wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Geoffrey Seiler has positions in UiPath. The Motley Fool has positions in and recommends UiPath and Veeva Systems. The Motley Fool has a disclosure policy.

UiPath Shares Plunge as Its CEO Resigns. Time to Buy the Dip? was originally published by The Motley Fool

Signup bonus from