There is no doubt that Nvidia (NASDAQ: NVDA) has been one of the top artificial intelligence (AI) stocks to buy on the market in the past year-and-a-half thanks to the critical role it is playing in the advancement of this technology.

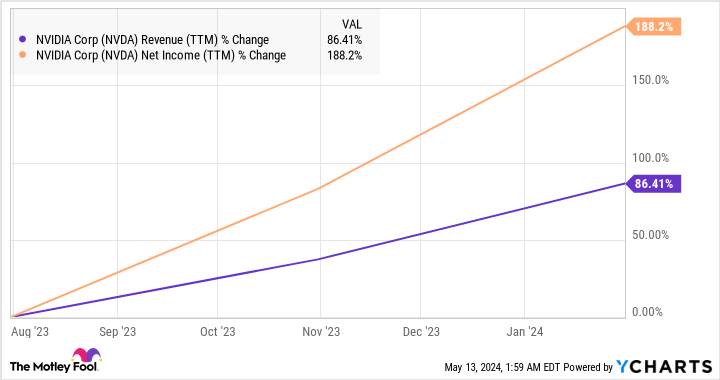

After all, training large language models (LLMs) such as ChatGPT wouldn’t have been possible without chips from Nvidia. Major cloud computing companies and governments around the globe have been lining up to buy Nvidia’s AI graphics processing units (GPUs), leading to outstanding growth in the company’s revenue and earnings.

NVDA Revenue (TTM) data by YCharts

There is a good chance that Nvidia will be able to sustain the impressive growth that it is posting in its top and bottom lines. That’s because the company’s dominant position in the AI chip market seems safe considering the technology lead that it enjoys over its rivals. However, there is a chance that investors who aren’t comfortable paying for Nvidia’s expensive valuation could be seeking alternatives to capitalize on the AI boom.

Nvidia is trading at 75 times trailing earnings. It may be able to justify that valuation by sustaining its red-hot growth, but for investors looking for a cheaper AI stock, The Trade Desk (NASDAQ: TTD) could turn out to be a top pick that could be an even better buy than Nvidia. Let’s look at the reasons why.

The Trade Desk is using AI to win market share in a lucrative niche

The Trade Desk provides a cloud-based, data-driven, programmatic advertising platform to advertisers. This platform allows them to purchase ad inventory from multiple channels, set up, run, and optimize ad campaigns, and serve ads to the right audience on the relevant platform in a cost-efficient manner to increase advertisers’ return on investment.

The company uses real-time insights and algorithms to ensure that advertisers using its platform can get the most out of their ad dollars. More importantly, The Trade Desk has been leveraging AI to ensure that advertisers get more out of its platform. In 2018, the company launched and started integrating an AI tool known as Koa into its platform. Koa analyzed almost 9 million queries each second “to help buyers extend audience reach and spend more efficiently.”

More specifically, The Trade Desk claimed that Koa can help advertisers increase their reach by 3 times and reduce costs by 20%. The company released a new AI tool called Kokai last year, utilizing 13 million advertising impressions each second to “help advertisers buy the right ad impressions, at the right price, to reach the target audience at the best time.”

Such AI-enabled tools are helping The Trade Desk grow at a faster pace than the digital advertising market, and accelerate its growth. For instance, in 2023, the company’s revenue increased 23% to $1.95 billion. That was well ahead of the 10.7% growth in digital ad spending last year. More importantly, The Trade Desk’s latest results for the first quarter of 2024 suggest that it is winning a bigger share of the digital ad market as its growth is accelerating.

The company reported a 28% year-over-year jump in revenue last quarter to $491 million, a nice increase from the 21% year-over-year growth it clocked in the same period last year. The company’s adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) margin also increased by five percentage points from the year-ago period.

The Trade Desk’s earnings of $0.26 per share beat the consensus estimate of $0.22 per share. Its revenue was also higher than the expectation of $480 million. Even better, The Trade Desk’s revenue guidance of $575 million is higher than the Wall Street forecast of $567 million. The EBITDA forecast of $223 million has also exceeded the $219 million consensus expectation.

The company’s quarterly revenue forecast would translate into a jump of 23% from the year-ago quarter, while its adjusted EBITDA is on track to increase by a similar figure. It is also worth noting that digital ad spending is estimated to increase by 13.2% in 2024, and the Trade Desk’s Q1 growth and Q2 guidance suggest that it is set to grow at a faster pace than the market once again.

So, The Trade Desk’s strategy of using AI to power its programmatic ad platform is set to help it capture a bigger share of the digital ad market. This should bode well for the company’s long-term growth. That’s because the digital ad market is forecast to generate $1.15 trillion in annual revenue in 2030, up from $420 billion last year, as per Grand View Research.

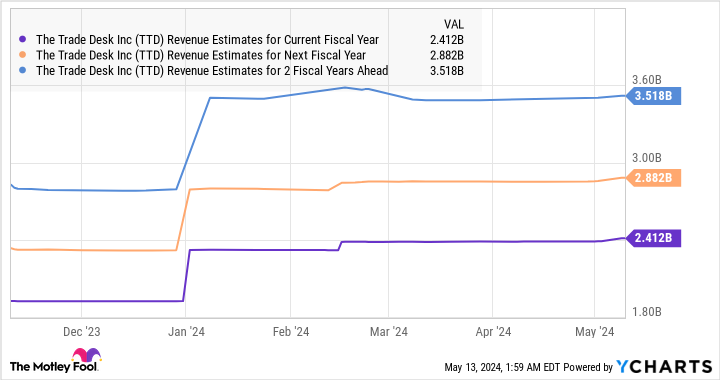

The Trade Desk, therefore, has a massive addressable opportunity ahead of it, and the fact that it is gaining ground in the digital ad market explains why analysts have been increasing their growth expectations for the company.

TTD Revenue Estimates for Current Fiscal Year data by YCharts

Investors can expect the stock to deliver healthy gains

The Trade Desk stock is currently trading at 21 times sales, a small discount to its five-year average sales multiple of almost 24. Of course, the sales multiple is higher than the U.S. tech sector’s price-to-sales ratio of 7, but The Trade Desk’s growing stature in the digital ad market could justify it.

If the Trade Desk can maintain its current sales multiple after three years and achieves $3.52 billion in revenue in 2026, as per the chart in the previous paragraph, its market cap could increase to $74 billion. That points toward a jump of 72% from the current level.

Also, The Trade Desk is cheaper than Nvidia, which commands a sales multiple of 36. So, investors looking for a relatively cheaper alternative to Nvidia can consider buying The Trade Desk, as it could turn out to be a top AI stock.

Should you invest $1,000 in The Trade Desk right now?

Before you buy stock in The Trade Desk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and The Trade Desk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $559,743!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and The Trade Desk. The Motley Fool has a disclosure policy.

Forget Nvidia: Here’s My Top Artificial Intelligence (AI) Stock to Buy Instead was originally published by The Motley Fool

Signup bonus from