Shares of Palantir Technologies (NYSE: PLTR) have been hot this year, trading up around 40%. Strong earnings numbers and an encouraging outlook for the data analytics company — thanks in part to artificial intelligence (AI) — have growth investors bullish on the stock’s long-term future.

The one reason investors may be hesitant to buy the stock is that there are growing concerns about a possible bubble when it comes to AI stocks, and with Palantir trading near 52-week highs, investors may be tempted to hold off on investing in the stock.

Are you better off waiting for Palantir’s shares to dip as part of a bursting bubble before potentially investing in the business, or should you buy the stock now regardless of a potential dip?

Comparing Palantir’s valuation to other fast-growing AI stocks

When it comes to fast-growing companies, you’re often going to end up paying a premium if you want to own shares of a business. You’re not going to see Palantir’s stock fall to a price-to-earnings (P/E) multiple of 15. Something catastrophic would have to happen for it to fall to such a modest valuation. The question becomes a matter of how much of a premium is justifiable.

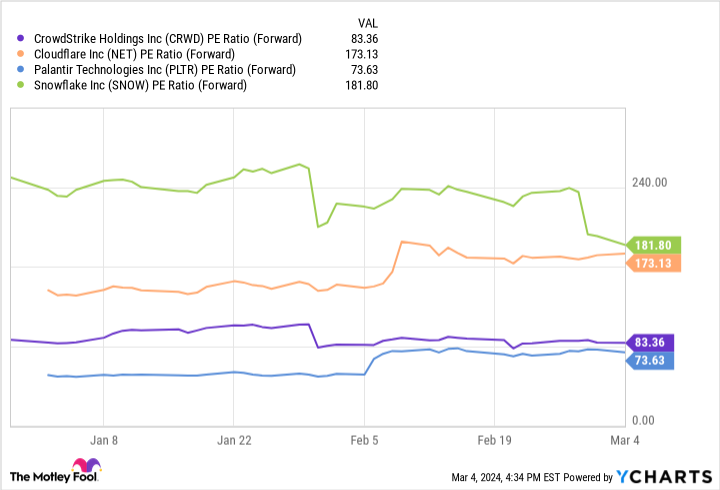

For AI stocks, investors have been paying high multiples based on their expected future earnings, effectively paying in advance for future growth, which can be risky if expectations don’t match up to reality. Here’s how Palantir’s valuation compares to those of other stocks that are big on analytics and can benefit from AI.

Palantir’s business has only recently become profitable; it has posted positive net income for five consecutive quarters. While its forward P/E multiple appears high, it could improve in the future. But even based on this metric, it compares favorably against other data-focused AI stocks.

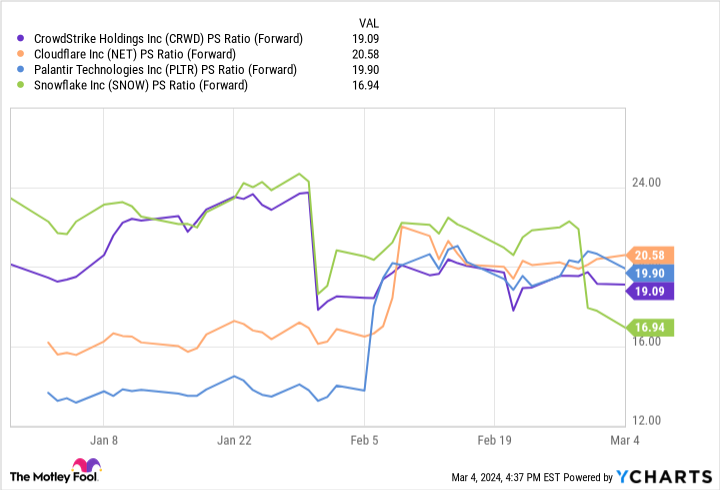

Another way to compare Palantir is by evaluating expected revenue, which may be more appropriate given the fact that many of these companies aren’t generating much profit just yet.

Here Palantir’s valuation is right in the middle of the pack, suggesting that its price is fair compared to the prices of other comparable stocks.

Does Palantir’s revenue growth rate warrant a premium?

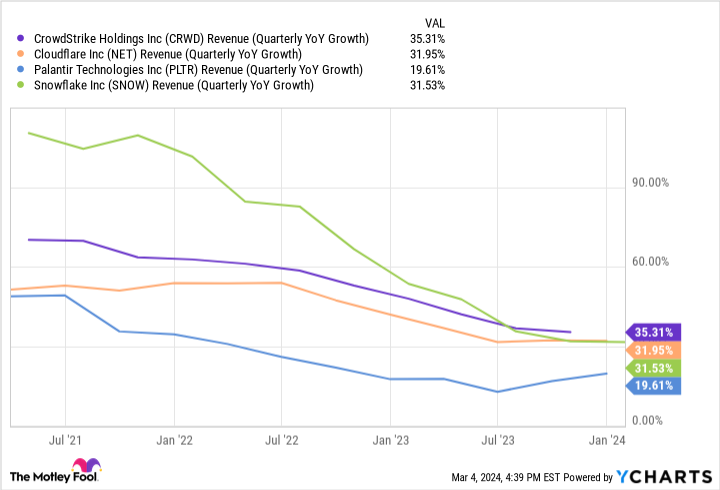

Investors’ willingness to pay a premium for a business may ultimately come down to how fast it is growing. Here’s how these stocks fare against one another in terms of their quarterly growth rates.

Palantir’s revenue growth rate is around 20%, and that’s roughly what management expects for 2024. That’s a decent rate of growth, but it is a bit underwhelming compared to the other stocks on this list, which suggests that perhaps Palantir’s valuation is a bit rich and that it should be trading at a lower revenue multiple.

Should you buy Palantir stock right now?

Palantir has a lot of potential through its AI platform to uncover many use cases for customers. But right now there doesn’t appear to be a huge influx of orders that signal to management a much faster growth rate ahead. Palantir could be a good long-term investment, but the risk is that its valuation today is a bit high, and unless you’re willing to hold on to the stock for several years, it may remain overpriced for a while — and that could make it susceptible to a possible sell-off.

While this could still be a good investment for the long term, I would hold off on buying shares of Palantir right now. Its valuation may have become a bit too rich given its relatively modest growth rate, and there are potentially better buys out there today.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 8, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Cloudflare, CrowdStrike, Palantir Technologies, and Snowflake. The Motley Fool has a disclosure policy.

Should You Buy Palantir Stock Now or Wait for a Dip? was originally published by The Motley Fool

Signup bonus from