Investors interested in the aerospace sector naturally gravitate toward high-profile stocks like Boeing (NYSE: BA), and for good reasons. Boeing has a multiyear backlog in place and, despite its issues in recent years, remains a critical part of the commercial aerospace industry. Still, there’s more to the sector than the first-line names, and I think a lesser-known company like Carpenter Technology (NYSE: CRS) is a better buy. Here’s why.

Boeing’s problems

Before discussing Carpenter, a few words on Boeing. The recent results were somewhat disappointing, with management postponing its 2024 guidance as it digests the aftermath of the latest manufacturing quality issue on Boeing airplanes. The latest issue, a structural failure on Alaska Airlines flight 1282, led CEO David Calhoun to tell investors on the earnings call: “We have more work to do. I know that these moments that impact delivery schedules can frustrate our customers and our investors.”

As such, he declined to give an outlook for 2024, and CFO Brian West went on to dampen expectations for Boeing’s 2025/2026 outlook by saying, “We’re still confident in the goals we laid out for ’25, ’26 although it may take longer in that window than originally anticipated.”

Boeing just about met its 2023 free-cash-flow guidance of $3 billion to $5 billion in reporting $3.1 billion and missed its delivery targets on the 737 in 2023 (396 planes delivered compared to an initial outlook for 400-450), and it continues to report losses in its defense business. So it’s fair to say the company continues to face challenges.

Given these challenges, it’s natural to be concerned about aerospace suppliers. Still, it’s worth noting that Boeing’s problems largely involve manufacturing quality issues rather than an inability to meet its delivery targets due to product unavailability. In addition, the problem in defense is a margin issue rather than a revenue growth one.

Why Carpenter Technology is well placed

Significant delays in airplane deliveries will impact aerospace suppliers like Carpenter over the near term. Still, Boeing, Airbus, and other manufacturers will endeavor to catch up, and have multiyear backlogs in place.

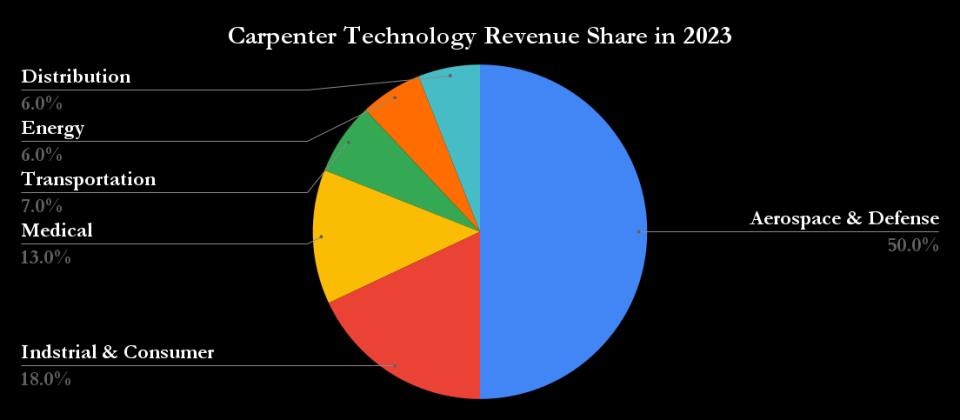

Carpenter is a producer and distributor of premium specialty alloys for the industries as outlined in the chart below. Of the non-aerospace businesses, its industrial and consumer business has exposure to semiconductors — a market set to recover in 2024. Its material solutions to the medical end market (for use in dental implants, stents, orthopedics, and other applications) have attractive long-term growth prospects due to an aging population and increases in medical procedures.

Turning to the focus of this article and Carpenter’s revenue, its aerospace products span three sub-markets, namely engines (40% of commercial aerospace revenue), structural and avionics (30%), and fasteners (20%).

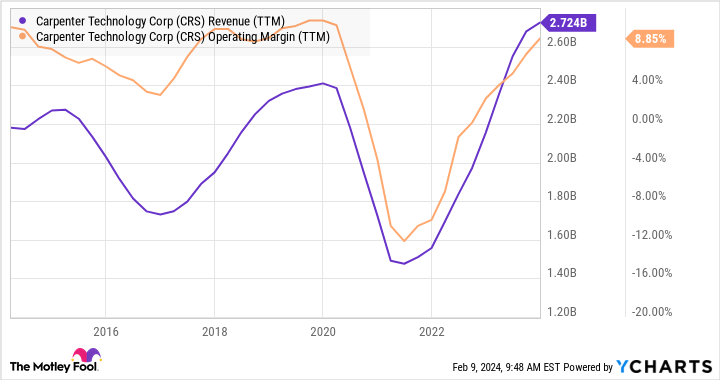

As previously noted, airplane manufacturers are doing all they can to ramp up production, and that’s flowing into increased revenue and margin performance at Carpenter. Carpenter is a business with relatively high fixed costs, meaning that its margins get crushed when there’s an industry slowdown, but it expands rapidly in a recovery.

The chart below shows that its gross margins are firmly in recovery mode.

Carpenter applies a raw material surcharge to its pricing and discloses sales with and without the surcharge. As such, its adjusted operating profit margin, excluding surcharges, was 14.4% in the recently reported second quarter of 2024 (its financial year finishes at the end of June), a figure up from 5.4% in the same quarter a year ago. Moreover, CEO Tony Thene prepared investors for more expansion to come on the earnings call, saying, “We anticipate our margins will continue to improve with productivity improvements and a richer product mix.”

In addition to the margin leverage that Carpenter generates through increased sales, there’s also the matter of rapid free-cash-flow expansion as increased margins and better capacity utilization improve cash flow.

While Carpenter reported a cash outflow of $25.4 million in the first half of 2024, CFO Timothy Lain forecasts, “We anticipate that for fiscal year 2024, we will generate meaningful positive free cash flow.”

Indeed, Wall Street analysts have Carpenter generating $148 million in free cash flow in its financial 2024, leading to $179 million in its financial 2025. As such, based on the current price, Carpenter will trade at 21 times free cash flow at the end of June and then 17.4 times its free cash flow at the end of June 2025, and a price-to-earnings ratio of 13.1.

Those are attractive valuations for a company set to expand margins as the aerospace industry continues to recover, led by production ramps at Boeing and Airbus.

Should you invest $1,000 in Carpenter Technology right now?

Before you buy stock in Carpenter Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carpenter Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of February 12, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends Alaska Air Group. The Motley Fool has a disclosure policy.

Forget Boeing: This Stock Is Poised for a Potential Bull Run in 2024 was originally published by The Motley Fool

Signup bonus from