Markets wobbled at the start of Wednesday’s trading session as investors geared up for the Federal Reserve’s decision on interest rates.

According to the CME Fed Watch Tool, it’s a foregone conclusion that the Fed will hold rates steady today. And while markets have already priced in the Fed’s decision, investors will listen closely to Fed Chair Jay Powell’s afternoon speech and answers to reporter questions for further clues about the future direction of interest rates.

SPY, the SPDR S&P 500 ETF Trust, slid by a quarter of a percentage point while DIA, the SPDR Dow Jones Industrial Average ETF Trust inched 0.2% higher.

The Fed meeting has grabbed attention from tech earnings. Amazon.com Inc. reported first-quarter beats on both top and bottom lines after Tuesday’s closing bell, with the tech giant saying profit more than tripled year-over-year to $10.4 billion. It’s shares jumped about 2.5%.

Amazon is the largest holding in XLY, the Consumer Discretionary Select Sector SPDR Fund, which dropped 0.6% in midmorning trading.

QQQ, the Invesco QQQ Trust which tracks the tech-heavy Nasdaq, slid by half a percent as investors awaited the Fed decision. Tech has gained this year, despite the “higher for longer” rate environment. But QQQ has underperformed the broader market, as higher interest rates keep high growth companies like those in the tech sector under pressure.

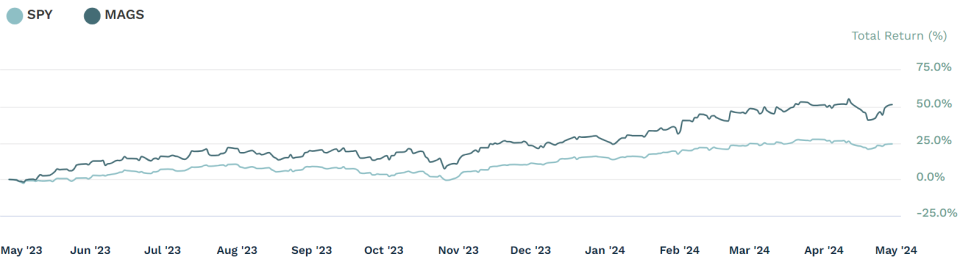

But while tech might not be keeping pace with the wider market, the Mag 7 is blowing it out of the water. MAGS, the Roundhill Magnificent Seven ETF, which holds the Magnificent Seven in its fund, jumped 0.4%, boosted by Amazon. MAGS has soared just under 18% so far this year.

MAGS vs. SPY Performance

More tech earnings will be on deck this week as Apple Inc. is set to report tomorrow after the bell. And on Friday, investors will turn their attention to the state of the labor market for the April jobs report.

Any strength (or weakness) in the jobs market will also provide investors with further clues on future path of rates. The Fed uses the jobs data as a proxy for the strength of the U.S. economy since a stronger economy is better equipped to handle higher rates.

Permalink | © Copyright 2024 etf.com. All rights reserved

Signup bonus from