Growth stocks are companies expected to outperform the U.S. stock market (generally using the S&P 500 as a proxy) because of their potential for high earnings growth. This growth potential is largely why growth stocks have been the darlings of the market for quite a while now. After all, why wouldn’t investors take a liking to companies that can produce market-beating returns?

When some people think of growth stocks, their mind goes to smaller companies on the verge of a breakthrough. However, that’s not always the case. A company’s growth potential isn’t tied to its size — many small companies remain stagnant, and many large companies continue growing rapidly. The latter case can be the best of both worlds.

For investors looking for a combination of growth potential and stability, the Schwab U.S. Large-Cap Growth ETF (NYSEMKT: SCHG) is a great option.

Some great companies leading the way for the ETF

Growth stocks are often more volatile than other types of stocks because a lot of their value comes from their potential. However, large-cap companies (typically with market caps of over $10 billion) are generally well established and have the resources to weather down periods. In the Schwab U.S. Large-Cap Growth ETF’s case, it’s being led by some of the greatest companies in the world.

Here are the ETF’s top 10 holdings and how much of the fund they make up (as of April 12):

Ten companies accounting for over 56% of a 250-stock ETF doesn’t scream “diversification,” but these large-cap growth companies are the cream of the crop. Over the past decade, Alphabet has performed the worst out of the group, but it’s still up close to 500%.

A lot of growth stocks are tech companies, so the Schwab U.S. Large-Cap Growth ETF is skewed that way, but the ETF can be a good supplement to a portfolio that already contains good representation from other sectors.

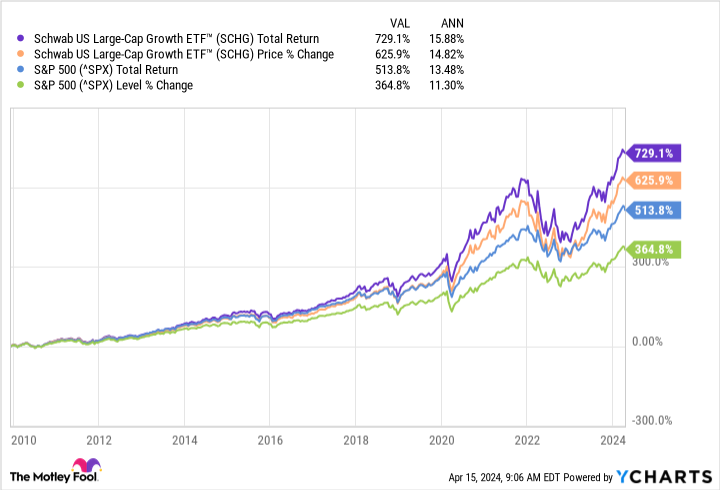

A history of outperforming the U.S. stock market

Since its Dec. 2009 inception, the Schwab U.S. Large-Cap Growth ETF has outperformed the S&P 500, averaging around 14.8% annual returns compared to the latter’s 11.3%. The difference is a little less when looking at total returns, but that’s largely because the growth focus of the Schwab U.S. Large-Cap Growth ETF excludes companies that focus more on dividends.

Past results do not guarantee future returns, but the Schwab U.S. Large-Cap Growth ETF has the right ingredients to be a lucrative addition to investors’ portfolios. For perspective, $6,000 annual investments that average 12% annual returns would add up to over $430,000 in 20 years.

Low fees mean investors keep more of their returns

An important part of investing in any ETF is understanding its expense ratio and how it could affect your returns. Luckily, the Schwab U.S. Large-Cap Growth ETF is one of the cheaper ETFs you can find in the stock market with an expense ratio of just 0.04%, or $0.40 per $1,000 invested.

To get an idea of how important expense ratios can be, let’s revisit our above scenario, in which someone invests $6,000 annually and averages 12% returns for 20 years. Below is roughly how much would be paid in fees during that span based on different expense ratios:

|

Expense Ratio |

Amount Paid in Fees Over 20 Years |

|---|---|

|

0.04% |

$2,000 |

|

0.50% |

$24,300 |

|

0.75% |

$35,900 |

Calculations by author. Fees rounded to the nearest hundred.

As you can see, the Schwab U.S. Large-Cap Growth ETF offers investors a chance for market-beating returns and a low expense ratio that ensures they keep as much of those returns as possible.

Should you invest $1,000 in Schwab Strategic Trust – Schwab U.s. Large-Cap Growth ETF right now?

Before you buy stock in Schwab Strategic Trust – Schwab U.s. Large-Cap Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab Strategic Trust – Schwab U.s. Large-Cap Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

This ETF Should Be Your Go-To If You Want the Best of Both Worlds in Growth Stocks was originally published by The Motley Fool

Signup bonus from