Despite becoming the dominant e-commerce force in South Korea in just over a decade, Coupang (NYSE: CPNG) has seen its stock decline by 70% since its 2021 initial public offering. This divergence between its poor stock performance and booming operations lays the groundwork for what could be a once-in-a-decade opportunity for investors.

However, since the company announced a $500 million acquisition of beleaguered luxury goods upstart Farfetch (OTC: FTCH), the market has maintained a cautious stance toward Coupang’s stock — despite its already discounted price.

So, does this recent purchase make Coupang a pass at today’s prices? Or is this deal a reasonable risk-reward proposition at Coupang’s near-all-time-low valuations? Here’s why I’m thinking the latter.

Leading the e-commerce charge in South Korea

Coupang is home to over 20 million active users, a figure that grew 14% compared to last year and equals around 40% of South Korea’s population. The company operates in two business segments:

-

Product commerce (97% of sales): The company’s core operating segment includes Coupang-owned e-commerce sales, third-party merchant sales, Rocket Fresh (grocery delivery), and advertising. Product commerce generated adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $1.4 billion over the last year with an adjusted EBITDA margin of 6%.

-

Developing offerings (3% of sales): Perfectly named, Coupang’s second segment is composed of Coupang Eats (restaurant ordering and delivery), Coupang Play (content streaming), international sales (primarily Taiwan), and fintech. Over the last 12 months, this unit recorded an adjusted EBITDA loss of $371 million with a margin of -57%.

With these two units, Coupang has built a full suite of offerings that have helped it bring over 11 million users to its membership program, Rocket WOW. For less than $50 a year, a WOW membership gives users benefits such as Coupang Eats, next-morning grocery delivery, free returns, one-day delivery time, free delivery on Rocket-tagged products, and access to Coupang Play.

While many of these services, such as Coupang Eats and Play, are still scaling and have yet to reach profitability, they play a crucial part in the company’s growth story. For example, members who have used Coupang Eats spent roughly twice as much with the company as those who haven’t tried it, highlighting that the unit acts as a loss leader to drive higher engagement and retention among members.

Best yet for investors, despite the smaller segment’s seemingly alarming adjusted EBITDA loss, most of this likely stems from its recent expansion into Taiwan. On pace to become the most downloaded app in Taiwan in 2023, Coupang saw a faster adoption for Rocket Delivery than when it launched the service in its home country, highlighting immense customer demand.

Most recently, Coupang seemed to spook the market with its $500 million purchase of Farfetch in December, sending its stock down over 20% at one point. However, here’s why the deal’s risk-reward proposition shouldn’t scare investors.

The Farfetch deal isn’t a death knell

First and foremost, the deal will not financially ruin Coupang. The company is home to a growing cash hoard of nearly $5 billion, and its $500 million bridge-loan-turned-buyout of Farfetch is a relatively small bet. For further perspective, Coupang generated $429 million and $1.8 billion in net income and free cash flow (FCF), respectively, over the last year.

On the reward side of the risk-reward equation, the struggling company could bring massive upside potential to Coupang, whose home country of South Korea spends more on luxury goods per capita than any other country. Generating over $2 billion in sales over its last year of operations, Farfetch was a behemoth in its own right — once commanding a market capitalization of $24 billion.

Farfetch’s platform is home to over 3,400 brands bought by 4 million customers and could be a perfect innovation playground for founder and CEO Bom Kim. Now that it’s removed from the pressures of facing financial ruin, it will be fascinating to see what Coupang tells investors when it reports its fourth-quarter earnings on Feb. 27.

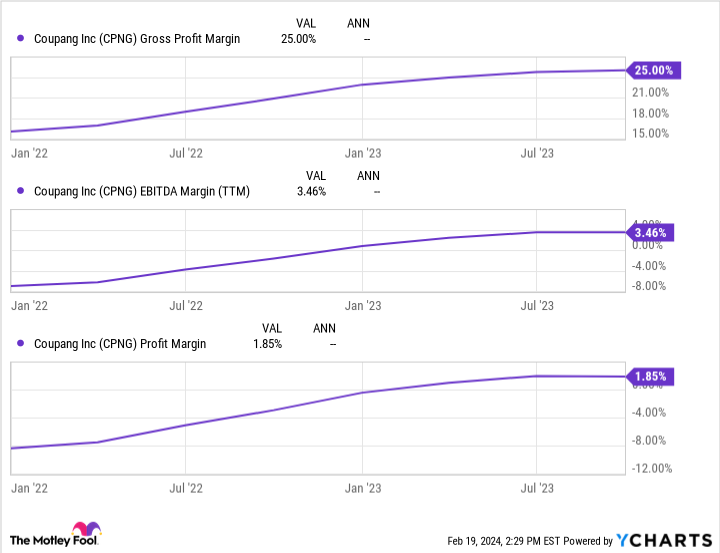

Rising margins and nearly all-time low valuation

Perhaps the most crucial reason Coupang not only looks stable enough to endure its purchase of Farfetch but potentially be a once-in-a-decade investment at today’s prices is its rapidly improving margins.

Scaling beautifully over the last two years — as Kim projected — the company is beginning to reap the rewards from years of heavy capital expenditures on building its logistical network in South Korea. With South Korea having a population density that is 14 times higher than the United States, Coupang could see outsize profitability once it nears peak efficiency due to this unique geographic advantage.

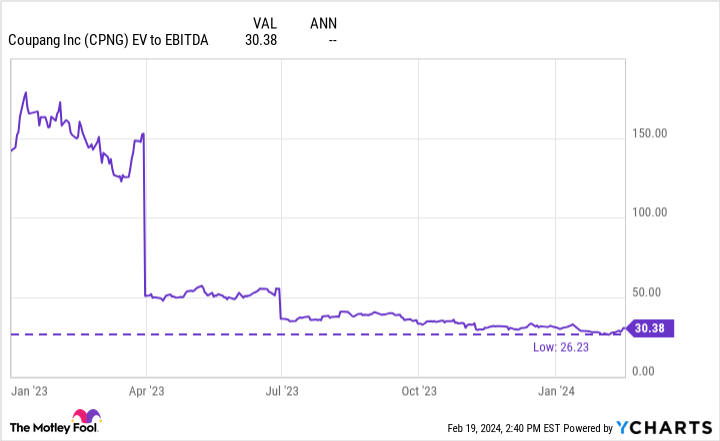

The cherry on top for investors? Coupang’s enterprise value-to-EBITDA ratio remains near all-time lows. With Kim expecting the company’s EBITDA margin of 3.5% to move up to 10% or more over the long term, this valuation looks cheap considering Coupang’s growth options and streamlining efficiencies across its business.

Should you invest $1,000 in Coupang right now?

Before you buy stock in Coupang, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coupang wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

Josh Kohn-Lindquist has positions in Coupang. The Motley Fool has positions in and recommends Coupang. The Motley Fool recommends Farfetch. The Motley Fool has a disclosure policy.

1 Growth Stock Down 70% You’ll Wish You’d Bought at Today’s Near-All-Time-Low Valuation was originally published by The Motley Fool

Signup bonus from