First Solar (NASDAQ:FSLR), a global solar energy solutions provider headquartered in Arizona, is a cheaply valued AI beneficiary that had been ignored by the market until recently. FSLR stock soared more than 30% between May 20 and 22 based on two pieces of news. First, UBS (NYSE:UBS) identified the company as a major winner of AI-driven electricity demand. Second, China pledged to support the solar industry by ending a price war that significantly impacted the sector’s profitability. I am bullish on FSLR stock, as I believe projected growth is yet to be accurately reflected in its valuation.

The AI Opportunity

The rise of generative AI has exerted immense pressure on global electric grids as AI applications require substantial amounts of energy to function. According to a study conducted by Dr. Alexandra Sasha Luccioni, AI and Climate Lead at Hugging Face, generative AI systems use approximately 33 times more energy than computers running task-specific software applications.

According to data from the International Energy Agency, global data centers used 460 terawatt hours of electricity in 2022 and will use more than 1,000 terawatt hours of electricity by 2026, growing exponentially because of increasing AI usage. According to the IEA’s findings, this projected electricity consumption by data centers will be equivalent to the consumption in Japan with a population of 125 million.

A quick look at the energy consumption trends of leading AI companies confirms that power usage has increased as a result of AI investments. For example, Microsoft (NASDAQ:MSFT), in its Environmental Sustainability Report for 2023 published earlier this month, revealed that carbon emissions have increased by almost 30% since 2020, primarily driven by the construction of new data centers to support AI technology.

The AI opportunity for First Solar arises as a result of the carbon-neutral goals pledged by governments and multinational companies amid the rise of AI. The U.S., for example, has pledged to reduce carbon emissions by at least 50% compared to 2005 levels by 2030. Microsoft, on the other hand, has promised to become carbon-negative by 2030. The company also has an ambitious goal to remove all the carbon the company has emitted since its founding by 2050.

Apple (NASDAQ:AAPL) has also pledged to be carbon neutral for its supply chain and products by 2030. Given the massive rise in electricity consumption due to AI, large-scale companies that invest in AI will be forced to source power from sustainable sources, and First Solar can be seen as one of the biggest winners of this expected development.

Investing for Growth

First Solar is investing to expand its manufacturing capacity in the U.S. to meet the projected increase in solar power demand. During the Q1 earnings call earlier this month, the company discussed expansion plans in Ohio, Alabama, and Louisiana.

The company is also focused on developing advanced solar technology to improve cost efficiencies and, thereby, profit margins. For example, First Solar is planning to launch a perovskite development line and a new innovation center in the second half of this year.

China Delivers Good News for FSLR Stock

On May 22, Chinese regulators pledged to crack down on sales of solar equipment material at below-cost prices, which is good news for established solar companies. Due to the increasing number of solar equipment manufacturers, the last few years saw a build-up of manufacturing facilities, leading to an oversupply in the market. Solar companies have been pushing the Chinese government to intervene for many months with the hopes of eliminating companies that undercut market prices.

First Solar, as an established global player, will benefit from the Chinese government’s decision to take action to end pricing wars in the solar sector.

Is First Solar Stock a Buy, According to Analysts?

On May 21, UBS analysts Jon Windham and William Grippin claimed that First Solar will benefit from the power purchase agreements of large tech companies, as these tech giants have pledged to bank on renewable energy sources to cater to their increasing power consumption in the AI era. The analysts guided for strong earnings per share growth for First Solar, from $7.74 in 2023 to $36.74 by 2027. UBS raised its price target for First Solar to $270 from $252 and kept its Buy rating.

Piper Sandler analyst Kashy Harrison followed suit by raising his First Solar price target to $219 from $195. Additionally, JPMorgan (NYSE:JPM) recently raised its price target from $240 to $262 and maintained a Buy rating, while Susquehanna issued a price target of $258 after incorporating the projected AI-induced demand for renewable energy. Roth Capital Markets analyst Philip Shen also believes that First Solar will be a key beneficiary of the booming AI sector.

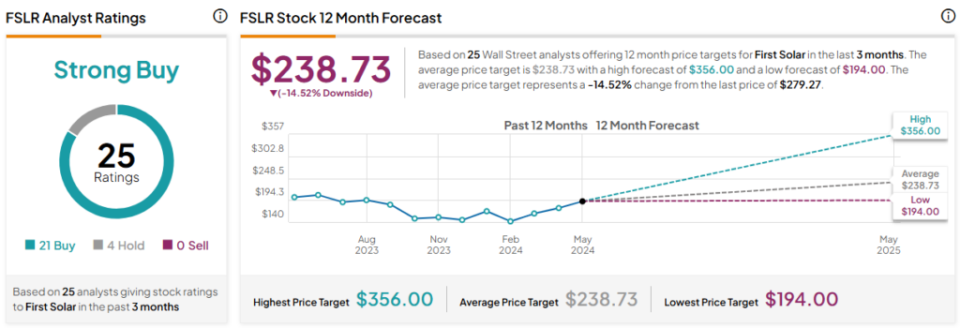

Overall, based on the ratings of 27 Wall Street analysts, the average FSLR stock price target is $238, which implies downside risk of 14.5% from the current market price.

Although analyst price targets suggest that investing in First Solar is a risky bet today, recent upgrades indicate that the average price target may continue to rise in the foreseeable future. This expectation is based on the company’s favorable positioning in the renewable energy market and its potential to benefit from increased demand for electricity.

First Solar is currently valued at a forward P/E of just 20x, which makes it cheaply valued, given that analysts project a five-fold increase in earnings per share by 2027.

The Takeaway: First Solar Is Cheap and Attractive

First Solar is well-positioned to capture the increasing demand for electricity stemming from the rise of AI technology. The company seems cheaply valued in the market and recent upgrades from Wall Street analysts will likely act as a catalyst pushing the stock price higher. China’s pledge to support the solar sector by targeting suppliers who undercut prices will also add fuel to the recent momentum behind First Solar stock.

Signup bonus from