The “Magnificent Seven” have had a phenomenal run in terms of not only stock performance but also business gains. Well, except for one. Over the past 12 months, each member of the group has averaged these revenue growth levels:

|

Company |

One-Year Average YOY Revenue Growth |

|---|---|

|

Microsoft |

17.6% |

|

Apple |

(0.6%) |

|

Nvidia |

139.8% |

|

Amazon |

11.7% |

|

Alphabet |

8.5% |

|

Meta Platforms |

15.4% |

|

Tesla |

21% |

Data Source: YCharts. YOY = Year over Year.

Two things stick out here. First, Nvidia is doing unbelievably well compared to its peers. Second, Apple (NASDAQ: AAPL) has averaged losing revenue over the past 12 months while every other company on this list has grown.

That’s a huge red flag, making me want to stay far away from Apple’s stock.

Apple’s stock has done well despite its business struggling

When you dig in, it’s evident that Apple’s stock has become disconnected from the business. Most investors would assume that if Apple’s revenue shrank over the past year, its stock would be flat or even down. But you’d be wrong.

Apple’s stock is up roughly 12% over the past year, making it the second-worst performer of the group behind Tesla (down 5%). But how can a stock that has shrinking revenue increase in stock price?

Revenue doesn’t have everything to do with how a stock is valued. There are a couple of other considerations to factor in. One of those is profits.

Over the same period, its revenue averaged a decline, but its earnings per share (EPS) averaged an 8.8% increase. Because Apple was disciplined with its operating expenses and engaged in stock buybacks, it grew its EPS despite falling revenue. This is a sign of a strong and well-managed business, something most people would say about Apple.

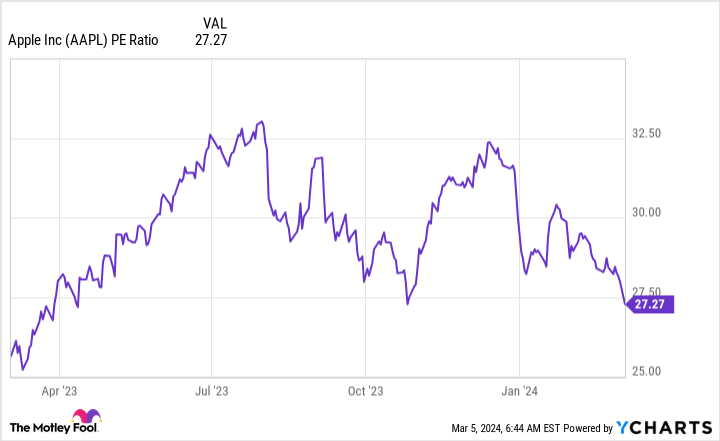

Another factor in Apple’s stock price rise is multiple expansion. What people are willing to pay for a stock fluctuates, and depending on various factors, this number can rise or fall. How “expensive” a stock is often described by a valuation ratio, like the price-to-earnings (P/E) metric, which divides a company’s stock price by its EPS.

For Apple, investors were willing to pay more and more for shares, although this figure has come down since the start of 2024.

Paying more than 30 times earnings for a company with shrinking revenue is very expensive, even for a company with the pedigree of Apple. This is part of why the stock has fallen nearly 12% since the start of 2024, while many of its peers have gained that much.

But with a more reasonable stock price, why am I not willing to touch Apple’s stock with a 10-foot pole?

Apple needs to find its next business

While Apple is a solid business, its products have nearly become commodities in the past few years. Plenty of other smartphone and accessory makers have quality products, so it comes down to user choice.

Additionally, the sales cycles of these products have become elongated thanks to how advanced the latest product generations have been. This has caused revenue to stagnate and likely won’t pick up anytime soon until Apple finds a new product to launch.

Businesses can only maintain expenses for so long before raising prices or compressing margins. Both of these would harm Apple, and I don’t envision a scenario where Apple can consistently grow its earnings at a healthy pace with low revenue growth.

With the stock trading at 27 times earnings, it’s way more pricey than its peer, Alphabet, which trades at 23 times earnings with better growth.

At the end of the day, Apple isn’t a bad company; it just isn’t worth the price tag you must pay for it. With longtime Apple bulls like Warren Buffett and Berkshire Hathaway selling shares, the writing may be on the wall for the formerly largest company in the world.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 8, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 “Magnificent Seven” Stock I Wouldn’t Touch With a 10-Foot Pole was originally published by The Motley Fool

Signup bonus from