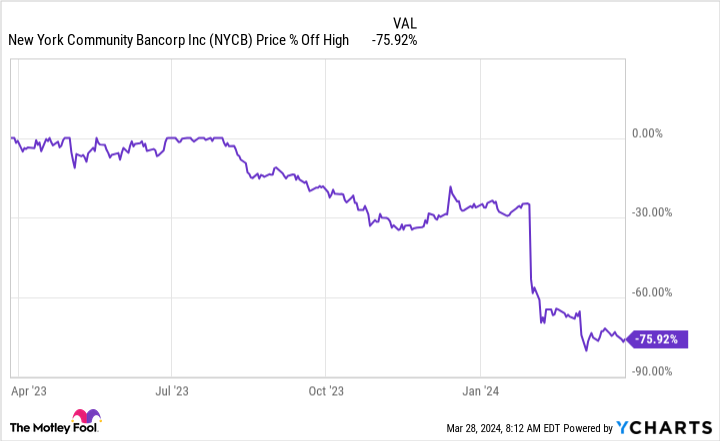

Share prices of New York Community Bancorp (NYSE: NYCB) have plunged roughly 75% from their 52-week highs. Most of the pain has come in the last three months following a terrible fourth-quarter 2023 earnings update.

It appears likely that the bank will muddle through its current headwinds thanks to a little outside help. But how likely is it that NYCB will get back into fighting shape in the next year?

New York Community Bancorp: Where did that come from?

At the end of 2022, New York Community Bancorp bought another bank. Then there was a rash of bank runs at several regional banks in early 2023, which NYCB managed to sail through largely unscathed. In fact, it even bought assets from one of the banks that collapsed during a run, which some might have taken as a sign of New York Community Bancorp’s strength.

Then it reported fourth-quarter 2023 earnings.

Although the headline on the earnings release stated that the bank had achieved “record results,” the big news from the Q4 update was a dividend cut. That was largely driven by a need to strengthen the company’s financial position. There were two reasons for that.

First, NYCB’s acquisitions had amplified its scale and therefore increased the scrutiny it would face from banking regulators. Bigger banks are expected to have stronger balance sheets. Second, the bank announced that it was having trouble with a couple of large loans. Specifically, net charge-offs increased to $185 million in the fourth quarter of 2023 from just $24 million in Q3.

And then things got really ugly for New York Community Bancorp.

It effectively fired its CEO in a strange multistep process only to replace the new CEO just weeks later. The announcement of the second CEO change was actually buried in a news release explaining that NYCB had received a $1 billion cash infusion from outside investors. While all this was playing out, the dividend got cut again to a token $0.01 per share per quarter. No wonder Wall Street is downbeat on the stock.

New York Community Bancorp has work to do

The good news in all of the mayhem at New York Community Bancorp is that it is likely to survive the current headwinds it is facing. That is, in no small part, thanks to the $1 billion cash infusion it received. But that doesn’t mean the business is fixed, it just means the company has the financial wherewithal to deal with its problems. CEO Sandro DiNello summed it up reasonably well in the announcement heralding the completion of the funding transaction:

“The completion of this major equity raise demonstrates the confidence these strategic investors have expressed in the turnaround currently underway at the Company and allows us to execute on our strategy from a position of strength. Our Company enters this next phase with an enhanced balance sheet and liquidity position.”

The one questionable statement in there is the use of the term “position of strength.” While New York Community Bancorp is certainly stronger than it was before the $1 billion infusion, it is still a work in progress. It might be better to view this as a “position of relative strength” compared to the day before the funding deal.

Dealing with the troubled loans outlined above is one of the big challenges it still has to handle. That will probably take some time, and there’s always a chance that other loans go sour. So investors need to pay close attention to the bank’s loan book.

But there’s another complicating factor, too, but it was put into an SEC filing, not announced in a news release: “[A]s part of management’s assessment of the Company’s internal controls, management identified material weaknesses in the Company’s internal controls related to internal loan review, resulting from ineffective oversight, risk assessment and monitoring activities.” That filing also announced that there would be some restatements and that the 2023 10-K would be filed late, which is usually not a good sign. Fixing internal control issues isn’t something that happens overnight and it might even require a total revamp of NYCB’s culture.

Solvable problems, but time-consuming fixes

At the end of the day, New York Community Bancorp’s $1 billion lifeline could very well have saved the bank. It is indeed in a much better position to tackle the challenges that it faces as it transitions from a small to a large banking institution.

But having more leeway to fix problems is not the same as being a strong and growing bank. It is probably going to take more than a year to get New York Community Bancorp back into fighting shape. With even the CEO calling this a turnaround situation, the stock is only appropriate for more aggressive investors willing to invest in the early days of that hoped-for comeback.

Should you invest $1,000 in New York Community Bancorp right now?

Before you buy stock in New York Community Bancorp, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and New York Community Bancorp wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Where Will New York Community Bancorp Be in 1 Year? was originally published by The Motley Fool

Signup bonus from