Shares of telecom giant AT&T (NYSE: T) have been stuck in a downtrend since the start of the pandemic in 2020. From peak to trough, the stock was down more than 50% at one point during 2023.

The company’s struggles to successfully integrate the expensive media acquisitions it had made over the previous decade initially kept a lid on the stock price. Once AT&T abandoned its media ambitions, culminating with the spin-off of WarnerMedia in 2022, uncertainty over its wireless business, concerns about its massive debt load, and general distrust from investors continued to put pressure on the stock.

Beginning in mid-2023, investor sentiment began to shift. A string of solid wireless subscriber gains, persistent growth for the company’s fiber internet business, and boosted free cash flow guidance helped win over investors. Since bottoming out, AT&T stock has soared by about 33%. The stock currently trades for around $18 per share.

Fiber and wireless growth

AT&T’s fourth-quarter report received a mixed reaction, with strong results and an outlook calling for solid free cash flow growth coupled with higher planned capital spending in 2024 than investors were expecting. However, the company’s performance was good enough to garner an analyst price target hike from J.P. Morgan.

J.P. Morgan analysts expect AT&T to deliver consistent growth in the long run in both the wireless and fiber internet businesses. Fiber is viewed as the most compelling growth driver, given that AT&T has room to expand its fiber network substantially. While AT&T originally planned to pass 30 million locations with its fiber network by the end of 2025, up from 26 million today, the company recently said that it sees opportunities to potentially bump that number up to 45 million over the long term.

This optimism around AT&T’s fiber business and continued growth in the wireless business prompted J.P. Morgan’s analysts to raise their price target from $18 per share to $21 per share.

There’s still room to run

Even at $21 per share, AT&T stock would still be priced pessimistically. The company generated $16.8 billion of free cash flow in 2023, a full $2.6 billion higher than the previous year and above the company’s updated guidance of $16.5 billion. For 2024, AT&T sees free cash flow coming in between $17 billion and $18 billion.

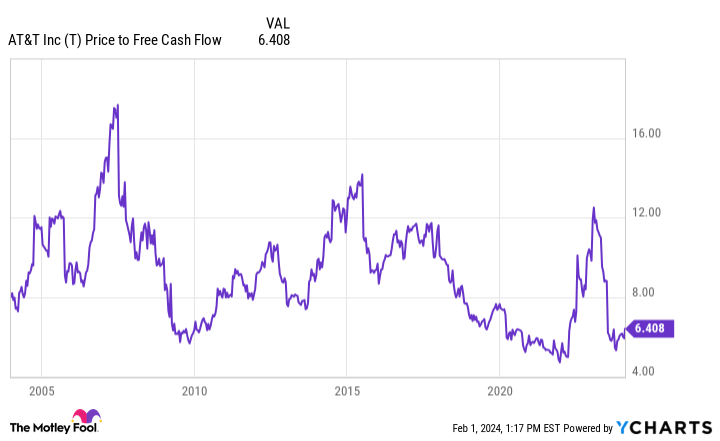

A stock price of $21 per share implies a market capitalization of about $151 billion. At the midpoint of AT&T’s free cash flow guidance range, the price-to-free cash flow ratio at $21 per share works out to about 8.6. That’s on the low end of the historical range over the past two decades, and about half of the peak value over that period.

Could AT&T stock finally climb above $20 per share this year? Absolutely. In fact, $20 per share may be overly pessimistic. Of course, there’s plenty that could go wrong. Most importantly, AT&T is sensitive to economic conditions. If customers start having trouble making payments, free cash flow would likely take a hit.

The pessimism that’s been weighing AT&T stock down for years appears to finally be lifting. If the company can maintain solid growth rates for its wireless and fiber internet businesses, the rally over the past six months could be just the beginning of a major recovery for AT&T stock.

Should you invest $1,000 in AT&T right now?

Before you buy stock in AT&T, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AT&T wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

Timothy Green has positions in AT&T. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Could AT&T Stock Finally Surge Past $20 in 2024? was originally published by The Motley Fool

Signup bonus from