Super Micro Computer (NASDAQ: SMCI) stock slipped in Tuesday’s trading. The company’s share price closed out the daily session down 6.8%, according to data from S&P Global Market Intelligence. Notably, it had been down as much as 11.7% earlier in the day’s trading, but it bounced back as some investors bought into the sell-off.

While there wasn’t any business-specific news pushing Supermicro stock lower today, the server-and-storage technology company’s share price lost ground as Wall Street weighed potential macroeconomic risks. The trend impacted many high-profile artificial intelligence (AI) stocks with growth-dependent valuations, including Nvidia and AMD.

Before the market opened this morning, Home Depot published its fourth-quarter earnings results and set a bearish backdrop for the broader market. While the retailer may not seem to have much connection to AI stocks, the company’s performance and guidance is a bellwether for the U.S. economy.

Notably, Home Depot’s management said that persistent inflation was continuing to impact its performance. The home improvement retail giant indicated that headwinds could continue throughout the year. If inflation continues to run hot, the Federal Reserve will likely delay the interest rate cuts that investors have been anxiously awaiting. If so, that could be bad news for Super Micro Computer and other growth stocks.

Is Supermicro stock’s recent pullback a buying opportunity?

Even with recent sell-offs for the stock, Supermicro is still up 177% in 2024’s trading. Over the last year, the company’s share price has risen an incredible 757%.

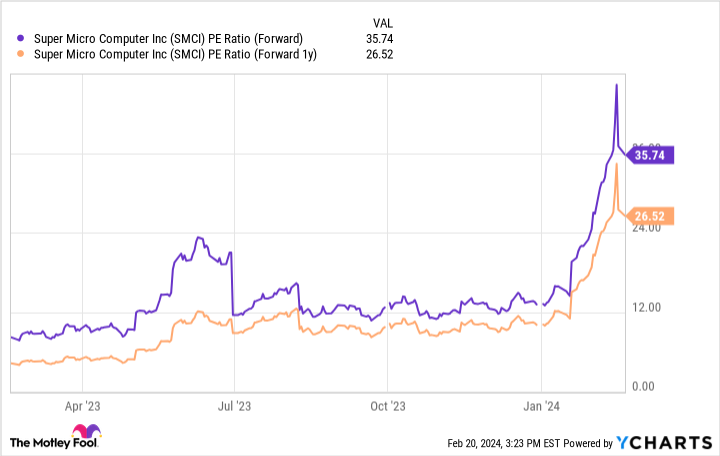

Even with dramatic improvements for the company’s performance outlook, explosive stock gains have had the effect of pushing the company’s valuation up to far more growth-dependent levels. Shares now trade at 26.5 times this year’s expected earnings and approximately 36 times next year’s expected profits.

Supermicro’s recent business momentum seems to support its current valuation, but investors should understand that macroeconomic headwinds could hurt the stock. Additionally, it remains to be seen whether the business will be able to sustain such rapid sales and earnings growth — or if demand for its high-performance rack servers is experiencing a more cyclical upswing.

If you’re bullish on the long-term outlook for the AI space and demand trends for high-end servers, Supermicro stock looks like a worthwhile portfolio addition. With Nvidia scheduled to report fourth-quarter earnings results after the market closes tomorrow, it’s possible that today’s valuation pullback for AI stocks will quickly be reversed.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 20, 2024

Keith Noonan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Home Depot, and Nvidia. The Motley Fool recommends Super Micro Computer. The Motley Fool has a disclosure policy.

Super Micro Computer Fell Again Today — Is This an Opportunity to Buy 2024’s Most Explosive AI Stock? was originally published by The Motley Fool

Signup bonus from