One of the rising stars among artificial intelligence (AI) developers is Palantir Technologies (NYSE: PLTR). The company markets its data analytics software under three monikers: Foundry, Apollo, and Gotham. The company markets these platforms to both the private and public sectors, and provides a wide range of capabilities, including data aggregation, security protocols, and trend analysis.

In April 2023, Palantir launched its fourth product: Artificial Intelligence Platform (AIP). In a world that is increasingly becoming dominated by ChatGPT and high-performance graphics processing units (GPUs), you may have missed Palantir’s milestone performance last year.

AIP has been nothing short of a smashing success. Just last week, Palantir hosted a livestreamed event during which customers showcased how AIP is transforming their business. As part of the marketing campaign, Palantir’s CEO, Alex Karp, sat down for an interview during which he proclaimed, “We don’t play golf, we play software.”

I found this conjecture both comedic and intriguing. Let’s break down what Karp may be alluding to and assess how Palantir is quietly emerging as an AI superstar.

Palantir has a unique approach to sales and marketing

Sales and marketing is one of the most challenging professions. Companies spend a lot of money trying to win over new customers and nurture existing accounts. One common form of customer success is getting to know your clients on a personal level — discovering their interests and crafting your retention efforts around that dynamic.

Anecdotally speaking, as a sports enthusiast, when I used to work at a tech start-up several years ago, I would get invited by account managers to attend games in luxury suites — fully comped. Moreover, sales reps at my own company would invite prospective customers to dinner, concerts, or a nice afternoon on the golf course.

Palantir is taking a much different approach to lead generation. The company is cutting out the wining and dining aspect of customer acquisition completely. Instead, following the release of AIP, Palantir began hosting immersive seminars called “boot camps”.

During these events, prospective customers have the opportunity to demo Palantir’s various software platforms and identify a use case centered around AI.

Customer acquisition is on the rise

I see the boot camps as more than just a funnel to fuel leads. Instead of schmoozing, Karp and his team are so confident in Palantir’s capabilities from a product standpoint that they’re actually inviting prospects to come and test it out. This is the definition of putting your money where your mouth is.

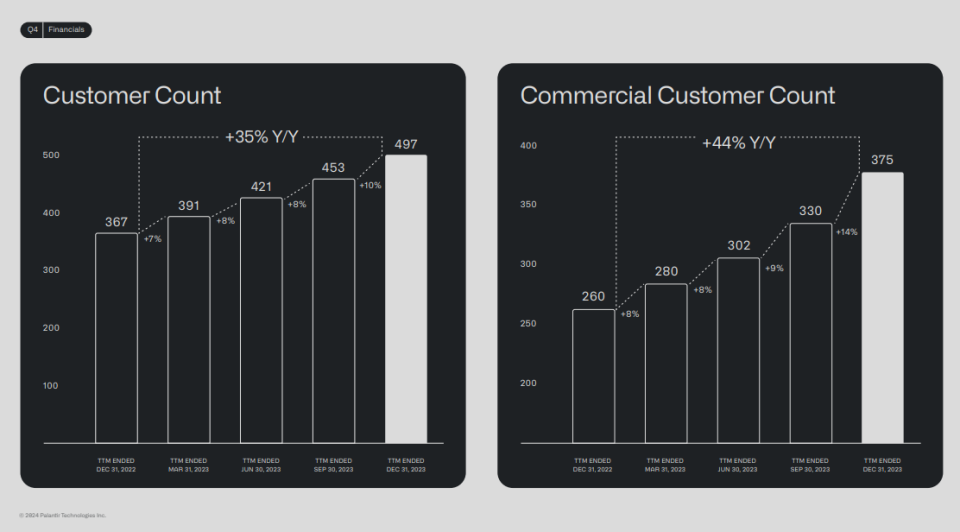

During 2022, Palantir hosted 92 customer demo pilots. Since the release of AIP last April, the company has conducted 850 boot camps. Indeed, the charts above undermine that these boot camps are fueling demand and customers are converting to paid accounts.

The combination of Karp’s hot takes and the clear success of AIP boot camps is helping Palantir strengthen its brand equity. This is important as the company faces fierce competition from the likes of Microsoft, Databricks, and even Amazon.

Is now a good time to invest in Palantir?

Palantir stock has been on a roll over the last year. Shares soared 167% in 2023 and are up 49% so far this year.

Given the enhanced buying activity, Palantir’s valuation multiples have become a bit extended. Currently, the stock trades at a price-to-sales (P/S) multiple of 26.9, which is notably higher than many of Palantir’s software-as-a-service (SaaS) peers.

Nevertheless, long-term investors understand that spending time in the market is far more important than trying to time the market.

Even though Palantir stock is enjoying a moment, the company’s AI journey is just beginning. As such, a prudent approach to investing in Palantir could be to use dollar-cost averaging and add to your position over time, so long as your investment thesis and risk profile remain unchanged.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 11, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Microsoft, and Palantir Technologies. The Motley Fool has positions in and recommends Amazon, Microsoft, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Palantir’s CEO Just Said “We Don’t Play Golf, We Play Software.” Here’s My Interpretation. was originally published by The Motley Fool

Signup bonus from