If you’re an Nvidia (NASDAQ: NVDA) or any type of artificial intelligence (AI) investor, then May 22 is a day you must have circled on your calendar. That’s when Nvidia reports Q1 FY 2025 results, which will give investors some clues as to how strong the market is for Nvidia’s class-leading GPUs (graphics processing units).

With how big of a move Nvidia’s stock has made after previous earnings releases, it may be wise to consider buying (or selling) some shares before then. I’ve analyzed Nvidia and come up with three reasons to buy and one to sell. So what should you do before May 22?

1. Reason to buy: Other companies are still talking about AI infrastructure demand

Nvidia’s primary product, the GPU, is vital for AI model development and training. GPUs allow parallel processing, giving them the ability to do multiple tasks at the same time. This is crucial for training AI models, as multiple iterations must occur before an AI model is usable.

Nvidia’s GPUs are the best on the market for AI training, and its customers are buying thousands of them at a time to outfit their servers with the best technology possible.

This caused Nvidia’s initial boom last year, but some investors (including myself) were worried that there would be little demand for more capacity once initial demand is satisfied. However, that isn’t the case.

Meta Platforms raised its long-term capital expenditure guidance to build more computing power to capture the massive AI opportunity it sees. On its conference call, Tesla CEO Elon Musk mentioned that they have about 35,000 Nvidia H100 GPUs active, with another 85,000 slated to be up and running by the end of this year.

The demand for Nvidia’s products is still there, which should bode well for it this quarter.

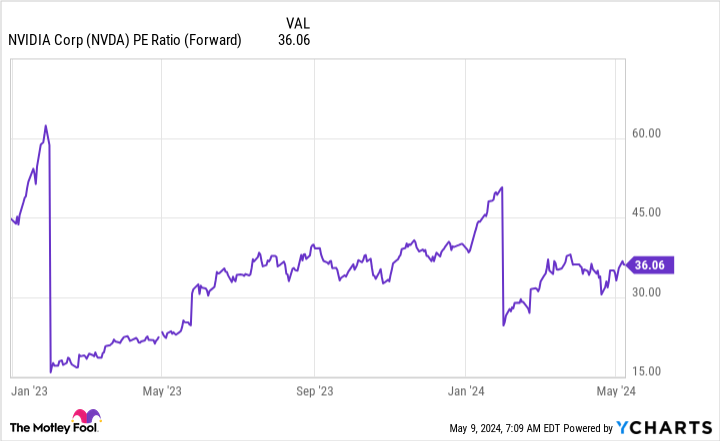

2. Reason to buy: The stock isn’t as expensive as investors might think

One gripe about Nvidia’s stock has been how expensive it is. That’s true if you look at the trailing-price-to-earnings (P/E) ratio. At 76 times earnings, it could be considered outrageously expensive. But that doesn’t do the stock justice. Nvidia is undergoing a massive transformation and is expected to post another massive quarter of growth (Wall Street projects 250% growth in Q1).

As a result, looking at trailing earnings does investors no good. Instead,they should utilize the forward P/E to value Nvidia.

At 36 times forward earnings estimates, Nvidia is far from cheap. However, it’s undergoing a massive shift, and this figure could be incredibly off the mark if Nvidia’s growth continues. Furthermore, it’s not far off from Microsoft, which trades at 35 times forward earnings despite growing much slower.

If valuation is a top reason to avoid Nvidia’s stock, you may need to rethink that, as many other stocks trade in a similar range as Nvidia despite not having the growth.

3. Reason to buy: New product launches could drive another demand wave

Although Nvidia may have some of the best products on the market, it isn’t resting on its laurels. Nvidia has launched a few new upgraded GPUs, like the Blackwell GPU. But what investors (and many companies) are waiting for is the H200.

This system is expected to launch in the second quarter of 2024 and is a massive upgrade over the already popular H100. Some companies may be holding out until the H200 is launched to future-proof their servers, as they don’t want to upgrade in a couple of years when the H100s become obsolete.

Although that’s speculation, the H200 will undoubtedly drive new demand, especially from companies willing to pay top dollar to have the best products available.

These are great reasons to buy Nvidia’s stock before its Q1 earnings date, but there’s also a reason to sell.

Reason to sell: Anything short of perfection could ignite a sell-off

While I mentioned that Nvidia’s stock isn’t as expensive as many think, it’s still priced for perfection. If Nvidia misses the mark in any way this quarter, there will likely be a heavy sell-off.

I think that’s unlikely because the heavy demand for Nvidia’s GPUs is still present. However, the company’s execution is unknown until investors see the financials.

Should Nvidia report a less-than-perfect quarter, investors must examine the situation more closely to determine whether the sell-off is warranted or a buying opportunity.

Although the odds of this happening are pretty low, something as simple as a slip-up or a tone on a conference call can make or break a stock.

With how the industry currently looks, I see no problem with buying Nvidia’s stock before Q1 results, as it’s slated to be another quarter of incredibly strong growth.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Meta Platforms and Tesla. The Motley Fool has positions in and recommends Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

3 Reasons to Buy Nvidia Stock Before May 22 (and 1 Reason to Sell) was originally published by The Motley Fool

Signup bonus from