Few other companies (let alone automakers) made as big of a public debut as Rivian (NASDAQ: RIVN). Raising more than $12 billion in 2021, Rivian’s IPO was the largest of any American company since Meta Platforms in 2014.

But since its historic start, Rivian has faced a daunting road in its journey to cement itself as a leader in the EV industry. While EV adoption is expected to grow at an exponential rate over the next decade, there is no promise it will be able to ride that momentum. By looking at where Rivian has been and evaluating its current position, a clearer picture of where the company could be in the next three years comes into focus.

The good part

There are two possible scenarios for Rivian over the next three years: It either figures out how to scale production and cut expenses enough to reach profitability, or the company collapses under the weight of growing costs and a lack of income.

Let’s start with the more optimistic outcome. Over the last three years, Rivian has made significant progress in terms of production. While production is typically the most challenging obstacle preventing companies from achieving profitability, Rivian is showing promise in refining its EV supply chain.

In 2023, Rivian produced more than 57,000 vehicles, its best year ever. Just three years ago, Rivian manufactured just over 1,000 vehicles.

Thanks to this rise in production, Rivian has started to narrow its losses. In Q3 2022, Rivian reported a whopping $1.7 billion loss. That equated to a loss of nearly $140,000 per vehicle sold. Based on the most recent earnings report, the estimated per-vehicle loss is around $30,000. While not yet profitable, there is clear and commendable progress being made in terms of generating revenue, which is also at an all-time high.

Best of all, several catalysts are currently in the works that could help push Rivian into the green. For example, management recently announced a new battery that “take[s] thousands of dollars of costs out [and] is much easier to manufacture and build as well.” The introduction of the battery pack is planned for 2024 and will undoubtedly improve operational efficiency and streamline its supply chain.

Perhaps most importantly, the company is beginning construction of its new 1,800-acre factory outside Atlanta this year. With phase one expected to be completed in 2026, it will increase total output by 200,000 units. Once fully operational in 2030, Rivian expects production to increase by 400,000.

Should Rivian maintain its current trajectory and get a boost from these other developments, profitability looks all the more likely. In fact, if all goes according to plan, Rivian could rise to become one of the top EV manufacturers in America by 2027.

The not-so-good news

Now, the bad part: Every optimistic outlook for Rivian has a corresponding counter-scenario that needs to be taken into account. Let’s start with production and finances.

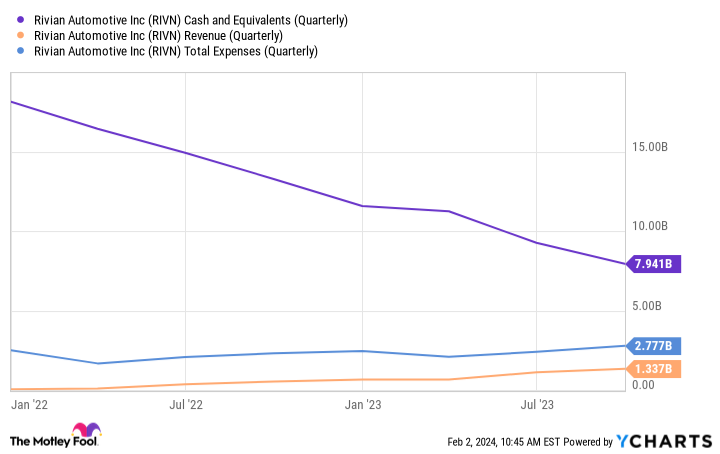

Clearly, production is trending in the right direction. But despite the increase, profitability still evades the company. As it currently stands, expenses are near the highest levels ever. While production is up, costs have cut into any chance of turning a profit.

Rivian’s inability to generate income has forced it to utilize its cash position to sustain operations. Fortunately, its massive IPO helped bolster reserves, but in a matter of three years, its total cash position has been reduced by more than 60%. Sitting at just under $8 billion today, at its current pace, Rivian only has enough cash to last another two to three years at best.

From this perspective, the new factory becomes all the more important, but also all the more risky. Construction projects of this size are notorious for delays, which often mean unforeseen costs.

Making matters potentially worse, while analysts expect 2024 to be another record year in the U.S. for EV sales, there is consensus that the rate of growth will fall as consumers deal with high interest rates and spend less money on luxury items like new vehicles. If the perfect storm unfolds in 2024 and there’s any hangover in 2025, Rivian’s position could very well be worse three years from now than it is today.

The final verdict

It’s far from a guarantee that Rivian will benefit from the growth in the EV industry and come out on top. The next few years will be trying and a period where Rivian will have to prove if it’s a true contender or just another pretender.

Rivian’s Q4 earnings report is scheduled to be released on Feb. 21, which should provide a clearer picture of its future. But for now, the company’s fate hangs in the balance. Although progress is apparent, Rivian must overcome significant financial challenges and adapt to evolving market dynamics before it can be considered a leader in the highly competitive EV landscape and worthy of a spot in investor portfolios.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. RJ Fulton has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms. The Motley Fool has a disclosure policy.

Where Will Rivian Be in 3 Years? was originally published by The Motley Fool

Signup bonus from