The good thing about retirement is that there’s no uniform way people should approach it. Some use it as a chance to travel the world, and others use it to rest and do as little as possible. Some never stop working because their job brings them fulfillment. There’s no right or wrong way to approach retirement.

However, when it comes to Social Security, there are a couple of important considerations to remember if you plan to continue working, starting with the lesser-known Social Security rule that we’ll discuss below.

It all begins with your full retirement age

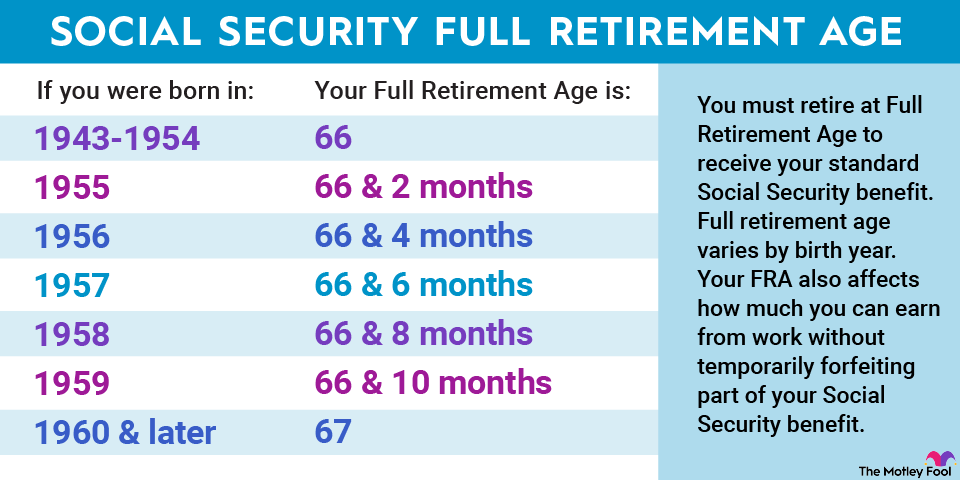

There are plenty of important numbers involving Social Security (and retirement, in general), but few are as important as your full retirement age. In Social Security, your full retirement age is when you’re eligible to receive your primary insurance amount (PIA). This is your baseline monthly benefit and is adjusted either higher or lower, based on when you claim it.

Your full retirement age is determined by your birth year as follows:

If you decide to claim benefits after your full retirement age, your monthly benefit will increase by 2/3 of 1% for each month until you reach 70.

If you decide to claim benefits before your full retirement age, your monthly benefit will be reduced based on how many months away you are from your full retirement age. Within 36 months, benefits are reduced by 5/9 of 1% monthly. Any additional month after 36 will further reduce benefits by 5/12 of 1% monthly.

What to know if you claim benefits early and want to work

If you claim benefits on or after your full retirement age, you can work and earn as much money as possible without worrying about repercussions. However, this isn’t the case when you claim benefits early. Claiming Social Security benefits early and continuing to work and earn over a certain amount will subject you to the Social Security retirement earnings test (RET).

Earning more than the threshold under the Social Security RET will reduce your benefits based on how much you exceed the limit and how close you are to full retirement age. If you won’t reach your full retirement age in 2024, the earnings limit is $22,320. Earning above that amount will reduce benefits by $1 for every $2 over that amount. If you hit your full retirement age in 2024, the limit is $59,520. Earning above that amount will reduce your benefits by $1 for every $3.

For example, if your earnings limit is $22,320 and you earn $32,320, your benefits will be reduced by $5,000. If your earnings limit is $59,520 and you earn $69,520, your benefits will be reduced by roughly $3,333.

The RET earnings limit generally changes annually, so it’s important to stay up to date on the current year’s amount. It’s not uncommon for someone to be over the threshold in one year but under it the next year if the limit increases. For perspective, the respective limits in 2023 were $21,240 and $56,520.

Don’t worry, your benefits aren’t permanently lost

Nobody likes to see their Social Security benefit reduced, but you can think about it as more of a temporary withholding. When you reach your full retirement age, Social Security recalculates your monthly benefit in a way that gradually adds back the withheld amount.

Imagine if your full retirement age was 67 and you decided to take benefits at 62 while making over the allowed threshold. If the RET lowered your annual benefits by $1,000, Social Security would’ve withheld $5,000 over those five years. Once you turn 67, however, that $5,000 would be added to your monthly benefits, spread over the rest of your life.

Despite the benefit reduction from earning over the threshold, some people may find it worthwhile, as long as the extra income provides personal satisfaction and the reduced Social Security benefits don’t threaten their livelihoods. There’s absolutely nothing wrong with working while retired or claiming Social Security — just make sure you’re aware of how it affects your benefits so you can adjust your financial plan accordingly.

What stocks should you add to your retirement portfolio?

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now. The 10 stocks that made the cut could produce monster returns in the coming years, potentially setting you up for a more prosperous retirement.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $697,878!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

The Motley Fool has a disclosure policy.

Planning to Work While Receiving Social Security? Don’t Let This Lesser-Known Rule Cost You Money. was originally published by The Motley Fool

Signup bonus from