Over the last year, Eli Lilly‘s (NYSE: LLY) stock is up nearly 120%. This monstrous move has helped propel the pharmaceutical leader to become the largest health care company in the world by market cap.

Although Lilly has a number of medications in its portfolio, perhaps its most popular at the moment is Mounjaro. Mounjaro is a glucagon-like peptide-1 (GLP-1) treatment for diabetes patients. It is also the primary competing product to the incredibly popular Ozempic, which was developed by Novo Nordisk.

Despite the rising popularity of GLP-1 treatments, Lilly has a lot more to offer. Let’s take a deep dive into the company’s entire business and understand what other catalysts could be at play.

The company’s portfolio is incredibly deep

For the year ended Dec. 31, Eli Lilly generated a total revenue of $34.1 billion. Among the company’s top-selling medications were diabetes treatments Trulicity, Mounjaro, and Jardiance. In fact, these three drugs accounted for a whopping 44% of Lilly’s 2023 sales. Considering that Mounjaro hasn’t even been commercially available for two full years, this level of revenue concentration might make investors feel that Lilly’s business hinges on the evolution of the diabetes market.

However, a more thorough look at the company’s financials will shed some light on just how prolific Lilly’s portfolio is. The company also develops Taltz — a treatment used for plaque psoriasis and psoriatic arthritis. During 2023, sales for Taltz grew by 11% year over year and reached $2.8 billion.

Moreover, Lilly’s cancer drug, Verzenio, could just be getting started. Revenue for Verzenio rocketed 56% year over year in 2023, with the company responsible for an impressive $3.9 billion in sales. In early 2023, the Food and Drug Administration (FDA) approved Verzenio for expanded indications. This means that Verzenio now has a broader reach and can be used in a larger cohort of patients. While Lilly certainly enjoyed high demand for Verzenio in 2023, the drug could be well positioned for even further gains in the long run.

The long-term picture looks encouraging

The overview above demonstrates that Lilly has many blockbuster drugs at its disposal. I see Lilly’s medical portfolio as a testament to the company’s relentless focus on innovation.

At the forefront of potential future catalysts is donanemab. Donanemab represents Lilly’s foray into treating Alzheimer’s — a market that could eclipse $13 billion by 2030, according to one market study. While management expects FDA approval for donanemab in the first quarter, this timing is not a guarantee. Nevertheless, encouraging results from clinical trials could suggest that Lilly’s chances of receiving approval for donanemab look good.

On top of this, Lilly’s business in the diabetes market could just be beginning. According to research from J.P. Morgan, the GLP-1 market is expected to eclipse $100 billion by 2030. Considering some market studies indicate that there will be 1 billion diabetics worldwide by 2050, the long-term picture for Mounjaro and similar treatments appears robust.

Moreover, operating alongside diabetes treatments are obesity care drugs. Novo Nordisk’s Wegovy is one of the more popular medications prescribed for obesity patients, with sales rocketing 393% last year just in the U.S. It’s no surprise to learn that Lilly developed a sibling treatment to Mounjaro geared for weight management. This drug, called Zepbound, only contributed a modest $176 million in sales during 2023, given that its FDA approval did not occur until November.

Should you invest in Eli Lilly stock?

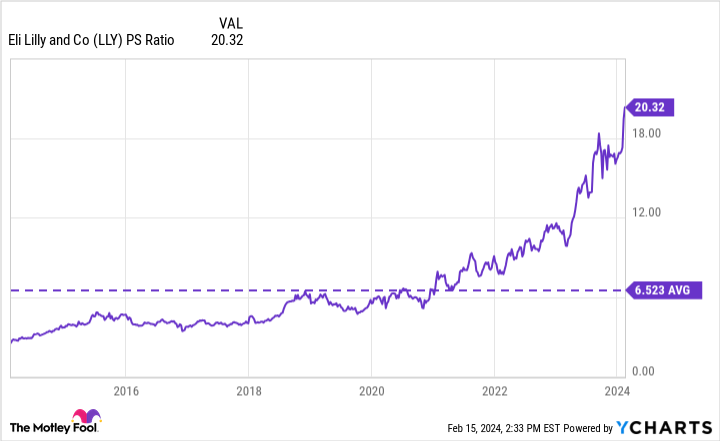

Eli Lilly currently trades at a price-to-sales (P/S) multiple of 20.3, which is roughly triple its 10-year average. The chart above clearly indicates the upward momentum in Lilly’s trading activity over the last year in particular.

While the stock is expensive compared to historical levels, investors should zoom out and think long term. In just the last week, analysts from Morgan Stanley, Truist Financial, and Barclays all raised price targets — signaling that some on Wall Street see plenty more room for the stock to run.

The depth of Lilly’s portfolio, coupled with bullish secular tailwinds in some of its existing major markets, makes the company a tough one to brush over. As I expressed previously, I see Lilly on the path to becoming a trillion-dollar company by the end of the decade. Although there could be setbacks in terms of FDA approval for new medications or yet-to-be-discovered side effects in existing treatments, the company’s diverse portfolio helps mitigate some of those concerns.

Despite its premium valuation, I think now is a good opportunity to use dollar-cost averaging as a strategy to build a position in Lilly stock. The upside could be massive, and I see the company as well positioned to dominate the health care space for years to come.

Should you invest $1,000 in Eli Lilly right now?

Before you buy stock in Eli Lilly, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Eli Lilly wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Adam Spatacco has positions in Eli Lilly and Novo Nordisk. The Motley Fool has positions in and recommends JPMorgan Chase and Truist Financial. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

Eli Lilly Has More Than an Ozempic Competitor — Much More was originally published by The Motley Fool

Signup bonus from