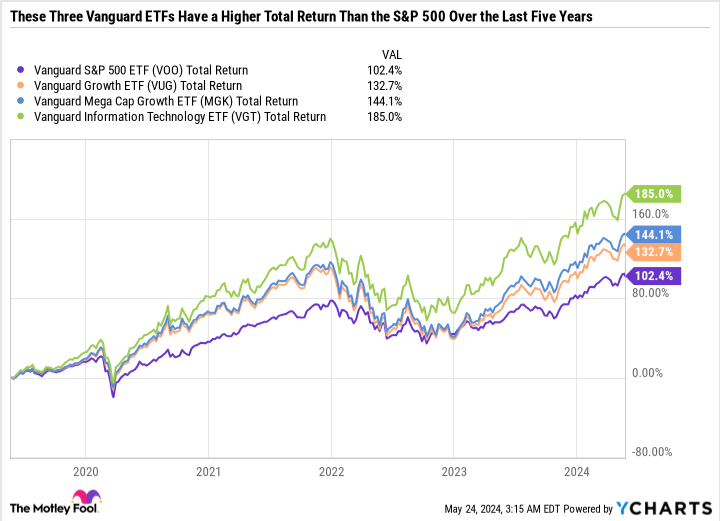

The S&P 500 has been on a tear, up 10.7% year to date, 27.1% over the last 12 months, and 37.6% since the end of 2022. And over the last five years, the Vanguard S&P 500 ETF (NYSEMKT: VOO) — a mammoth exchange-traded fund (ETF) with over $1 trillion in assets — has produced a total return (including capital gains and dividends) of over 102%.

It’s an impressive feat, and yet it’s still no match for the five-year total returns of the Vanguard Growth ETF (NYSEMKT: VUG), Vanguard Mega Cap Growth ETF (NYSEMKT: MGK), and Vanguard Information Technology ETF (NYSEMKT: VGT). Here’s a look at what’s fueling this outperformance, and whether you should buy these ETFs now.

Broad-based growth exposure

The largest Vanguard ETFs have a 0.03% expense ratio; they are the S&P 500 ETF, Vanguard Total Stock Market ETF, and the Vanguard Total Bond Market ETF. But close behind is the Vanguard Growth ETF, with a mere 0.04% expense ratio and a whopping $220 billion in net assets.

The fund essentially applies a growth filter on the S&P 500 and whittles it down to 200 holdings. The result is a higher concentration in large companies, mainly in the tech, consumer discretionary, and communications sectors.

The Vanguard Growth ETF has outperformed the S&P 500 over the last five years, but the trend hasn’t been a straight line up:

The fund got crushed in 2022 due to a widespread sell-off in big tech. The cumulative market cap of the “Magnificent Seven,” which includes Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla, finished 2022 at $6.9 trillion. Today, the combined market cap of these seven companies is a staggering $14.4 trillion — meaning the Magnificent Seven’s market cap more than doubled in less than 18 months.

Outsized returns from large-cap growth stocks are a recipe for success for the Vanguard Growth ETF. It’s also worth mentioning that the ETF includes a variety of holdings that may not be considered traditional growth stocks, like Visa, Mastercard, and even McDonald’s. The fund looks at which companies have the best growth potential in a certain industry, which adds a layer of diversification that would be missed by piling solely into red-hot growth stocks.

In this vein, the Vanguard Growth ETF is the perfect fit for an investor who wants broad-based market exposure through a growth lens rather than the S&P 500 or a total market fund.

Targeting the market’s top growth stocks

The Vanguard Mega Cap Growth ETF embodies everything that’s been working in the market lately. It basically takes the Vanguard Growth ETF a step further by condensing it to just 79 holdings. This approach applies the largest weights to the top holdings, which makes the fund more concentrated and vulnerable to a potential sell-off in those names, but also gives it greater exposure if they outperform.

For example, the Vanguard Growth ETF has 65% of its weighting concentrated in its top 15 holdings, while the Vanguard Mega Cap Growth ETF has a 72% weighting in its top 15 holdings.

The two ETFs are similar, featuring the exact same 15-largest holdings: In order, they are Microsoft, Apple, Nvidia, Amazon, Alphabet, Amazon, Meta Platforms, Eli Lilly, Tesla, Visa, Mastercard, Costco Wholesale, Advanced Micro Devices, Salesforce, Netflix, and Linde.

The Mega Cap Growth ETF has a slightly higher expense ratio at 0.07% compared to the 0.04% of the Growth ETF — but that’s only a $3 difference for every $10,000 invested.

Investors who want even more high-octane exposure to the largest growth stocks should choose the Vanguard Mega Cap Growth ETF over the Vanguard Growth ETF.

A low-cost way to invest in the tech sector

Had you invested five years ago, the Vanguard Information Technology ETF would have nearly tripled your money (including dividends). Although tech is the highest-weighted sector in both the Vanguard Growth ETF and the Vanguard Mega Cap Growth ETF, the weightings in some of the slightly smaller (but still large) tech stocks are noticeably lower in these funds than in a pure-play sector fund. The following table showcases this distinction well:

|

Company |

Vanguard Information Technology ETF |

Vanguard Mega Cap Growth ETF |

Vanguard Growth ETF |

|---|---|---|---|

|

Microsoft |

17.3% |

14.4% |

12.5% |

|

Apple |

15.3% |

12.4% |

10.8% |

|

Nvidia |

11.9% |

10.1% |

8.9% |

|

Broadcom |

4.4% |

0% |

0% |

|

Salesforce |

2% |

1.3% |

1.1% |

|

Advanced Micro Devices |

2% |

1.4% |

1.1% |

|

Adobe |

1.6% |

1.1% |

0.9% |

|

Cisco Systems |

1.5% |

0% |

0% |

|

Accenture |

1.4% |

1% |

0.8% |

|

Oracle |

1.4% |

0% |

0% |

Data source: Vanguard.

The Vanguard Information Technology ETF has higher tech-stock weightings than the Vanguard Mega Cap Growth ETF or the Vanguard Growth ETF. But an important detail is that some major tech stocks aren’t even in the Mega Cap Growth ETF or the Growth ETF. Out of the top 10 alone, Broadcom, Cisco Systems, and Oracle are completely absent — which may seem odd given these are industry-leading companies.

The reason is that all three of these companies are top tech holdings in the Vanguard Value ETF (NYSEMKT: VTV) — which excludes Microsoft, Apple, Nvidia, and the rest of the Magnificent Seven. The allocation is a bit of product marketing on Vanguard’s part, as it’s classifying certain tech stocks as value plays so that the Value ETF has some tech. But the bigger lesson is that it’s important to understand what you own, especially regarding ETFs. Even some of the largest, most reputable ETFs have nuances you should be aware of before investing.

The Vanguard Information Technology fund has a 0.1% expense ratio. That’s technically higher than the other two ETFs, but it’s a negligible difference unless you’re investing hundreds of thousands of dollars in these funds.

Approach growth investing in a way that suits your risk tolerance

All three ETFs are outperforming the S&P 500 because they have higher exposure to large-cap growth stocks. But this characteristic is a double-edged sword, as you can expect these ETFs to underperform the benchmarks if there’s a widespread sell-off in large-cap growth stocks.

If you’re interested in growth stocks no matter the sector, then the low-cost Vanguard Growth ETF is a great bet. If you want even more exposure, go with the Vanguard Mega Cap Growth ETF. But if you want to approach growth specifically through the tech sector, then the Vanguard Information Technology ETF and its 44.5% weighting in Microsoft, Apple, and Nvidia may be the best option.

Should you invest $1,000 in Vanguard Index Funds – Vanguard Growth ETF right now?

Before you buy stock in Vanguard Index Funds – Vanguard Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds – Vanguard Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $703,539!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors.

Daniel Foelber has positions in Advanced Micro Devices. The Motley Fool has positions in and recommends Accenture Plc, Adobe, Advanced Micro Devices, Alphabet, Amazon, Apple, Cisco Systems, Costco Wholesale, Linde, Mastercard, Meta Platforms, Microsoft, Netflix, Nvidia, Oracle, Salesforce, Tesla, Vanguard Bond Index Funds-Vanguard Total Bond Market ETF, Vanguard Index Funds-Vanguard Growth ETF, Vanguard Index Funds-Vanguard Total Stock Market ETF, Vanguard Index Funds-Vanguard Value ETF, Vanguard S&P 500 ETF, and Visa. The Motley Fool recommends Broadcom and recommends the following options: long January 2025 $290 calls on Accenture Plc, long January 2025 $370 calls on Mastercard, long January 2026 $395 calls on Microsoft, short January 2025 $310 calls on Accenture Plc, short January 2025 $380 calls on Mastercard, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The S&P 500 Just Hit an All-Time High, but These 3 Vanguard ETFs Have Performed Even Better Over the Last 5 Years was originally published by The Motley Fool

Signup bonus from