Stocks dubbed the “Magnificent Seven” skyrocketed last year, helping the S&P 500 soar into bull market territory. These technology leaders are involved in some of today’s hottest areas, from artificial intelligence (AI) to cloud computing services. And thanks to this, their names are highly recognizable: Amazon, Apple (NASDAQ: AAPL), Alphabet, Meta Platforms, Microsoft, Nvidia, and Tesla (NASDAQ: TSLA) make up this star-studded list.

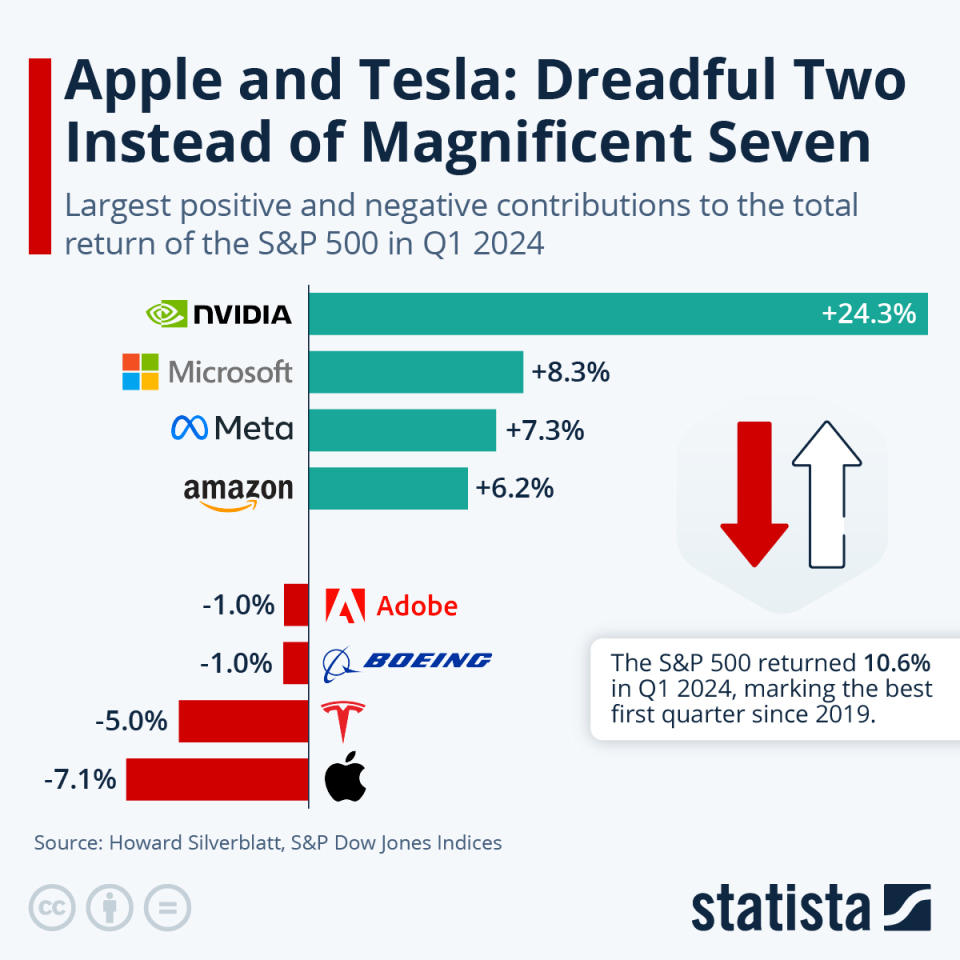

Most of these market giants have continued to soar, led by Nvidia, which has gained 79% so far this year. That helped the S&P 500 rise more than 10% for its best first quarter in five years, and that’s kept the Magnificent Seven in the spotlight in 2024. But two members of this elite group no longer are wowing investors, and instead, are in the spotlight for all the wrong reasons. Let’s take a closer look.

Double-digit declines

Which stocks am I talking about? Apple, the maker of world-famous products like the iPhone and Mac, and electric vehicle (EV) leader Tesla. These stocks have disappointed investors with their performance over the past few months, falling 11% and 32%, respectively, since the start of the year.

In fact, they even weighed negatively on the performance of the S&P 500 in the first quarter, together shaving 1.3 percentage points off the index’s return, according to Statista. The chart below shows Apple’s -7.1% contribution and Tesla’s -5% contribution to the S&P 500’s total return for the quarter. These two made the biggest negative contributions to the index.

A few reasons may be behind investors’ decisions to turn their backs on shares of Apple and Tesla in the first quarter. Let’s start with Apple. Yes, the company has grown earnings over time, and its products remain favorites worldwide. For example, Apple, for the first time, took the top seven positions in Counterpoint Research’s list of best-selling smartphones in 2023.

But some fans still are waiting for the next big innovation from Apple. Though the company recently released its Apple Vision Pro spatial computer earlier this year, it’s been met with mixed reviews. Apple also has been slower than other tech giants to detail its plans for AI. So, investors looking to bet on current and future high-growth players may turn away from Apple in favor of a company that offers a solid and clear path to growth over the next few years.

Tesla’s troubles

Now let’s consider Tesla. The company last year made moves such as lowering the prices on certain vehicles to increase volume and cutting production costs, and this is positive. But at the same time, some of Tesla’s current efforts are weighing on earnings, and the company also faces headwinds such as competition and negative currency impact.

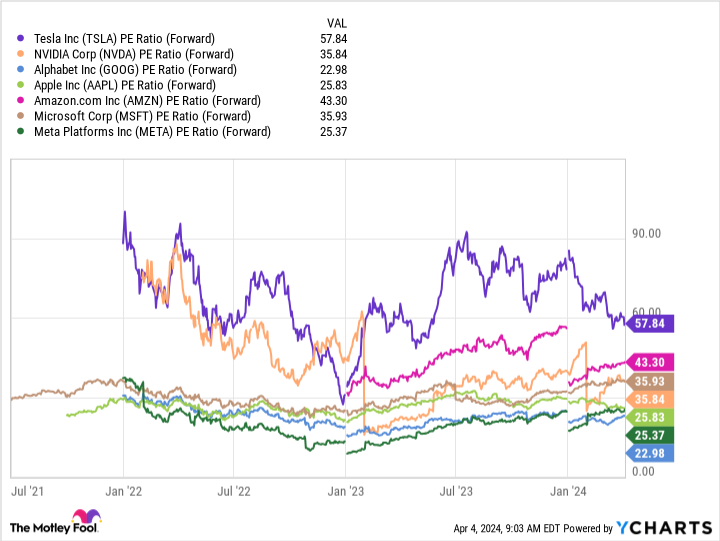

Tesla shares also trade for 57x forward earnings estimates, making them the most expensive of all of the Magnificent Seven stocks by this measure. This clearly could hurt demand for the stock and spur investors to buy shares of cheaper Magnificent Seven players right now.

As mentioned above, Nvidia has posted the best performance of all of these companies and contributed the most to the S&P 500’s increase so far this year. And for good reason. The tech giant delivered triple-digit gains in revenue and net income in the most recent quarter and just announced the upcoming launch of its much-anticipated Blackwell architecture and most powerful chips yet. Investors also are optimistic about the company due to its dominance in the AI chip market, especially considering forecasts that the AI market may surpass $1 trillion by the end of the decade.

Microsoft, Meta, and Amazon — the other top contributors to the S&P 500’s first quarter gain — also are investing heavily in AI. So, investors in the first few months of the year clearly have been aiming to get in on potential AI winners.

Is the party over for Apple and Tesla?

Does this mean the party is over for Apple and Tesla (and their shareholders)? Not necessarily. The long-term picture remains bright for both of these market leaders.

Apple’s solid moat — its brand strength — should ensure its products’ dominance in their markets, and the company’s next growth engine may be its services business. Tesla remains the EV leader in the U.S. and is developing the technologies today that could help it stand out over time — and maintain this leadership.

All of this means that, even though Apple and Tesla are standing in the spotlight today for all the wrong reasons, they — and their investors — still could score a major win over the long term.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $545,088!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 4, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

These 2 “Magnificent Seven” Stocks Are in the Spotlight for All the Wrong Reasons was originally published by The Motley Fool

Signup bonus from