As two of the world’s largest and most prolific drugmakers, Pfizer (NYSE: PFE) and AstraZeneca (NASDAQ: AZN) both have grand visions for how to grow even larger over the coming years. And with billions of dollars devoted to research and development, it’s almost certain to lead to the discovery of new golden-goose medicines that should enrich shareholders.

But for investors, the details about how those billions will be spent, and how those winning therapies will be found, are critical. And on that basis, it appears that investors will have more to like about AstraZeneca’s plans than Pfizer’s. Let’s investigate why that’s the case.

These ambitions are bigger and better

Pfizer’s strategic plan for 2030 is to grow total revenue by at least $45 billion, using a combination of internal research and development (R&D) and business development activities like acquisitions, licensing deals, collaborations, and purchasing of attractive pharmaceutical assets.

While the vision calls for continuing to compete in many of the same segments as before, cancer medicines are an area of particular focus. If everything goes as planned, the company will produce at least eight new blockbuster medicines before the close of the decade.

In 2023, Pfizer brought in $58.5 billion in revenue. Therefore, its goal is to reach a top line of $103.5 billion. That means it’s hoping to recapture the glory days of 2022, when annual revenue was just over $100 billion thanks to incredible demand for its coronavirus vaccines and antiviral pills. However, it’ll take years of focused effort to surpass its all-time heights in terms of sales.

On the other hand, AstraZeneca’s latest strategic plan is even more ambitious. Its revenue was $45.8 billion in 2023; management is now hoping to reach a sum of $80 billion by 2030, launching at least 20 new medicines along the way. Twelve of those new drugs each have the potential to bring in at least $5 billion in sales each year.

If management is to be believed, the business won’t need to do too much to reach its goals other than execute on its core pipeline as it exists today. Cancer drugs, rare-disease therapies, and biologics will be the segments of focus.

And while there are some plans for collaborations, acquisitions, and licensing deals along the way, AstraZeneca’s overall approach doesn’t emphasize the need to do extensive business development work. So it probably won’t need to take out much in the way of debt, thereby leaving it more capital to invest in growth, or return to shareholders, for years to come.

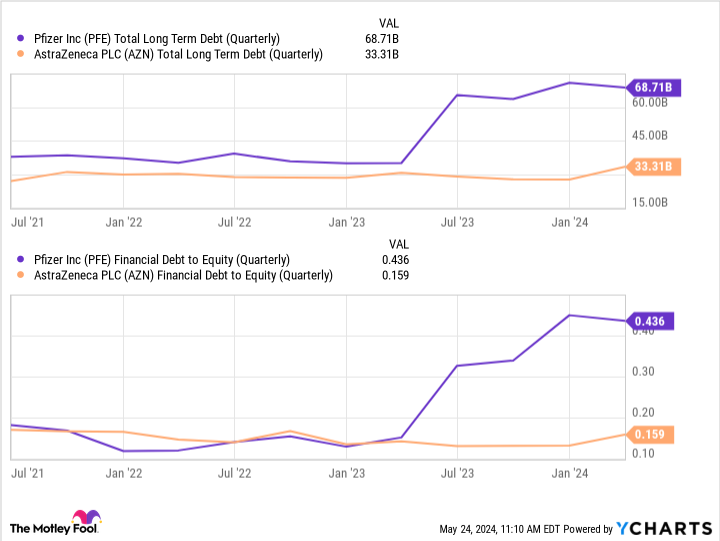

To see how that’ll leave AstraZeneca in comparison to Pfizer, take a look at this chart (can you guess when Pfizer started to make moves to acquire companies as part of its strategic roadmap?):

Eventually that money will need to be paid back, and the process will likely be a long one. AstraZeneca won’t have that challenge, and it’ll likely have more high-profile medicines on the market by 2030 as well.

Don’t get too lost in the weeds here

All the factors above mean that AstraZeneca’s stock is likely to durably outperform Pfizer’s if its clinical trials proceed as anticipated and ultimately yield profitable medicines.

Direct competition between the companies, most likely in the domain of antibody-drug conjugates (ADCs) for cancer, could result in one gaining the upper hand in its shares of specific markets. But from an investment perspective, AstraZeneca still looks more favorable.

Doing extensive business development activity to keep the pipeline packed with promising programs is nothing new in the pharma industry. But needing to do it, as Pfizer’s leaders seem to be thinking it will, shows a subtle lack of confidence in the consistency of the company’s pipeline (in both volume and quality). And there’s nothing that’s more core to a pharma business than a healthy pipeline.

So, based on these companies’ ambitions, it’s a safer bet to buy AstraZeneca stock than Pfizer over the next handful of years. It’s not likely that Pfizer’s grand plan will falter. But — especially if you’re looking to invest in something that’s going to grow consistently — it now looks like AstraZeneca is a better option.

Should you invest $1,000 in AstraZeneca Plc right now?

Before you buy stock in AstraZeneca Plc, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AstraZeneca Plc wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $697,878!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Alex Carchidi has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool recommends AstraZeneca Plc. The Motley Fool has a disclosure policy.

AstraZeneca Just Massively One-Upped Pfizer. Here’s What It Means for the Stock was originally published by The Motley Fool

Signup bonus from