Markets are in the red today after three major banks reported quarterly earnings before the bell on Friday.

JPMorgan Chase reported a beat on both top and bottom lines, with profits jumping 6% in the first quarter to $13.4 billion. Despite the beats, JPM Chairman and CEO Jamie Dimon highlighted future concerns, noting, “looking ahead, we remain alert to a number of significant uncertain forces… there seems to be a large number of persistent inflationary pressures, which may likely continue.”

Wells Fargo, and Citibank both reported declines, but not as steeply as Wall Street had been expecting. Bank ETFs slid on the underwhelming reports. XLF, the Financial Select Sector SPDR Fund, dropped 1%.

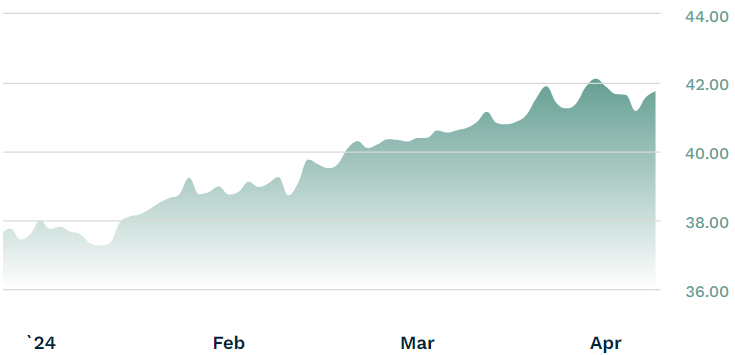

The banking sector has remained robust as the higher interest rates have increased profit margins for the financial sector. Year to date, XLF is up nearly 11%. But today’s reports highlighted that higher rates could become a headwind going forward.

XLF YTD Performance

Source: etf.com data

Blackrock also reported quarterly earnings before the bell on Friday, with a beat on both earnings and revenue. Blackrock’s assets under management (AUM) jumped to a record $10.5 trillion while revenue rose 11% thanks to higher fees and strong market performance.

Blackrock ETFs continue to perform well, while Blackrock’s largest ETF, IVV, the iShares Core S&P 500 ETF, is up more than 9.5% so far this year as the markets have continued their bull run.

Though higher rates have typically boosted the financial sector, the “higher for longer” rate environment presents challenges. Higher rates send consumers elsewhere for better yields in savings accounts that smaller banks offer, while many seeking loans for financial products like mortgages have chosen to stay on the sidelines and wait for interest rates to come back to Earth.

Inflation concerns have been in the forefront this trading week after the consumer price index (CPI), released Wednesday, highlighted persistent and stubborn inflationary trends.

Investors are currently forecasting that the Fed won’t cut rates until the July policy meeting at earliest, which will continue to weigh on real estate, and fixed income ETFs.

Signup bonus from