Last month, leading retailer Walmart (NYSE: WMT) announced that it would conduct a 3-for-1 stock split on Feb. 23. In recent years, investors have a seen a number of high-profile tech companies such as Alphabet, Amazon, and Tesla conduct stock splits. However, this is Walmart’s first split in over two decades. It last completed a stock split back in 1999.

Let’s dig into how stock splits work and what investors should understand before pouring into Walmart stock.

What savvy investors understand about stock splits

The dynamics of stock splits are quite simple: The number of shares rises by the split ratio, while the stock price drops by the same multiple. For example, following Walmart’s 3-for-1 split, shareholders will have triple the amount of shares they held previously. But the price of those shares will be at one-third their original value.

To be clear, stock splits do not inherently change the value of a company since the number of shares increases and the share price decreases by the same ratio. However, while it’s not a guarantee, share prices can rise following a split since the stock is perceived as being cheaper, thereby enticing a larger cohort of investors to buy the stock.

Stock-split stocks can therefore attract a lot of momentum traders. While that can be a strategy to book a quick profit, it’s highly risky and can leave you holding the bag. Investors interested in Walmart stock should be thinking longer-term beyond the stock split. It’s important to analyze what the company is doing to continue performing at a high level.

Walmart’s earnings are slowing…

For the quarter ended Jan. 31, Walmart reported earnings per share (EPS) of $2.04, a roughly 12% year-over-year decline. Management spent some time during the earnings call outlining what Walmart is doing to accelerate its earnings power, and how the company is evolving beyond brick-and-mortar stores.

More specifically, management referenced advertising services as well as fulfillment services as areas that carry particularly higher margin than the company’s core retail setting. Moreover, Walmart’s previously announced improvements to stores and fulfillment centers could help drive synergies on its e-commerce platform as well.

Management’s stated goal is to grow “operating income faster than sales.” This dynamic should help accelerate earnings growth over the long term. Although Walmart appears to have many exciting catalysts, investors should look at the stock’s valuation before pouring in.

… and the stock isn’t cheap

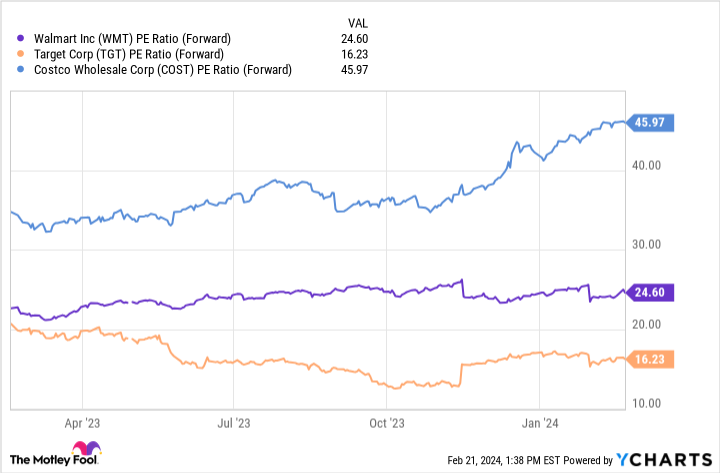

This chart illustrates the forward price-to-earnings (P/E) ratio, benchmarked against Costco Wholesale and Target. While Walmart’s forward P/E of 24.6 is in the middle of its two peers, it’s slightly higher than the S&P 500‘s forward P/E of 22.9.

One aspect that might be overlooked at the moment is Walmart’s induction into the realm of the Dividend Kings. While that’s encouraging, the bigger theme here is that Walmart has demonstrated it can consistently generate robust cash flow and use these funds to reward shareholders.

While the stock isn’t a bargain, there are plenty of reasons to consider scooping up some shares, and dividend investors in particular may want to consider Walmart for their portfolio. Nevertheless, I see Walmart as a stock that’s worth keeping on your radar. However, investors may be best-suited sitting on the sidelines at the moment and assessing the price action following the imminent stock split.

Should you invest $1,000 in Walmart right now?

Before you buy stock in Walmart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walmart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Costco Wholesale, Target, Tesla, and Walmart. The Motley Fool has a disclosure policy.

Party Like It’s 1999? Why Walmart Stock Should Be on Your Radar. was originally published by The Motley Fool

Signup bonus from