Coinbase (NASDAQ: COIN) has become the standard bearer for the crypto industry in the U.S. It’s outlasted rivals like FTX and watched as Binance was fined $4 billion and pushed out of the country.

Now, Coinbase is using its reputation and technical prowess to push into new markets and products like derivatives along with more mainstream products. It’s the leading custodian of crypto exchange-traded funds (ETFs), it’s working with big banks as a trading platform and custody for their customers, and developers are building with Coinbase’s tools and on its Base blockchain. There are lots of reasons to buy Coinbase, but these stand out above the rest.

The adult in the room

Crypto has been plagued by scams and frauds for years, including FTX. Coinbase has slowly but surely built a reputation as a trusted party in the crypto ecosystem, operating by the letter of the law or challenging the law when it’s unclear as it is in the U.S.

This means Coinbase will grow more slowly in a boom period, but it’s less likely to go bust in down periods. And that trade-off has been well worth it for investors. Coinbase is now dominating the custodian business for billions of dollars in ETFs, and I think it will be a key partner for developers on the blockchain.

Wherever Coinbase goes next, having a reputation as a trusted counterparty is a good position to be in.

A recovering exchange

Coinbase’s exchange business was being overrun by rivals in recent years as they offered more aggressive products and leverage. But, as we saw with FTX and Binance, aggression isn’t always a good thing.

During the past year, Coinbase has won back market share and currently has the No. 2 position globally behind Binance. Revenue in the exchange business jumped 64.3% to $529.3 million in the fourth quarter of 2023 and it looks like trading activity is picking up in 2024.

Coinbase’s upside is not only in the consumer market. This has become a trusted partner for institutions, and I think that will be key to the company’s growth.

Stablecoins are a hugee moneymaker

Coinbase was one of the creators of the USDC stablecoin, which has the seventh biggest market cap of all cryptocurrencies. And Coinbase makes millions from the interest earned on the assets backing USDC.

In the fourth quarter of 2023, Coinbase reported $171.6 million in stablecoin revenue, mostly from USDC. The company also owns a stake in Circle, which runs USDC. As the use of stablecoins increases on the blockchain, Coinbase will be a winner.

Leverage to the max

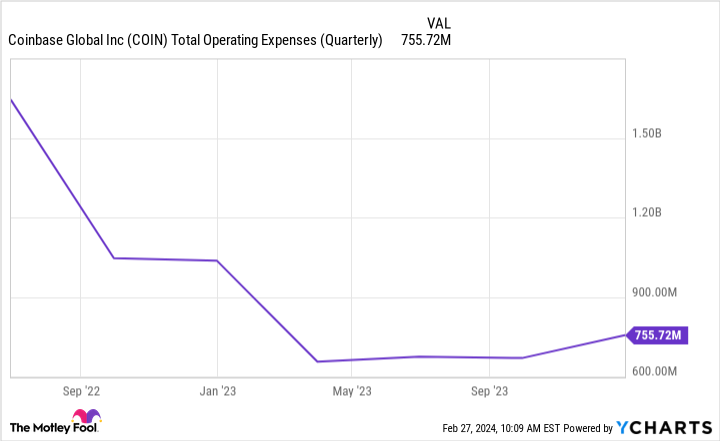

Like a lot of Silicon Valley companies, Coinbase has cut expenses to adjust to lower revenue during the past few years. And that’s now providing operating leverage to the business.

This leverage should continue if revenue growth holds up in 2024. With revenue growth, steady operating costs, and potential upside from new products and use cases for the blockchain for the long term, there’s a lot to like about Coinbase stock.

Should you invest $1,000 in Coinbase Global right now?

Before you buy stock in Coinbase Global, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coinbase Global wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 26, 2024

Travis Hoium has positions in Coinbase Global. The Motley Fool has positions in and recommends Coinbase Global. The Motley Fool has a disclosure policy.

4 Reasons to Buy Coinbase Stock Like There’s No Tomorrow was originally published by The Motley Fool

Signup bonus from