When short-term interest rates spike, small and mid-cap stocks tend to underperform benchmark indices like the S&P 500. Why? Let’s break it down:

-

Borrowing costs: Many small and mid-cap companies fuel their growth by borrowing money. When interest rates rise, borrowing costs increase, impacting their profitability and risk profile.

-

Well-capitalized large-cap stocks: Conversely, large-cap stocks–typically well-capitalized giants–often thrive in high-interest rate environments. They have less reliance on borrowing and can weather rate hikes more effectively, making them top safe havens for investors.

The catalyst: anticipated rate cuts

While the Federal Reserve may hold tight on cutting interest rates because of sticky inflation, experts predict a string of rate cuts within the next 12 to 18 months. These rate cuts could serve as a powerful catalyst for smaller companies that lean on loans to expand their operations.

Two top Vanguard exchange-traded funds (ETFs) should be prime beneficiaries of an interest rate drawdown in 2025. Read on to find out more about these low-cost Vanguard ETFs.

Vanguard Small-Cap Index Fund ETF Shares

The Vanguard Small-Cap Index Fund ETF (NYSEMKT: VB) aims to track the CRSP US Small Cap Index, composed of U.S. companies with an average market capitalization of $7 billion. This small-cap ETF is an ideal vehicle to gain exposure to this market segment because of its ultra-low expense ratio of just 0.05% and respectable yield of 1.45%.

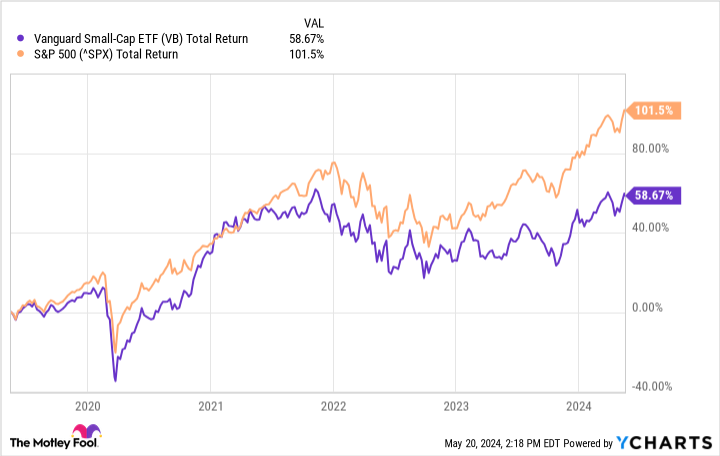

Over the prior five years, the VB has delivered average annual returns of 7.74%. The fund has underperformed the S&P 500 over this period because of the 16-year-long bull market in large-cap U.S. stocks. However, small caps have historically been the better growth vehicle for long-term investors.

VB Total Return Level data by YCharts

The VB is exceptionally well-diversified, with approximately 1,417 stock holdings spread across every major economic sector. Still, Vanguard classifies the fund as “aggressive” based on its risk-rating scale, reflecting the heavy dose of risk associated with stocks in general, and small-cap equities in particular.

Vanguard Mid-Cap Index Fund ETF Shares

The Vanguard Mid-Cap Index Fund ETF (NYSEMKT: VO) closely tracks the CRSP US Mid Cap Index, which measures the returns of mid-size U.S. companies. The VO sports a minuscule expense ratio of 0.04% and an above-average yield of 1.59%.

This mid-cap fund is considerably less diversified than its small-cap counterpart, holding only 329 stocks in its portfolio. However, the average market cap of companies within the portfolio stands at $31.3 billion. The inherently larger size of companies within VO’s portfolio, relative to the VO, provides an extra layer of safety.

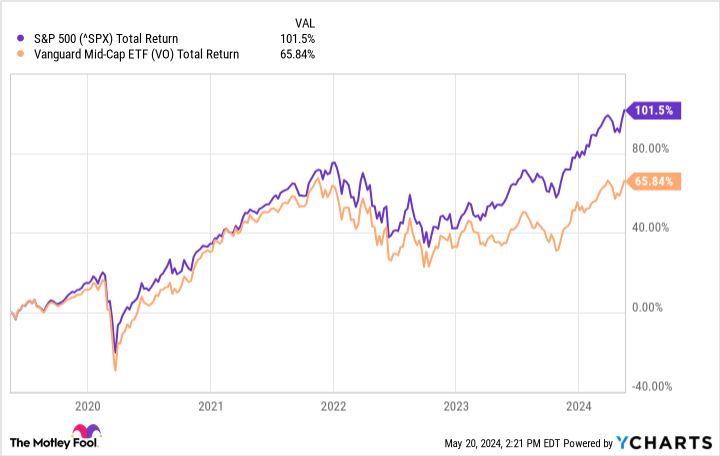

On the performance side of the ledger, the VO has delivered an average return of approximately 9%. Despite this fairly healthy average annual return, this mid-cap fund has underperformed the S&P 500 by a wide margin over this period. A reversal in interest rates should favor the VO over this benchmark index in the years ahead.

Final thoughts

Before interest rates shift, investors should position themselves wisely. Consider the VB and VO ETFs as potential additions to your portfolio ahead of this catalyst. These low-cost Vanguard ETFs offer diversified exposure to small and mid-cap stocks, allowing you to capitalize on a wide array of interest rate-sensitive growth stocks.

Should you invest $1,000 in Vanguard Index Funds – Vanguard Small-Cap ETF right now?

Before you buy stock in Vanguard Index Funds – Vanguard Small-Cap ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds – Vanguard Small-Cap ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

George Budwell has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Mid-Cap ETF and Vanguard Index Funds-Vanguard Small-Cap ETF. The Motley Fool has a disclosure policy.

2 Vanguard ETFs to Buy Hand Over Fist Before This Happens was originally published by The Motley Fool

Signup bonus from