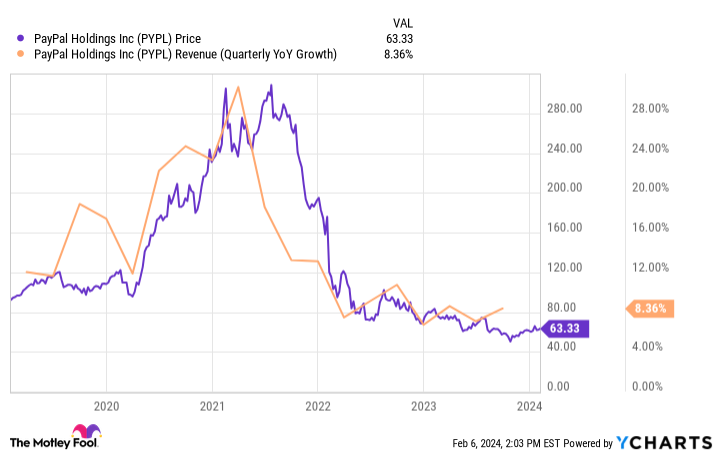

For the past few years, PayPal‘s (NASDAQ: PYPL) stock has been hampered by the company’s slowing growth. To be sure, revenue still heads higher nearly every quarter, but it’s at a pace that’s far lower than the market had grown to expect. A slowdown in growth has forced the share price lower, from $300 to $60 over just two years. The slide in share price also came with a collapse in valuation multiples.

However, recent news suggests that a new runway for growth could be right around the corner, providing a strong investment case for growth and value investors alike.

PayPal’s growth is slowing due to this

To understand PayPal’s latest fall from grace, it’s important to understand why the stock skyrocketed to such heights in the first place.

In early 2002, PayPal stock went public through an initial public offering (IPO). Before the year was through, the company was acquired by eBay. It was a great match. PayPal needed online shoppers to adopt its platform to grow. Meanwhile, in the early days of digital commerce, eBay required a proven, trusted payment processor to convince consumers that buying goods and services online could be safe and reliable. By linking each business, eBay and PayPal provided each other with paved runways for growth.

After years of fruitful synergy, eBay decided to spin off PayPal, making it an independent company. The true growth potential of PayPal was finally unleashed. Management soon moved into high-growth verticals like micropayments and international transfers. The company went on a buying spree, purchasing Honey, a coupon discovery browser plug-in, for $4 billion in 2020, while taking full ownership over China’s GoPay app that same year. In 2020 alone, PayPal shares more than doubled in value.

The separation of eBay and PayPal — the catalyst behind the company’s newfound growth — eventually became a headwind. In 2021, eBay didn’t renew a five-year contract that made PayPal its payment processor. PayPal’s total payment volumes continued to increase, but the loss of eBay as a reliable means to reach customers provided a significant growth headwind. That, combined with a slowdown in online spending after pandemic closures reversed, caused the share price to collapse.

PayPal stock finally looks like a bargain

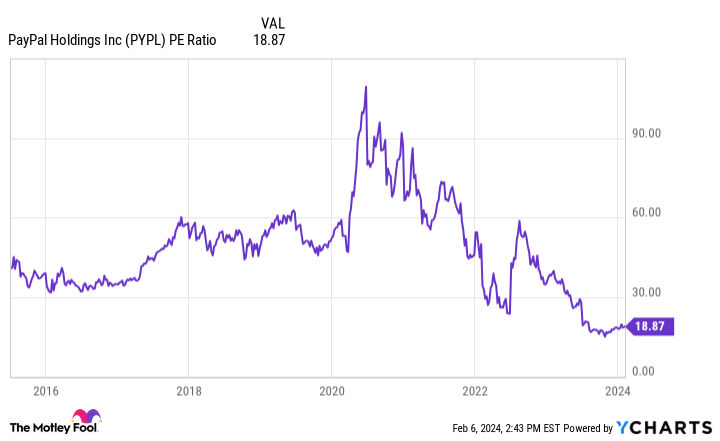

Following PayPal’s meteoric collapse, shares look like a bargain for the first time in years. The stock trades at under 19 times earnings, its cheapest multiple ever. The S&P 500 index, for comparison, trades at a price-to-earnings multiple of 23.

PayPal shares, once a ticket to rapid growth, are now cheaper than the market. Investors just aren’t willing to believe in PayPal’s long-term growth prospects, but there’s reason to believe a turnaround could be just around the corner.

On Jan. 25, PayPal’s management team unveiled six new features that it believes can reinvigorate the company’s slumping growth. The market responded with cautious optimism, but there’s reason to believe one feature, in particular, will chart the company’s next growth runway.

PayPal thinks it found a “Fastlane” to higher growth

There’s no doubt that e-commerce sales in general will continue to rise in the years to come. In 2024, for example, e-commerce retail sales are expected to grow by 9.4%. That’s higher than PayPal’s revenue growth in recent quarters. All PayPal needs to do is figure out how to grow alongside its core market, ideally gaining market share along the way. Its new Fastlane service could be the killer feature that unlocks this opportunity.

Currently in the pilot phase, Fastlane promises to allow online merchants to convert shoppers into buyers faster, with higher conversion rates. According to PayPal, there would be “no username or password to remember, no personal info to update, no need to share a credit card with businesses all over the web.” With over 400 million active users, PayPal can easily recognize a huge number of digital shoppers. By integrating Fastlane, merchants can allow shoppers to checkout without entering any additional information. PayPal believes it can reduce checkout time by almost 40%, with plans to bring the platform to millions of merchants upon launch.

Why is Fastlane such a killer feature? Across the highly competitive e-commerce world, efficiencies matter. Amazon once estimated that a one-second increase in page load speeds would cost it $1.6 billion in annual sales. Every friction point, no matter how small, can cause a shopper to click elsewhere, abandoning a potential purchase.

Merchants like eBay ditched PayPal because it could easily replicate the payment aspect of the business, keeping the processing fees for itself. PayPal now needs to offer more than just a payment option for merchants, and Fastlane appears to be the first of many innovations that could finally persuade merchants to prefer PayPal once again. The transition will take time, but this new focus could put PayPal back on the trajectory of growth, making the current depressed multiple a bargain for patient investors.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and PayPal made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of February 6, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and PayPal. The Motley Fool recommends eBay and recommends the following options: short January 2024 $45 calls on eBay and short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.

PayPal Stock Can Return to Rapid Growth With Killer New Features Like This was originally published by The Motley Fool

Signup bonus from