Ahead of Chipotle Mexican Grill‘s planned 50-for-1 stock split, investors may be wondering which stock could be next.

One candidate is Nvidia (NASDAQ: NVDA), whose stock has skyrocketed 230% over the past year and is now hovering around $950 per share. So, let’s explore why a company might split its stock, Nvidia’s history of stock splits, and whether investors should buy the chipmaker.

What’s a stock split?

A stock split is a corporate action in which a company divides its existing shares into multiple shares, effectively increasing the outstanding shares while maintaining the same market capitalization. This results in its shareholders receiving more shares, while their ownership stake and the total value of their investment remain unchanged.

For instance, if an investor holds five shares of a company priced at $1,000 per share and the company executes a 10-for-1 stock split, the investor would then own 50 shares priced at $100 each, with the total investment value remaining at $5,000.

Why would a company split its stock?

While many brokerages let retail investors purchase fractional shares, others, like Vanguard, don’t offer this option. So, when a stock like Nvidia trades at a high price, it might become too expensive for many potential investors. Having a lower share price could make a stock more affordable, potentially leading to more demand for the company’s shares, which may increase its overall market capitalization.

Another benefit is that a lower stock price can help attract and keep talented workers. Nvidia co-founder, president, and CEO Jensen Huang supports this reasoning, saying it provides workers greater flexibility in their ownership of company stock through compensation or stock plans.

Nvidia has split its stock before

Nvidia is no stranger to stock splits. Since going public in 1999, it has split its stock on five occasions, all under Huang. The company’s most recent one, a 4-for-1 split, happened in July 2021.

Notably, when the company announced its last stock split, its stock traded near $600 per share, well below its current price of $950 per share.

When Jim Cramer asked about it in March, Huang said, “We’ll think about it,” and reiterated why he likes the practice, saying: “It’s a good thing. We want to make sure we take care of our employees.”

Is Nvidia a buy ahead of a potential stock split?

Although stock splits may spark interest, investors are advised to refrain from basing their investment decisions solely on this factor. Instead, the company’s financial performance and management’s guidance wield far greater influence on its long-term stock performance.

In Nvidia’s fiscal 2024, the company generated $60.9 billion in revenue and $29.8 billion in net income, an improvement of 126% and 581%, respectively, compared to its fiscal 2023. The meteoric rises were largely driven by the growing demand for its expensive H100 chip, which is the engine behind the generative artificial intelligence boom.

Huang summed up the unprecedented fiscal year by saying in the company’s fourth-quarter earnings release: “Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations.”

Nvidia’s management guided for roughly $24 billion in revenue for fiscal Q1 2025, which would represent a 234% year-over-year increase. Also, management projected its generally accepted accounting principles (GAAP) gross margin to be between 76.3% and 77%, resulting in a significant year-over-year increase from 64.6%. Anytime a company can increase its gross margin, it displays its pricing power, which Nvidia has in its industry-leading chips.

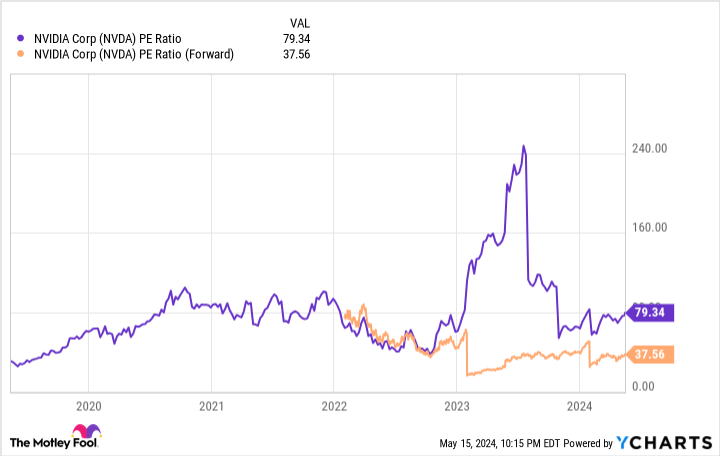

No matter how quickly a company is growing, investors still need to pay attention to valuation to ensure that they do not overpay for its stock. For a mature company like Nvidia, the price-to-earnings (P/E) ratio is a standard valuation metric that looks at a company’s stock price compared to its trailing 12 months of earnings. As of this writing, Nvidia trades at 79.3 times trailing earnings, higher than its five-year median of 71.9. However, if you look at Nvidia’s forward P/E ratio, which compares the stock price to the company’s expected earnings over the next 12 months, its stock trades at a more reasonable 37.6.

While value investors may scoff at Nvidia’s valuation, considering the average trailing P/E ratio of the S&P 500 is 23.2 times earnings, it’s important to underscore that the unprecedented growth that Nvidia has seen in terms of sheer revenue and net income over the past year. For those reasons, coupled with the continued growth of generative artificial intelligence, long-term growth investors should consider buying or adding to Nvidia. Investors can always implement a dollar-cost averaging strategy to build a position over time without the stress of short-term volatility.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Collin Brantmeyer has positions in Chipotle Mexican Grill and Nvidia. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Nvidia. The Motley Fool has a disclosure policy.

Stock Split Watch: Is Nvidia Next? was originally published by The Motley Fool

Signup bonus from