U.S. wireless carrier AT&T (NYSE: T) recently closed out its fiscal 2023 year with earnings. The company, popular with income-focused investors, got great news regarding its financials and how they may affect its dividend moving forward.

However, it wasn’t all sunshine. The company is coming up short in one crucial area that could limit the stock’s total returns upside. AT&T remains a somewhat controversial stock that may or may not fit your portfolio.

The good news for dividend investors

AT&T is one of a handful of companies that dominate the wireless communications market in the United States. The company has been around for ages because communications are a consistent part of our daily lives. While the business has primarily moved from landlines to cellphones, the same companies still build and maintain the networks.

It’s a household name for dividend investors because it’s traditionally paid a generous dividend that yields over 6% at today’s share price. For some folks, like retirees or those approaching retirement, the dividend is everything. For them, earnings were a positive. That’s because management guided for between $17 billion and $18 billion in free cash flow for this year.

Remember, dividends are a cash expense for a company. The safest dividend is one that a company can pay right out of its cash profits. AT&T’s dividends currently cost the company about $2 billion each quarter, or $8 billion annually. As you can see, that leaves plenty of financial cushion for AT&T if it achieves anywhere near the cash flow management is predicting.

Free cash flow is counted after a business makes capital investments, so that number has already factored in the money AT&T invests to maintain and build its networks. Dividend investors can be reasonably sure that their dividends will continue to flow uninterrupted.

Where AT&T might lose your interest

Everyone has different investing goals, which means a dividend isn’t enough for many others. Those people might not like what they’re about to read. While AT&T’s cash flow looks healthy, management guided for bottom-line earnings that came in well below analysts’ expectations. Management’s guided $2.15 to $2.25 per share was well below the $2.47 analysts hoped for.

Management listed several factors that will drag on 2024 profits, but this lack of earnings growth has been the stock’s Achilles’ heel for some time now. The company earned $2.51 per share in 2014, higher than management’s guidance for 2024!

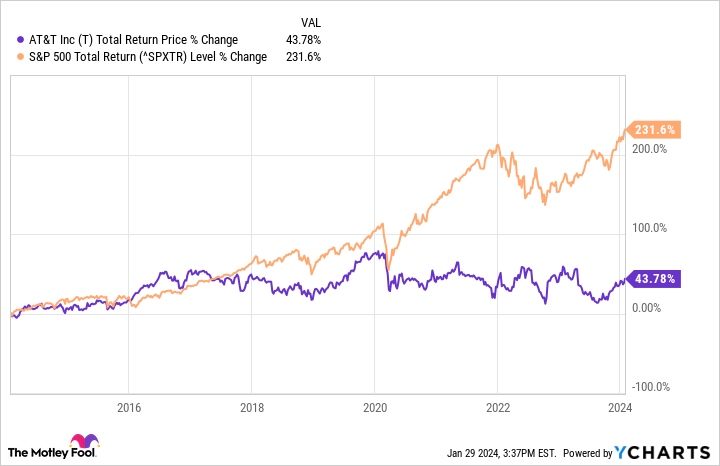

Shrinking profits create an uphill battle for investment returns. It’s no wonder the stock has underperformed the S&P 500 by a mile over the past decade, even factoring in that big dividend.

It’s hard to get excited for now

Telecom isn’t a very high-growth industry in the United States, where the population is growing slowly, and almost everyone has a cellphone by now. Companies must operate efficiently in a mature industry to create value, and AT&T hasn’t done that. It’s still paying down a massive debt from its failed entertainment acquisitions earlier this decade.

Speaking of that debt, management believes it can get AT&T’s leverage down to 2.5 times net debt (total debt minus cash) to EBITDA by the first half of 2025. It also expects earnings growth in 2025, but how much is a gigantic question mark. It’s hard to get excited about AT&T’s total return potential just yet, at least not until investors know what growth they can expect next year and beyond. Until then, it’s hard to call the stock a bargain, even at just 8 times next year’s earnings.

Should you invest $1,000 in AT&T right now?

Before you buy stock in AT&T, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AT&T wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of the S&P 500 since 2002*.

*Stock Advisor returns as of January 29, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

AT&T’s 6.4% Yield Looks Great After Earnings… But There’s Bad News, Too was originally published by The Motley Fool

Signup bonus from