Over the past decade, many fintech stocks have done extraordinarily well. These investments combine the huge addressable markets of financial stocks with the rapid growth rates of tech stocks.

The only problem is that it can be difficult to determine when to buy fintech stocks. Their valuations are often outrageous, requiring investors to pay a steep price for growth.

Fortunately, two of the market’s best fintech stocks are now on sale. If you’re looking for fintech bargains with big upside, these companies are for you.

Follow Warren Buffett by investing in this growth machine

Warren Buffett is one of the greatest investors of all time, and it pays to pay attention to what he’s buying. Buffett’s holding company, Berkshire Hathaway, holds a roughly $1.3 billion position in a little-known fintech stock called Nu Holdings (NYSE: NU).

Despite a $56 billion market cap, most U.S. investors haven’t heard of Nu. That’s because it operates entirely outside the U.S. Its main focus is Latin America, where it has a presence in Brazil, Colombia, and Mexico.

What kind of fintech business is Nu? On the surface, it’s a traditional bank. Users can open a checking or savings account through Nu, or even buy insurance and brokerage products.

The trick is that all of these services are available via smartphone. That’s a huge deal in Latin America, where a few powerful banks have controlled the market for decades. These incumbents charged high prices for simple financial products both because of their market power and because they operated vast and expensive infrastructure, like physical branches.

With a digital-first approach, Nu can offer its services to a huge number of people at a lower cost. Plus, it can roll out new services much faster than the competition. All its customers need to do is click a few buttons.

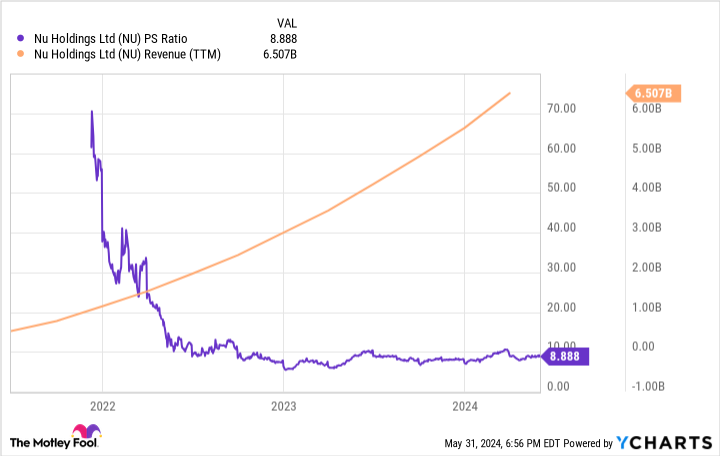

Nu already has an incredible track record of success. Over the past decade, it has gone from essentially zero customers to nearly 100 million. Sales have skyrocketed, sending the company’s price-to-sales ratio sharply lower.

At recent prices, shares trade around 9 times sales. That’s expensive for a bank stock. But in reality, Nu is a fintech stock. It’s the perfect example of how fintech stocks can combine the scale of the financial industry with the rapid growth of tech companies.

This year, analysts expect the company to grow sales at an astounding 43%. In 2025, sales are expected to jump by 22%. With a proven business mode and a huge runway of growth, it’s no surprise that Berkshire and Buffett are long-term holders of the stock.

NU PS Ratio data by YCharts

Bet on Bitcoin with this cryptocurrency stock

Want to bet on the rise of Bitcoin? You can, of course, buy Bitcoin directly. But there are other ways to get involved. Investing in Block (NYSE: SQ) is a great opportunity. Its current valuation is just screaming for attention.

As its name suggests, Block is focused on the growth of blockchain technologies like Bitcoin. Its Square payment platform, for example, allows merchants to accept cryptocurrencies as a form of payment. Its peer-to-peer lending service Cash App, meanwhile, has millions of users already buying, selling, and transacting in cryptocurrencies. It also runs TBD and Spiral, two business segments focused on the long-term adoption of Bitcoin in particular.

Finally, Block acquired a controlling interest in the music streaming service Tidal in 2021. While not obviously related to blockchain, the creator industry is one of the biggest opportunities to deploy blockchain-enabled micropayments. All of this is to say that Block is all in on Bitcoin and blockchain in general.

SQ PS Ratio data by YCharts

Just like Nu, Block has a strong history of revenue growth. But in late 2021 and early 2022, revenue growth briefly slowed. The company also flipped from generating a profit to posting quarterly losses. The market punished the stock for these developments, sending the price-to-sales ratio from over 10 to just 1.7. Also during that time period, Bitcoin sales to customers began appearing on Block’s income statement as revenue. The explosion in Bitcoin revenue is a great thing for the company’s long-term future, but this mix shift to lower-margin sales also contributed to the market’s decision to price the stock cheaper on a price to sales basis.

Founder Jack Dorsey was brought back on as CEO to right the ship in 2023, and last quarter, Block returned to profitability. Growth rates have also recovered somewhat, yet the company’s valuation remains depressed.

Block is certainly exposed to some exciting sectors that should maintain high growth for years, if not decades. It also has a portfolio of quality businesses that, when run well, produce a profit. The market, however, hasn’t quite caught on to the company’s turnaround success.

Don’t be surprised to see Block stock perform very well in 2024 if it can stack consecutive quarters of growth and profitability. If the market doesn’t reward this success, it only adds even more long-term upside to the stock.

Should you invest $1,000 in Nu Holdings right now?

Before you buy stock in Nu Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nu Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Ryan Vanzo has positions in Bitcoin. The Motley Fool has positions in and recommends Berkshire Hathaway, Bitcoin, and Block. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

These 2 Fintech Stocks Are Set to Soar in 2024 and Beyond was originally published by The Motley Fool

Signup bonus from