Super Micro Computer (NASDAQ: SMCI) has been a fantastic stock to own in 2024, as it’s up nearly 200% this year. However, that figure was more than 300% at one time; the stock is nowhere near its 2024 highs.

With the stock about $400 off of its highs, is it time to buy the dip? After all, Super Micro Computer (often called Supermicro) has been growing at a lightning pace.

Artificial intelligence demand is fueling Supermicro’s stock

Supermicro is cashing in on the same trend that many others have been: artificial intelligence (AI). In essence, Super Micro Computer gave investors a second chance to buy Nvidia, as it’s a very similar style of investment.

Super Micro Computer makes highly customizable servers, which are essential for maximizing the performance of the hardware within them. For AI, these servers are packed full of GPUs (graphics processing units), often made by AI king Nvidia. Companies wanting to expand their computing power can’t just haphazardly hook up their GPUs; they need to put them in a server where they are properly networked and cooled. As the demand for AI computing power accelerates, Supermicro benefits.

Supermicro is also closely tied with Nvidia, which was on display when Super Micro Computer became the first server maker to market Nvidia GH200 and GB200 GPUs, which are next-generation technologies.

The demand increase that Supermicro is experiencing is very similar to the level Nvidia saw back in 2023. So, when investors recognized this at the start of 2024, they bid up the stock to levels where Supermicro would have been if it had experienced the same growth as Nvidia.

However, the market realized that this level was far too high, which is why the stock sold off recently. Its earnings, though, have been nothing short of fantastic.

The stock is still quite expensive, even if long-term projections are hit

In the fiscal third-quarter of 2024 that ended March 31, Supermicro’s revenue rose an astounding 200% year over year to $3.85 billion. Guidance was also strong, with management expecting between $5.1 billion and $5.5 billion in revenue for fiscal Q4, representing 133% to 152% growth.

But the problem is that the market was expecting that level of growth, so the stock didn’t skyrocket following earnings; it actually fell more than 10%.

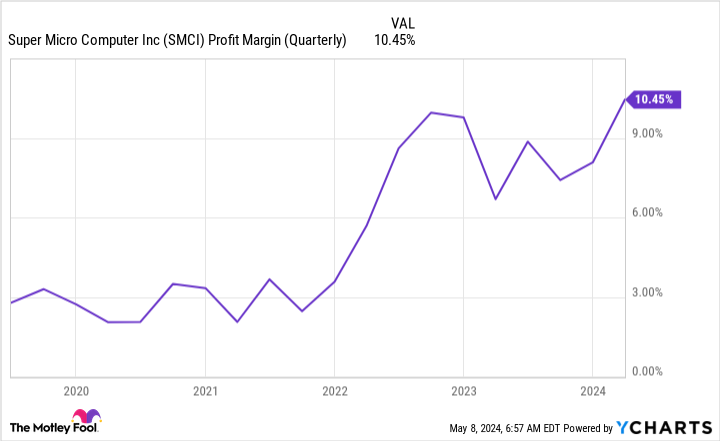

The biggest issue with Super Micro Computer is that its current trading level doesn’t align with management’s long-term goals, which are to achieve $25 billion in annual revenue. In the fiscal third quarter, Supermicro posted a profit margin of 10%, so if it could maintain that profitability level for an entire year and hit its revenue goal, it would produce $2.5 billion in profits. Supermicro currently sports a $48 billion market cap, so the stock would trade around 19 times earnings if all those projections were true.

Considering that Nvidia trades for around 34 times forward earnings right now, this doesn’t leave much room for Supermicro’s stock to grow. Furthermore, Supermicro should be valued at a discount to Nvidia as it doesn’t have as much differentiating technology or margin levels as Nvidia does.

As a result, Super Micro Computer is still trading around levels that it would be if it hit management’s long-term goals. That doesn’t leave much room for upside, which makes me want to avoid the stock.

One thing to note: This doesn’t mean I think Supermicro will struggle as a company. Due to massive AI demand, it should do quite well. However, the juice has already been squeezed from this stock, and AI investors should look for another company to quench their AI thirst.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Should You Buy the Dip on Super Micro Computer Stock? was originally published by The Motley Fool

Signup bonus from