Investing in the stock market can be daunting, especially when it involves picking individual stocks. It’s a process that demands extensive research and continuous monitoring but also carries significant risk.

For those looking to bypass these complexities, Vanguard offers a compelling solution with its range of 86 exchange-traded funds (ETFs). Among them, the Vanguard Total Stock Market ETF (NYSEMKT: VTI) stands out as a one-stop shop for investors seeking a diversified stock portfolio.

Why choose the Vanguard Total Stock Market ETF?

This particular ETF is designed to give investors exposure to the entire U.S. equity market, including small-, mid-, and large-cap growth and value stocks. Its broad diversification and low expense ratio make it an attractive option for both novice and experienced investors.

It tracks the performance of the CRSP US Total Market index. Composed of 3,656 individual stocks, this index represents a true tour de force in terms of diversification.

Expense ratio

The Vanguard Total Stock Market ETF sports an incredibly low expense ratio of 0.03%, significantly lower than the category average of 0.79%. This means more of your investment goes toward growing your capital rather than paying fund management fees.

10-year return average

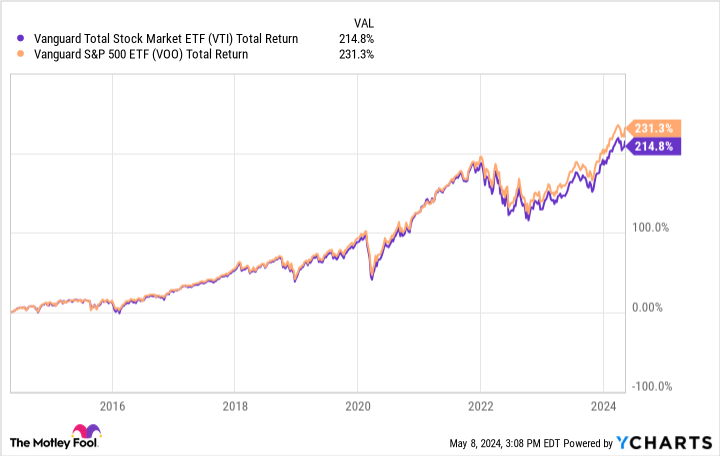

Over the past decade, this ETF has delivered an average annual return of 11.77%. While the Vanguard S&P 500 ETF outperformed it over this period, it didn’t do so by a wide margin (see graph below).

This fact demonstrates the ETF’s ability to provide robust returns while offering comprehensive exposure to the stock market.

Risk profile

The Vanguard Total Stock Market ETF carries a risk level of 4 on a scale of 1 to 5, with 5 being the highest risk. This metric indicates a higher risk potential, compared to lower-risk investments such as bonds and other fixed-income instruments. But it also offers the possibility for higher returns, which is typical for stock market investments.

Top five holdings and their weights

The top five holdings in this ETF’s portfolio are some of the largest and most well-known companies on the planet that include:

-

Microsoft — 6.12%

-

Apple — 4.93%

-

Nvidia — 4.20%

-

Amazon — 3.30%

-

Meta Platforms — 2.09%

These holdings underscore the Vanguard Total Stock Market ETF’s focus on technology and innovation, areas that have historically driven an outsized portion of the market’s growth.

Sector weightings

The Vanguard Total Stock Market ETF’s sector weightings are reflective of the broader market, with technology (32.1%), consumer discretionary (14.2%), industrials (13.1%), healthcare (11.9%), and financials (11%) being the most heavily weighted sectors. This broad allocation aligns with the fund’s goal of a balanced approach to value creation and risk management.

Final thoughts

This ETF screens as an excellent choice for investors who prefer a hands-off approach to stock market investing. Its low costs, broad diversification, and solid track record of returns make it a suitable core holding that can serve as a complete stock portfolio.

Whether you’re starting out or just looking to simplify your investment strategy, the Vanguard Total Stock Market ETF offers a straightforward path to participating in the growth potential of the U.S. stock market. More broadly, investing in low-cost ETFs like this one can help mitigate the risks associated with individual stock selection while still providing the opportunity for healthy levels of capital growth. It’s a strategy that aligns with Vanguard’s philosophy of making high-quality investment options accessible to all in a low-cost manner.

Should you invest $1,000 in Vanguard Index Funds – Vanguard Total Stock Market ETF right now?

Before you buy stock in Vanguard Index Funds – Vanguard Total Stock Market ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds – Vanguard Total Stock Market ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $554,830!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. George Budwell has positions in Apple and Vanguard S&P 500 ETF. The Motley Fool has positions in and recommends Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Vanguard Index Funds-Vanguard Total Stock Market ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Vanguard ETF That Can Serve as a Complete Stock Portfolio was originally published by The Motley Fool

Signup bonus from