The American stock market is on fire. The S&P 500 index, a benchmark for U.S. equities, has been printing fresh all-time highs this year and trading at a staggering 70% above its historical average when measured by the 10-year cyclically adjusted P/E ratio, known to many as the Shiller P/E Ratio.

The question on many investors’ minds is whether this is the time to pull back on stock investments, particularly those tracking this benchmark index like the Vanguard S&P 500 ETF (NYSEMKT: VOO).

To answer this question, we must consider past lessons within the context of the unprecedented era humanity is entering.

What the past can teach us

Historically, buying into the S&P 500 at all-time highs has been smart. Valuation metrics like the Shiller P/E ratio lack predictive power for stock or index movements in the short term, typically less than a year.

Instead, market momentum has been a more reliable indicator over periods shorter than a decade, with indices often gaining an additional 12.7% in the 12 months following the achievement of all-time highs.

This phenomenon is driven by “recency bias,” where investors prioritize recent market performance over long-term fundamentals, potentially leading to overvaluation and subsequent market corrections.

So despite the S&P 500’s current Shiller P/E Ratio of 34.7, significantly higher than the modern-era average of 20.3, it may not be time to shift to risk-free assets like bonds or high-yield money market accounts.

After all, the market’s forward momentum indicates that further gains are on the horizon. That said, S&P 500 bull markets that result in stretched valuation metrics typically lead to multiyear bear markets, characterized by the outperformance of risk-free assets relative to stocks.

History, in turn, suggests that the pro move is to keep buying core funds like the Vanguard S&P 500 ETF for two to three more quarters while keeping an eye on the underperforming bond market. A deeper analysis suggests the stocks may be poised to break with this trend line, paving the way for an extended bull run in the S&P 500 over the next several years.

What the future may hold

We are witnessing a unique phase in financial history. Technological innovations could render past trends irrelevant and upend conventional thinking.

The advent of artificial intelligence (AI), autonomous vehicles, and the automation of labor-intensive jobs will revolutionize society within the next five years.

For example, the ongoing displacement of jobs by AI, with Goldman Sachs predicting that 300 million full-time jobs may be replaced, underscores the magnitude of this transformation.

This rapid technological evolution necessitates a reevaluation of traditional concepts such as the value of a four-year college degree and the future of industries like car insurance and entry-level employment.

All these pressing issues will have a significant impact on stock market valuations in the coming years. So, as we navigate this era of AI, our approach to investment valuation may also need to adapt.

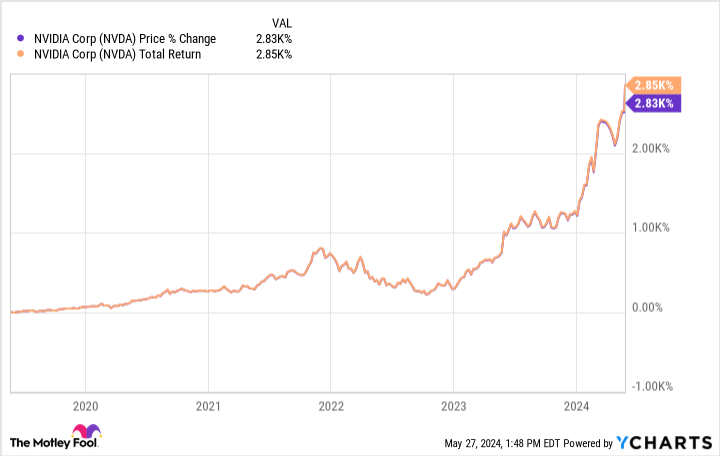

The stock market seems to be anticipating these changes, with chipmakers like Nvidia (NASDAQ: NVDA) at the forefront of this shift. After all, Nvidia’s stock, which lies at the heart of the AI revolution, has done this in the past five years:

In short, these technological advancements are already reshaping the U.S. stock market.

What it means to investors

Investing in the era of AI presents both enormous challenges and life-changing opportunities.

While historical trends can provide valuable insights, the unique circumstances of the current market and the transformative impact of emerging technologies require a fresh perspective on investment strategies.

The American stock market’s current performance may be a harbinger of a new era in investing. Traditional valuation metrics may have to be supplemented by a deeper understanding of technological advancements and societal changes.

This emerging theme, in turn, should power U.S. large-cap stocks higher for an extended period. The Vanguard S&P 500 ETF thus screens as a top buy, despite its premium valuation and tendency to revert to the mean when its valuation breaks historical precedent.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

George Budwell has positions in Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Nvidia and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

Is the Vanguard S&P 500 ETF Still a Buy? Here’s What History Says and Why You Should Ignore It. was originally published by The Motley Fool

Signup bonus from