Can you remember the first time you used the internet? For some of us, it feels like a lifetime ago that we were installing a dial-up internet program for the first time. It was slow. It was glitchy. And it was hard to imagine how something with so many obvious deficiencies was going to change the world.

However, the internet improved incessantly from the start, while simultaneously transforming multiple trillion-dollar industries. And history might be on the brink of repeating itself.

Xometry (NASDAQ: XMTR) is one of the most obscure businesses on the stock market. But it might be on the cutting edge of a very lucrative shift in manufacturing.

Why this is an intriguing investment idea

Most people don’t interact with the manufacturing world on a daily basis. But it’s nonetheless enormous. Xometry addresses six manufacturing processes including injection molding and 3D printing. And these six areas represent a $260 billion opportunity. Expanding into other areas would increase the size of its market.

Unlike most people, many companies do regularly interact with the manufacturing world. They need custom parts, prototypes, and entire production runs.

Many manufacturing shops are small and the space is fragmented. Therefore, it can be hard for companies to find the most capable shops at the best price points. It can be even harder to communicate manufacturing needs, get bids, and start production in a timely fashion.

Xometry provides an online marketplace powered by artificial intelligence (AI) to solve all of these problems. The company strives to provide a platform that makes it easy to submit a job proposal. The AI immediately prices the job. If the buyer accepts the price, then Xometry outsources the job at a lower price to its network of small shops. Then, it profits from the difference in what it charges and what it pays.

I love this investment idea because Xometry is addressing a huge market, which could be lucrative. But it’s also enough of a niche as to not invite too much unwanted attention and competition. Moreover, as it grows, it can develop a network effect that could become a competitive advantage.

Furthermore, I believe that it’s logical to expect this idea to grow, just like the internet has for decades. It seems likely that the digital revolution for manufacturing will only progress over time. Therefore, Xometry should only have a tailwind at its back. As companies give it a try for the first time and realize it really works, adoption for its platform should soar.

But what about the execution?

Not all good ideas are good investments — companies must also execute well for a long time. When thinking about Xometry’s trajectory, it’s important to consider both the attractiveness and the effectiveness of its platform.

Starting with its attractiveness, Xometry’s user base is growing at an impressive pace. In 2023, it added about 15,000 net new active buyers for 36% year-over-year growth. And in the first quarter of 2024, it added about 3,000 more.

Xometry is growing well on the supplier side of its marketplace as well — the small, independent shops that do the jobs. As of the first quarter, it has 3,400, up 36% from the prior-year period.

In summary, I’d say Xometry’s platform is attractive to businesses and manufacturers because of how fast it’s growing.

Turning from its attractiveness to its effectiveness, I believe investors should be encouraged here as well.

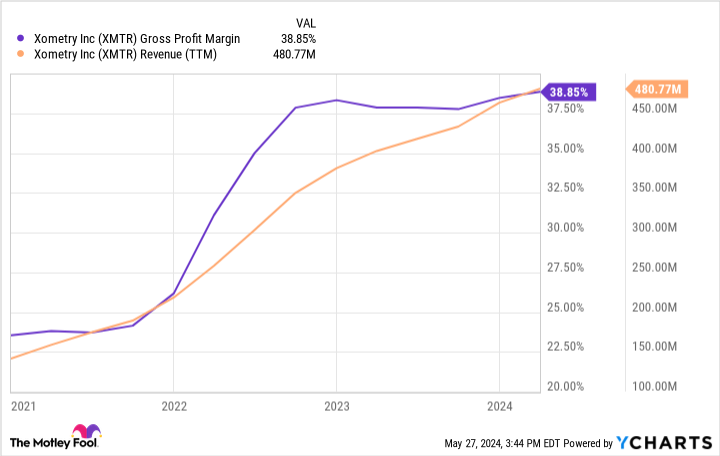

Xometry’s gross-profit margin increases when the spread improves between what it charges and what it pays. The trend is bumpy. But the long-term trajectory shows marked improvement in this area, suggesting the company’s AI is doing what it’s supposed to.

Xometry isn’t guaranteed to succeed. Perhaps the economics of the business will regress. And it’s possible that fresh competition will enter the space with better technology. In that case, investors will be glad they sat on the sidelines.

However, if it keeps growing its user base, and its platform keeps pricing jobs appropriately, then it’s reasonable to expect Xometry to continue taking market share in a $260 billion market as the space is increasingly digitized. If that happens, then this could be an incredible investment opportunity.

For perspective, Xometry trades at a cheap 1.6 times its trailing sales, and its market valuation is only $770 million. That’s an inexpensive price and a small market value for a company that could emerge as an undisputed leader in such a large market. Therefore, I believe that within a few years, many investors will wish that they had purchased Xometry stock at today’s prices.

Should you invest $1,000 in Xometry right now?

Before you buy stock in Xometry, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Xometry wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $703,539!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Jon Quast has positions in Xometry. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

A Few Years From Now, You’ll Wish You Bought This High-Growth Stock was originally published by The Motley Fool

Signup bonus from