Nvidia‘s (NASDAQ: NVDA) shares are on fire — but this isn’t a short-term phenomenon. The chip designer’s stock has been on the rise for a few years. It took off in 2020, and since that time, it’s soared more than 1,600%.

Investors have piled into the stock on optimism about the company’s position in artificial intelligence (AI), a market forecast to grow in the double digits to more than $1 trillion by the end of the decade. Today, Nvidia is the world’s AI chip leader, with a market share of more than 80%. But that isn’t the only reason investors are excited about the stock. One favorable trend explains why Nvidia shares have become unstoppable.

The data center business

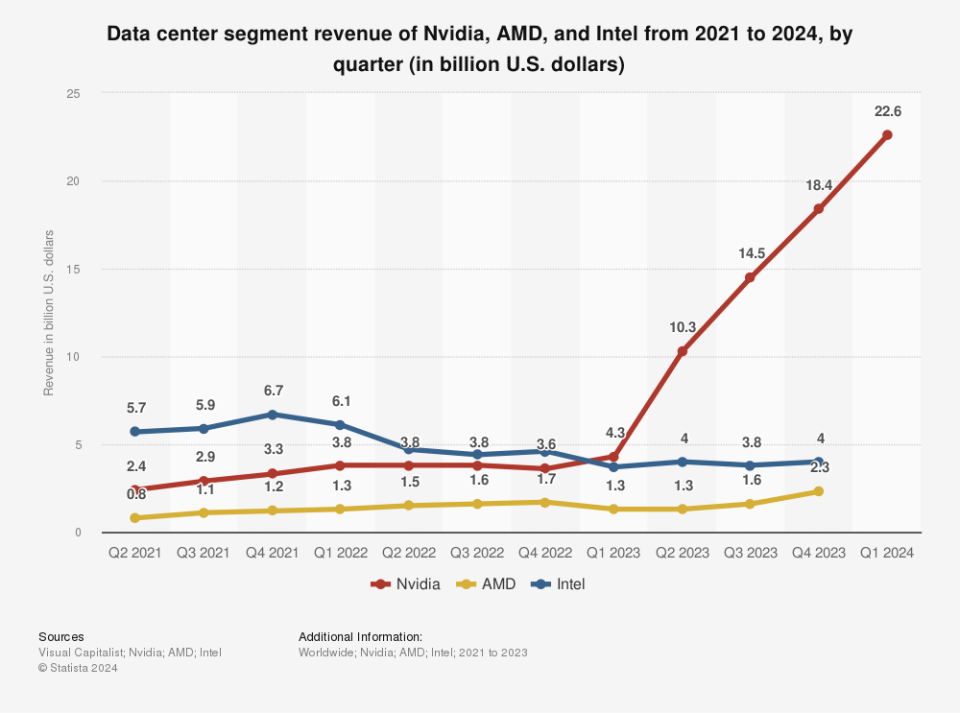

First, it’s important to note that Nvidia’s data center business includes all of the revenue it makes through its AI products and services. Rivals Advanced Micro Devices and Intel also have data center businesses and have been ramping up their offerings to compete with Nvidia.

Here’s the favorable trend that’s boosted the company’s stock. As shown in the chart below, Nvidia’s data center revenue has climbed — and actually roared higher as of early last year — while the data center revenue of rivals has lagged behind. Intel’s data center revenue actually has declined from earlier levels.

Investors like this trend of growth because it gives them confidence that Nvidia is staying ahead of its rivals. The idea that the company has what it takes to keep the increasing revenue trend going will keep the positive share price momentum. The tech giant has pledged to continue innovation to make that happen, and it’s set for what may be its biggest launch yet: The release later this year of its Blackwell architecture and most powerful chip ever.

In addition to Nvidia’s AI chips, the company sells entire platforms to help customers launch their AI programs, so the revenue opportunity is broad. All of this means Nvidia’s explosive growth may be far from over, and this could equal significant gains for the stock over the long term.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

1 Favorable Trend Explains the 1,600% Rise in Nvidia’s Stock Price was originally published by The Motley Fool

Signup bonus from