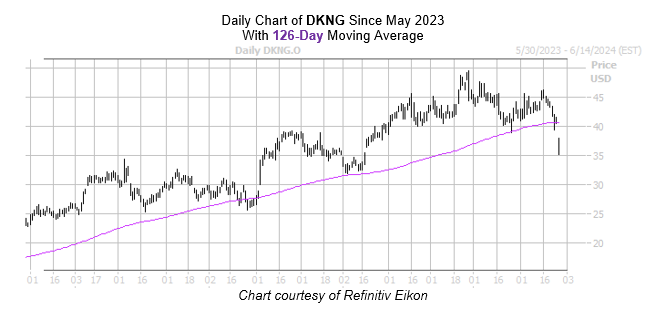

The shares of sports betting company DraftKings Inc (NASDAQ:DKNG) are crumbling today, last seen 11.6% lower to trade at $36.09, after the Illinois Senate passed a 2025 budget that will raise taxes on gross gaming revenue raise by more than 140%. Today’s plunge could be short lived, if past is precedent, as DKNG recent pulled back to a historically bullish trendline.

The stock is now below its 126-day moving average after spending a significant period of time above it, defined for this study as having traded north of this trendline 80% of the time in the past two months, and in eight of the past 10 trading days. Per data from Schaeffer’s Senior Quantitative Analyst Rocky White, four similar signals occurred during the past three years, with DKNG averaging a 12.9% one-month gain.

From its current perch, a similar move would put the shares back above the $40 mark and fill their 12.2% monthly drawdown. And despite today’s sharp drop, DraftKings stock remains up 54% over the last 12 months and is holding its year-to-date breakeven level.

Now looks like a good time to weigh in on DKNG’s next move with options. Its Schaeffer’s Volatility Index (SVI) of 40% stands in the low 6th percentile of annual readings, implying options players are pricing in relatively low volatility expectations at the moment.

Signup bonus from