The artificial intelligence revolution has caused a growth surge for the technology’s enablers, most of which reside in the semiconductor sector.

In fact, the stock movements for these companies have been so strong that many now trade at very, very high stock prices, setting these AI beneficiaries up for a potential stock split.

Stock splits don’t create or destroy any value on their own. After all, if a company has twice as many shares but half the stock price, the company’s total market cap remains the same. However, stock splits can help certain people afford shares if they don’t have a broker that allows fractional share buying. Moreover, splits can increase a stock’s liquidity, which can help lower-bid-ask spreads for trading purposes, and therefore attract larger funds to a stock.

Therefore, even though the following five stocks have already had very strong runs, a split could potentially drive these AI winners to even further upside.

1. Nvidia

First and most obvious on the list is AI GPU leader Nvidia (NASDAQ: NVDA). Not only is Nvidia currently leading the entire AI revolution with its best-in-class AI chips and software ecosystem, but it also has a history of stock splits. While Nvidia split its stock a few times in the early 2000s, its most recent was a 4-for-1 split in July 2021.

Of course, with the stock having quintupled since that split a mere three years ago and its share price reaching $944 as of this writing, it’s not a stretch to the think the company may choose to split its stock again.

Nvidia anticipated the AI revolution well before other peers did, giving it a long multi-year lead. In fact, Nvidia has been investing in its CUDA software ecosystem since 2006. CUDA allows developers to program Nvidia’s graphics processors for data processing, thus enabling AI. Fast forward to the introduction of ChatGPT in late 2022, and that foresight looks like a stroke of genius. The 17-year head-start on the competition has allowed for some nice network effects, with AI developers building most of their applications with CUDA and making it difficult for competitors to make inroads.

But Nvidia isn’t resting on its laurels; last October, management declared it would double the speed at which it introduces a new chip architecture, from once every two years to once per year. On that note, management introduced its new Blackwell architecture in March, which will be hitting the market in late 2024. These new AI chips offer a big leap forward over even the current Hopper architecture, offering 2.5 times the training performance and up to five times the inference performance over its predecessor.

Nvidia has its Q1 earnings release tomorrow on Wednesday, May 22, and all indicators point to its strong AI-fueled hypergrowth continuing.

2. Super Micro Computer

One AI stock that has had even better returns than Nvidia over the past three years is Super Micro Computer (NASDAQ: SMCI). Sure, a lot of Super Micro’s recent success is owed to Nvidia’s AI chips, but SMCI’s returns in the stock market have actually been far superior. Since July 2021, the last time Nvidia split its stock, Nvidia is up by five times. But Super Micro’s stock has increased a whopping 25 times over in less than three years. As a result, Super Micro’s stock price has appreciated to about $900 per share as of this writing, setting it up for a potential split.

A good part of that outperformance was a result of Super Micro’s starting from a significantly lower valuation. In the past, its server products were thought of as “commoditized” with a lot of other competitors in the space.

But the AI revolution has exposed the business model strengths CEO Charles Liang had been cultivating for 30 years. Architecting its servers out of, “building blocks,” or creating the smallest possible modules or server components independently, then being able to build servers out of any combination of these components, Super Micro has mass-customization capabilities that enable it to satisfy virtually any customer modification request. Not only that, but the architecture also saves on costs, as parts of a server can be refreshed instead of having to replace an entire system.

Moreover, Liang has stressed energy-efficiency in its server design for some 20 years, far before it was fashionable. But with the enormous electricity needs and costs of AI servers, Super Micro’s efficient designs are finding even more favor today. And with offices right in the heart of Silicon Valley close to Nvidia and other chipmakers, Super Micro is often able to stay ahead of competitors with the latest in-demand features such as liquid cooling, and is often first-to-market with servers containing the latest and greatest chips.

While Super Micro’s P/E ratio has ballooned from the single digits to 50 over just the past few years, it’s also displaying the growth to back it up, with a stunning 200% growth last quarter. As such, I’d expect Super Micro’s share price to at least maintain these valuation levels, with a stock split potentially in the cards.

3. Broadcom

Another AI beneficiary is Broadcom (NASDAQ: AVGO), thanks to two main factors. First, Broadcom makes the world’s leading networking and routing chips with its Tomahawk and Jericho brands, and data center networking needs are exploding thanks to the data-intensive nature of AI.

Second, Broadcom has application-specific integrated chip (ASIC) design IP that third parties can use to make AI accelerators. In this area, Broadcom has landed some big fish, with both Alphabet and Meta Platforms using the company’s ASICs to design their own in-house AI accelerators.

As a result of its highly cash-generative business and AI-fueled growth, Broadcom has seen its share price rally to over $1,400 per share. That definitely puts it in the running for a stock-split.

Of course, the AI boost has only been the most recent catalyst pushing Broadcom’s stock. Even before the AI revolution, Broadcom was an impressive winner thanks to CEO Hock Tan’s visionary acquisition strategy. Over the past 18 years under his tenure, Tan has sought to acquire strong semiconductor franchises, then cutting costs as these defensible niche technologies are folded into the Broadcom corporate umbrella.

Then in 2018, Tan expanded Broadcom’s reach when it bought its first software company, California Technologies, diversifying the chipmaker into software, albeit still within its main enterprise infrastructure market. After buying cybersecurity firm Symantec in 2019, Broadcom made its biggest purchase yet in VMware, a software leader that enables hybrid cloud capabilities and data center virtualization. VMware should also benefit from the growth of AI as customers use many clouds with unique capabilities while striving to keep their data safe in their own data centers. As a result of the VMware acquisition, which closed late last year, Broadcom’s software mix has grown to roughly 40% of revenues.

Now, Broadcom isn’t just a chipmaker, but a diversified technology platform company with many ways to win. Look for its profitable growth to remain strong in the years ahead.

4. ASML Holdings

The path to making every leading-edge semiconductor, Nvidia GPUs included, runs through ASML Holdings (NASDAQ: ASML). This is because the Netherlands-based lithography company has a monopoly on key extreme ultraviolet lithography (EUV) technology needed to make today’s most advanced chips.

EUV technology took some 20 years to develop with significant buy-in from ASML’s customers to fund leading research, so don’t think that EUV capabilities can be copied anytime soon. The resulting technology allows for chipmakers to draw extremely fine transistor designs with light wavelengths that do not occur naturally on earth. And ASML’s latest version of EUV, called “high-NA” EUV, can print designs down to widths of just 8nm. ASML is set to rake in the dough from high-NA, just introduced late last year, as these machines currently go for between $300 million and $400 million a pop!

EUV only began to be used commercially in 2018, with the first EUV-enabled products coming out in 2019. So, we are still only at the beginning of the EUV era. As such, ASML has seen its stock rocket 367% over the past five years, reaching $940 per share, thus making it a candidate for a stock split.

5. Lam Research

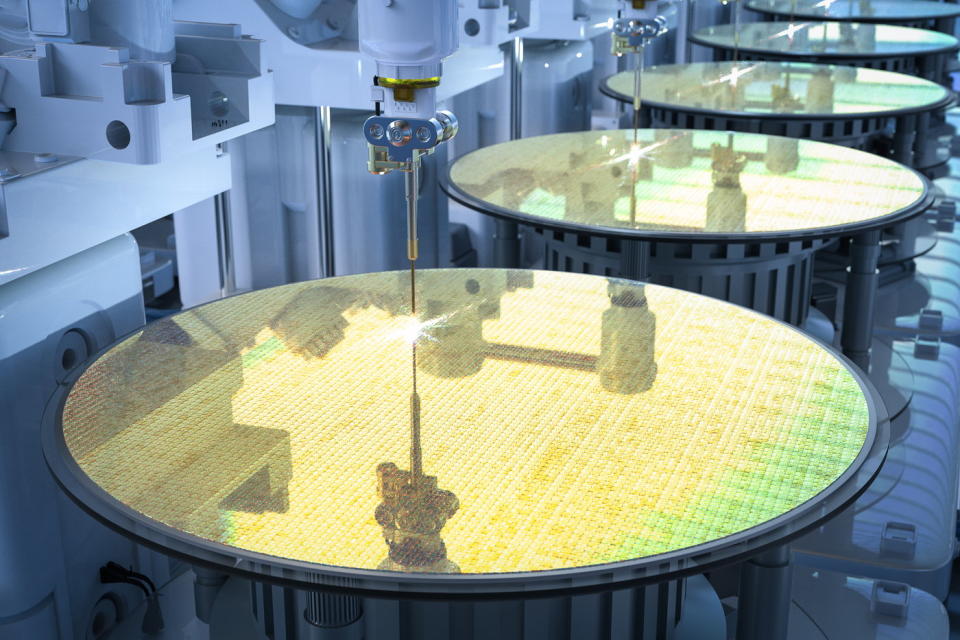

Like ASML, Lam Research (NASDAQ: LRCX) is a semiconductor equipment leader that has also seen shares rally over the semiconductor bull market. But whereas ASML is the de facto leader in lithography, which draws designs on a silicon wafer using extremely fine light, Lam’s technology does the exacting and painstaking work of etching the printed design and then depositing semiconductor material in extremely intricate patterns to construct the chip.

While Lam doesn’t have a clear monopoly over etch and deposition technology like ASML does with EUV, Lam actually does have a monopoly over certain process steps in the chipmaking process. More specifically, Lam dominates the deposition technology crucial to “stacking” chip components in a vertical fashion. Over the past decade or so, that has led to Lam benefiting from the production of 3D NAND flash chips, in which memory-makers stack storage modules in a “3D” fashion in greater and greater numbers of layers with every generation.

Now, logic and DRAM chips crucial for AI are also “going vertical,” including high-bandwidth memory DRAM that is currently seeing such strong demand from AI applications. In fact, on its January conference call with analysts, Lam management noted it had a 100% market share in certain technologies needed for stacking DRAM modules. And with new gate-all-around transistors and 3D designs making their way into logic chips, look for Lam to get a further AI boost in the years ahead.

That’s why shares have rocketed 385% over the past five years to $941 per share as of this writing, setting this strong compounder up for a possible stock split as well.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Billy Duberstein has positions in ASML, Alphabet, Broadcom, Lam Research, Meta Platforms, and Super Micro Computer and has the following options: short January 2025 $1,840 calls on Super Micro Computer, short January 2025 $110 puts on Super Micro Computer, short January 2025 $125 puts on Super Micro Computer, short January 2025 $130 puts on Super Micro Computer, short January 2025 $280 calls on Super Micro Computer, and short January 2025 $85 puts on Super Micro Computer. His clients may own shares of the companies menitoned. The Motley Fool has positions in and recommends ASML, Alphabet, Lam Research, Meta Platforms, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

Stock-Split Watch: 5 Artificial Intelligence (AI) Stocks That Look Ready to Split was originally published by The Motley Fool

Signup bonus from