Although its stock is up by close to 2,000% over the last 10 years, MercadoLibre (NASDAQ: MELI) still has relatively low name recognition in the U.S. today. Some might rightly call it the Amazon of the Amazon. But for me, I call this Latin American giant in e-commerce and digital financial services a no-brainer stock to buy for the long haul.

MercadoLibre operates in Brazil, Mexico, Colombia, and other nations in the region. According to Statista, 266 million people in Latin America had adopted e-commerce as of the end of 2023. By 2029, that number is expected to increase by 57% to about 420 million. Adding nearly 200 million users in a six-year span could do wonders for a platform such as MercadoLibre.

The company had a substantial base of nearly 54 million active buyers (people who made at least one purchase during the quarter) as of the first quarter of 2024. That was enough to make it a leading e-commerce player in the region. But it’s not too big to grow significantly from here, especially considering Statista’s forecast.

E-commerce adoption doesn’t happen in a vacuum. When transactions are digital, there’s also a need for digital financial solutions (fintech). And because items need to be shipped to buyers, logistics networks are required as well. MercadoLibre excels at providing these things, too.

According to the research group Market Data Forecast, fintech in Latin America is just a $16 billion annual market right now — still relatively young. But these same researchers believe the Latin American fintech space could be valued at $52 billion by 2029. In short, just like e-commerce, fintech’s growth in Latin America is exploding higher.

MercadoLibre is doing well with its fintech segment, Mercado Pago: 49 million people use the platform every month, and it’s on pace to process over $150 billion in payment volume this year.

Turning to logistics, MercadoLibre can deliver most of the products ordered on its platform in two days or less, which is a big accomplishment in this region.

With both e-commerce and fintech services expected to grow at incredible rates in Latin America over the coming years, MercadoLibre’s stock could be a no-brainer buy, as it’s one of the companies best-positioned to benefit from the trend.

Two more reasons to give MercadoLibre a close look

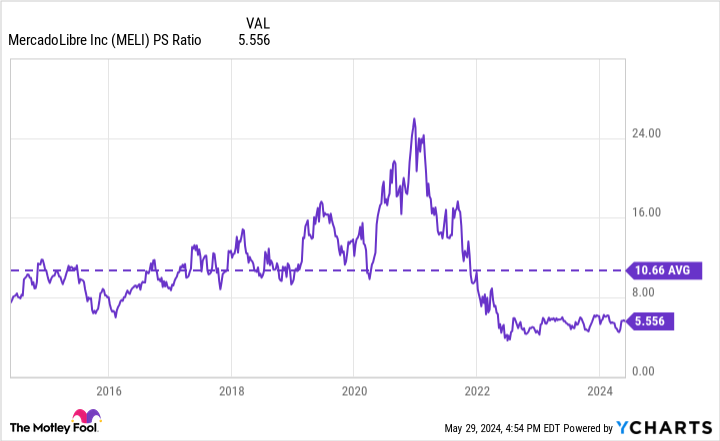

I won’t name names, but I believe many large-cap stocks are overvalued right now. MercadoLibre’s valuation is quite reasonable, though. As of this writing, it trades at less than 6 times its trailing sales and at almost half of its average valuation for the past decade.

This valuation is quite reasonable considering how much growth potential the company has. In addition, its profits could be on the verge of rocketing higher.

For starters, like many of its e-commerce peers, the company is leaning into advertising — and that business is absolutely taking off. In the first quarter, ad revenue was up 64% year over year. Selling advertising space is typically a way for online businesses to boost profits, and that could be the case here as well.

I’ll give one more example of MercadoLibre’s potential profit boosters: One of the company’s largest markets is Argentina, where the economy has been held back for decades due to out-of-control inflation. But its recently elected president, Javier Milei, intends to change this, and early results are promising. Argentina’s outlook could finally be improving, and if it does, that could give another boost to MercadoLibre.

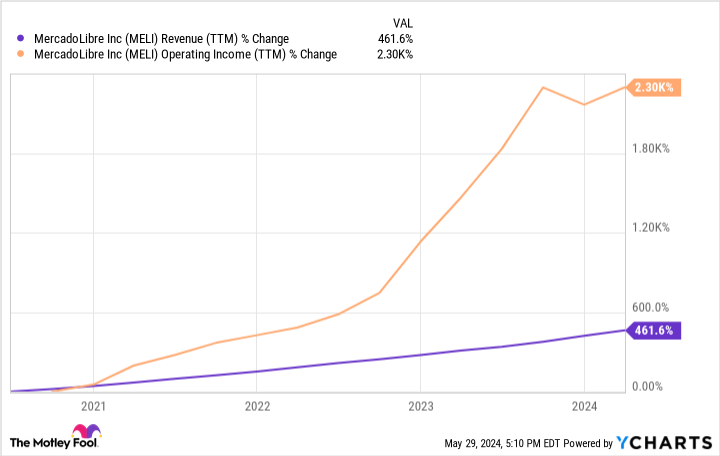

Boosting profits isn’t just a future aspiration for MercadoLibre — it’s a present-day reality. Over the last five years, its improvements in operating income have far outpaced its stellar revenue growth.

The next milestone on a long highway

Only a limited number of companies have ever reached a market capitalization of $100 billion. But I fully expect MercadoLibre to be one of them within the next few years. That’s not a very bold claim: The company is already valued at about $87 billion as of this writing. To hit $100 billion would only require it to grow by another 15% or so.

However, I don’t think $100 billion will be the high point for this business. It will merely be the next milestone for MercadoLibre as it continues to deliver exceptional returns for shareholders over the long term.

Should you invest $1,000 in MercadoLibre right now?

Before you buy stock in MercadoLibre, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jon Quast has positions in MercadoLibre. The Motley Fool has positions in and recommends Amazon and MercadoLibre. The Motley Fool has a disclosure policy.

This No-Brainer Stock Could Join the $100 Billion Club Within the Next Couple of Years was originally published by The Motley Fool

Signup bonus from