The market has been red-hot this year, with the S&P 500 index hitting new highs recently. This surge has been led by growth stocks, as the economy remains solid and the potential of artificial intelligence (AI) is still in its early days.

Stocks are performing well, but one growth stock that still looks like a solid buy right now is Amazon (NASDAQ: AMZN). If you have $5,000 to invest right now, Amazon could be a fantastic buy. Let’s look at what makes the stock an attractive investment today.

E-commerce and cloud juggernaut

When looking at the largest growth stocks in the S&P, the one thing that most of them have in common is that they have become dominant players in a particular area. Examples of this include Apple in smartphones, Alphabet in search, and Nvidia with graphic processing units (GPUs).

However, Amazon has become a dominant leader in two fields: e-commerce and cloud computing.

In e-commerce, Amazon has managed to capture a dominant market share of nearly 38%, according to data analytics website Statista. That is well ahead of its next largest competitor Walmart with just over 6% share.

Amazon’s dominance can be attributed to its vast warehouse and logistics network that can get both its own products as well as third-party offerings on its platform to customers quickly and cheaply. The amount of goods on its platform is staggering, which gives consumers an unmatched amount of options. The reviews on the company’s website as well as Amazon’s return policies also should not be overlooked, as they help give consumers confidence in their purchases.

Taken together, this has created a huge moat for the company. At the same time, e-commerce is still growing around the world at a solid clip, with Boston Consulting Group projecting a 9% compound annual growth rate through 2027.

Amazon should continue to be a major winner as e-commerce continues to grow and take share from traditional brick-and-mortar retailers.

Meanwhile, Amazon is also the No. 1 player in cloud computing with the Amazon Web Services (AWS) platform, which has about a 32% market share. Global cloud infrastructure service has been on the rise as companies continue to move from on-premise solutions to the cloud along with the rise of AI.

This helped AWS see 17% revenue growth in the first quarter of this year to $25 billion. While strong, this did trail the growth of Microsoft Azure and Google Cloud. The chief challengers grew by 31% and 28%, respectively.

AI opportunity

Throughout the years, Amazon has shown it is determined to win and that it is willing to spend money to ensure it happens. So while the company may currently trail in the AI race, I would not expect this to continue.

The company is already starting to ramp up capital expenditures to build new data centers to meet increasing demand for generative AI. On its most recent earnings call, the company said that while it will have to spend money up front, it will lead to improved operating margins and free cash flow down the line.

Amazon has also begun selling customers large language models (LLMs) to help them in their AI efforts. Through its Bedrock solution, the company offers customers a number of foundation models from both itself and AI start-ups, while its SageMaker offering helps customers create their own AI models by doing such tasks as preparing data for AI usage and helping train models more quickly.

The company has also developed its own AI chips in Trainium and Inferentia, although taking share away from Nvidia will not be easy given the dominance of its Cuda software platform. Amazon right now is likely more at the lower end of the market, but given the company’s deep pockets and its strategy, it’s best not to underestimate it in this area.

Applying AI to its e-commerce platform is another opportunity. The company has already introduced some AI initiatives, such as making it easier for third parties to create listings through a new AI listing tool where all a customer needs is a URL to their existing website. AI can be applied to many areas of the company, from better product recommendations, to better product search, to helping improve logistics and inventory management.

Inexpensive stock

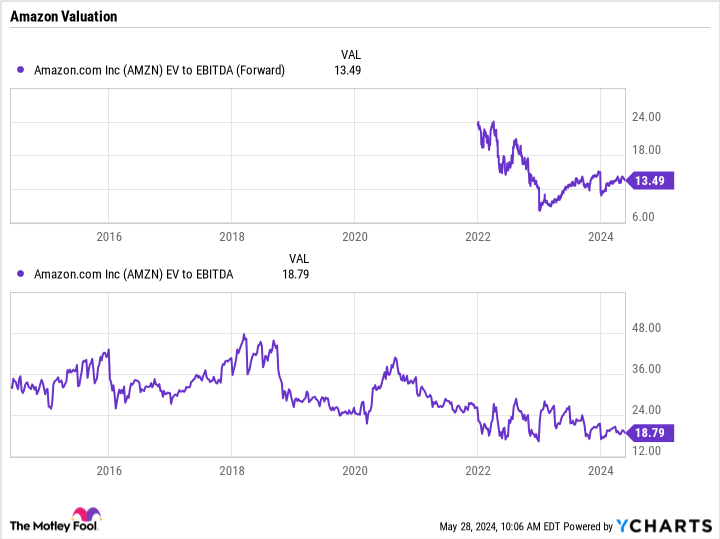

Given Amazon’s willingness to spend to build out its logistics network and data centers, my preferred method of valuing the company is using an enterprise value (EV)-to-EBITDA multiple. This takes into consideration the company’s net debt, while excluding noncash items such as depreciation. This metric reflects a company’s cash-generating ability and operational efficiency while also considering its debt and cash balances.

From that perspective, the stock trades at an attractive 13.5 times forward multiple. That is much lower than the 24x multiple it traded at in the recent past.

While Amazon hasn’t been an immediate AI winner, the company is investing heavily in the area. Meanwhile, history has shown that the company is willing to spend big to win big in the long run.

With this growth stock trading at a historical discount and having a big AI opportunity in front of it, now is great time to invest $5,000 or whatever amount is best for you.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Nvidia, and Walmart. The Motley Fool has a disclosure policy.

The Ultimate Growth Stock to Buy With $5,000 Right Now was originally published by The Motley Fool

Signup bonus from