Artificial intelligence is a growth topic, so it feels weird to associate AI with dividend stocks. I’m here to tell you that the two can coexist perfectly. Some great dividend stocks are at the center of AI’s growth today.

Two wonderful examples immediately come to mind: International Business Machines (NYSE: IBM) and Equinix (NASDAQ: EQIX). Here is why investors can count on these two AI stocks for solid passive income and total investment returns in the future.

IBM continues to evolve

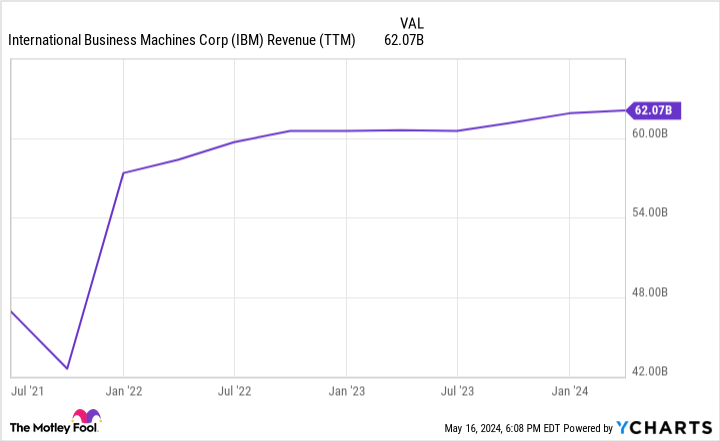

International Business Machines — or IBM as everyone calls it — has continued to evolve. From the 1980s to the early 2000s, IBM was a one-stop shop for on-premise IT systems. However, the IT world changed with the emergence of cloud technology. IBM has steadily adapted over the years, spinning off its managed IT business as Kyndryl several years back. IBM stumbled and shrunk for a while but has clawed its way back to growth by focusing on hybrid-cloud solutions, the idea that companies need both cloud and on-premise equipment to meet their needs.

Consistent revenue growth resumed in 2022, and IBM recently tapped the mergers and acquisitions market with a $6.5 billion deal to acquire HashiCorp. The company specializes in automated solutions in hybrid-cloud IT, which IBM says gives it complete end-to-end hybrid-cloud services. HashiCorp does business with 85% of the Fortune 500 and has over 4,400 customers, giving IBM potential cross-selling opportunities over the long term.

Investors hope IBM can carve out its market share as companies with hybrid cloud setups seek new AI solutions.

In the meantime, investors can benefit from a healthy dividend that yields just under 4% today. That’s what’s cool about dividend stocks: they pay you to hold them. IBM is no stranger to paying dividends; it has paid and raised dividends for 29 consecutive years. A payout ratio of 48% supports the dividend so investors can feel good about its safety moving forward.

Arguably the best real estate play on AI

People are investing in all aspects of AI: chips, software, and more. But what about the real estate? Equinix has you covered there. It’s a real estate investment trust (REIT) that owns and operates a network of 260 internet and data centers spread across five continents. In other words, it’s a global multi-tenant data center provider. Companies can rent data center space, connect directly to cloud computing and storage, and pay Equinix to manage the infrastructure’s day-to-day needs. It’s like a data center in a box.

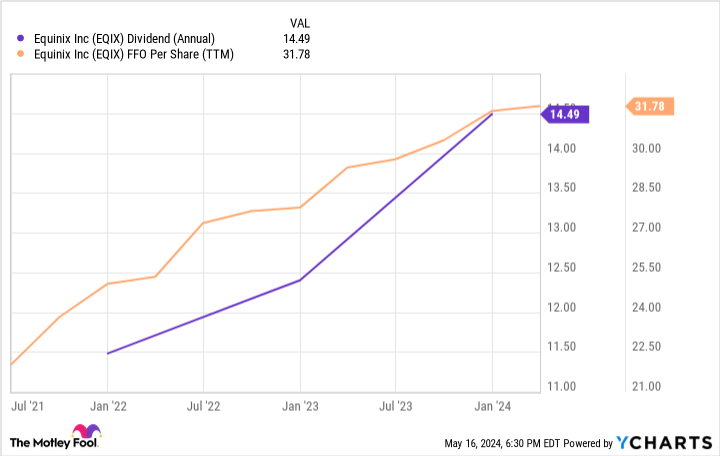

Equinix is a REIT, which makes it an outstanding dividend stock because REITs must pay at least 90% of their taxable income out as dividends. Equinix has paid and raised its dividend for 10 straight years. The company deals with over 10,000 customers, signing them to long-term leases that average over 18 years in the remaining term. Additionally, Equinix has generated 21 consecutive quarterly revenue growth, which shows how resilient the business is on the backs of secular cloud growth in recent years.

The business should remain busy for a while. According to research by Kohlberg Kravis Roberts & Co, global data center demand is expected to grow between 12% and 15% annually through 2030. AI will likely have a significant influence on this.

Of course, investors will enjoy stellar dividends while holding shares. The stock yields 2.1% today, but the payout has grown by an average of 10.5% annually over the past five years. The current payout is just 54% of funds from operations (a REIT’s profits), so investors should look for more increases as AI tailwinds continue fueling consistent growth at the company.

Add it all up, and Equinix has the makings of a solid total return investment.

Should you invest $1,000 in International Business Machines right now?

Before you buy stock in International Business Machines, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and International Business Machines wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Equinix. The Motley Fool recommends International Business Machines. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Offer Dividends and Long-Term Returns was originally published by The Motley Fool

Signup bonus from