The past few years have been a wild ride for PayPal (NASDAQ: PYPL). The fintech specialist gained tremendous traction in the early days of the pandemic. Business activity soared and financial results followed, bringing its share price along for the ride.

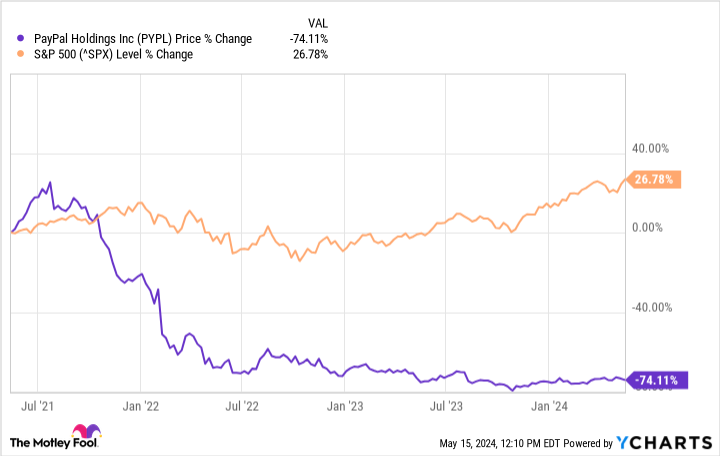

However, the pandemic-related boom started slowing, leading to decreased top-line and active accounts growth. The market responded by selling off PayPal’s shares. The stock is down by 74% in the past three years.

Despite this abysmal performance, there remain excellent reasons to invest in PayPal.

A transition year for PayPal

PayPal’s first-quarter results were decent by the standards of the past couple of years. Revenue increased by 9% year over year to $7.7 billion, and total payment volume (TPV) landed at $403.9 billion, 14% higher than the year-ago period. However, active accounts declined by 1% to 427 million. What investors want, though, is for PayPal to generate the kinds of results that are closer to what it did during the early-pandemic quarters, which featured strong growth in active accounts and double-digit percentage revenue increases.

That will be the job of PayPal’s management team, led by Alex Chriss, its new CEO. During the company’s first-quarter earnings conference call, Chriss warned that this year will be a transition one for PayPal. While he is planning multiple initiatives to supercharge the business, many of them won’t make a meaningful impact on the company’s financial results immediately.

Still, these efforts to improve the business look promising. The general trend is that PayPal wants to improve the checkout experience for customers and merchants, partly through the power of artificial intelligence (AI). The company has introduced various new features along those lines. They include FastLane, a service that allows customers to save their information and check out in one click without the need to sign into an account, register for one, or enter the same data for every purchase.

PayPal also introduced Smart Receipts, which use an AI-powered algorithm to predict what customers might want to buy next.

Here’s one crucial reason why these efforts are important. PayPal’s ecosystem is vast — few fintech companies generate as much TPV as it does or have as many active accounts. That’s not an accident. PayPal is a pioneer in online checkout, and has developed a powerful brand name. The company’s network should allow it to experiment with various strategies to make the shopping experience easier, faster, and more enjoyable for consumers, while helping merchants retain customers and generate repeat sales.

Alex Chriss is already doing that less than one year into his new position. And there is much more to come. Meanwhile, retail activity will continue shifting online. The growth of e-commerce in the coming years will help jolt the fintech industry as well, meaning there will be lucrative opportunities for PayPal to pounce. The company is well-positioned to do precisely that, especially as it makes a conscientious effort to improve its business.

The valuation looks reasonable

PayPal’s terrible performance in recent years has made the stock much less expensive. The company is trading at a forward price-to-earnings (P/E) ratio of 15.65. That’s lower than the S&P 500‘s average of 20.8. The forward P/E for the financials industry currently tops 15.4, pretty close to PayPal’s.

Though valuation was a concern for many investors when PayPal’s stock soared a few years ago, that should no longer be a significant roadblock to investing in the stock, especially considering its prospects. In my view, PayPal deserves a slight premium given its position in the fintech industry, the potential of this market, and the fact that it benefits from a competitive advantage in the form of the network effect and a strong brand name. PayPal should deliver solid returns in the next decade. Now looks to be as good a time as any to initiate a position in the company.

Should you invest $1,000 in PayPal right now?

Before you buy stock in PayPal, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PayPal wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Prosper Junior Bakiny has positions in PayPal. The Motley Fool has positions in and recommends PayPal. The Motley Fool recommends the following options: short June 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

1 Stock Down 74% That Could Make You Richer in 2024 and Beyond was originally published by The Motley Fool

Signup bonus from