Vanguard’s largest exchange-traded funds (ETFs) — like the Vanguard S&P 500 ETF, Vanguard Total Stock Market ETF, Vanguard Growth ETF, or Vanguard Value ETF — garner a lot of attention. And for good reason. They are all fine funds worth considering.

But one less-discussed fund is the Vanguard Large-Cap ETF (NYSEMKT: VV). Here’s why it stands out as my top Vanguard ETF to buy and hold for at least the next five years, along with some strategies for incorporating ETFs into your portfolio.

A primer on the ETF

The Vanguard Large-Cap ETF has an ultra-low 0.04% expense ratio and focuses mainly on U.S. large-cap stocks — both growth and value. Like the S&P 500, the top holdings are growth stocks like Microsoft, Apple, and Nvidia because they are the most valuable companies.

The fund closely tracks the CRSP U.S. Large-Cap Index, which has 527 holdings compared to 530 holdings in the Vanguard Large-Cap ETF. The fund sports a 26.4 price-to-earnings ratio and a dividend yield of 1.3%. It has gained over 10% year to date and is hovering around an all-time high.

A close second

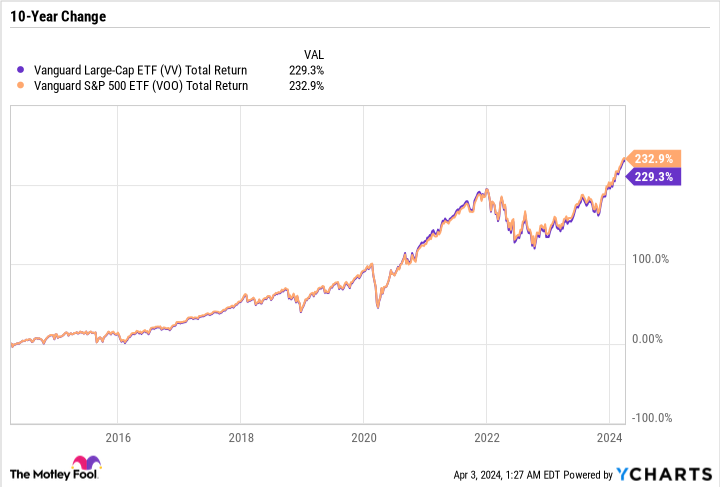

You may be wondering about the differences between the Vanguard Large-Cap ETF and the Vanguard S&P 500 ETF. After all, doesn’t the S&P 500 track the 500 largest U.S. companies? The funds are indeed very similar — so close, in fact, that they have nearly identical total returns over the past decade.

The main reason why I’d pick the Vanguard Large-Cap ETF over the Vanguard S&P 500 ETF is that the S&P 500 has more specific rules that can sometimes result in companies being in the index for too long or not getting added quickly enough.

In comparison, the Vanguard Large-Cap ETF can have more holdings and tracks a different index than the S&P 500. It’s a very subtle difference, and at the end of the day, it’s essentially a toss-up between the two funds.

The essence of ETF investing

I like that the Vanguard Large-Cap ETF captures the essence of low-expense ETF investing. When investing in a massive $49 billion fund like the Vanguard Large-Cap ETF, the goal is to get exposure to many different industries and market themes while avoiding the risks of a single company imploding.

By comparison, thematic ETFs charge higher fees and focus on a specific idea, like renewable energy, cybersecurity, or cloud infrastructure.

Combining a passive investment vehicle like the Vanguard Large-Cap ETF with individual stocks in your portfolio opens the door to be creative and invest in companies you like while achieving baseline diversification. A low-cost, large-cap fund is a good choice when you have savings you want to put in the market but don’t have any high-conviction ideas or already own your top picks.

Having a passive play can simplify the decision-making process, which can be especially helpful when the market is volatile. A balanced large-cap growth fund can be easier to hold through such periods. Because equity valuations have expanded, it can be tempting to hit the sell button on a stock that is up several times. Or during a bear market, it can be equally tempting to get too pessimistic and sell a company at a bad time when the underlying investment thesis is still strong.

In many ways, a fund like the Vanguard Large-Cap ETF can be easier to buy and add to over time, because it’s going to move mostly with the market. It will be down for the same reasons the market is down, or up for the same reasons the market is up. The lack of finger-pointing or putting blame on an individual company can help let winners run.

Simple, yet effective

When looking for a fund that can be bought and held for multiple years, low fees, stability, simplicity, and diversification are the most important qualities. The Vanguard Large-Cap ETF has these qualities in spades. It’s the perfect fund to pair with individual stocks. If that combo suits your investment style too, then the Vanguard Large-Cap ETF may be worth a closer look.

Should you invest $1,000 in Vanguard Index Funds – Vanguard Large-Cap ETF right now?

Before you buy stock in Vanguard Index Funds – Vanguard Large-Cap ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds – Vanguard Large-Cap ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $539,230!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 4, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, Vanguard Index Funds-Vanguard Growth ETF, Vanguard Index Funds-Vanguard Total Stock Market ETF, Vanguard Index Funds-Vanguard Value ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

If I Could Only Buy and Hold 1 Vanguard ETF For the Next 5 Years, This Would Be My Top Pick was originally published by The Motley Fool

Signup bonus from