Investors looking for an ultra-high-yield investment opportunity will likely be attracted to Energy Transfer (NYSE: ET). This midstream master limited partnership (MLP) is offering a huge 8.7% distribution yield, which is well above the market’s scant 1.4% yield. But Energy Transfer isn’t the only option in the midstream sector to consider. Comparing it to industry bellwether Enterprise Products Partners (NYSE: EPD) may help you make a better buy, sell, or hold decision.

Energy Transfer’s yield is a winner, but not its distribution

When you pit Energy Transfer against Enterprise Products Partners on distribution yield, Energy Transfer’s 8.7% yield is the winner. Enterprise’s yield is more than a percentage point lower at 7.3%. That’s a big difference if you are a dividend investor trying to live off of the income your portfolio generates.

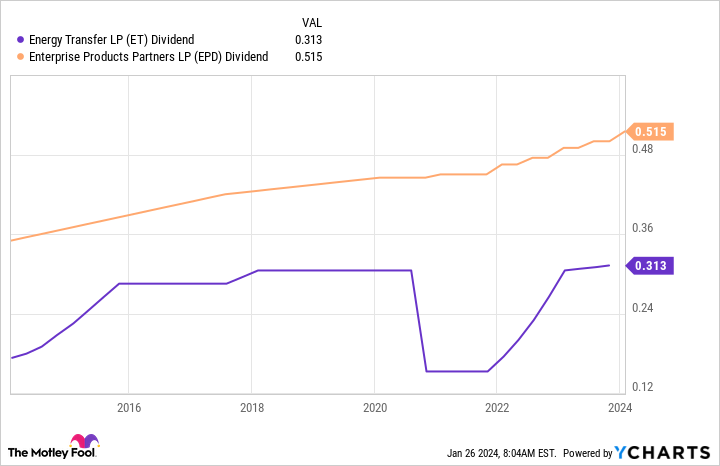

But, if that is what you are trying to do, there’s another bit of information here that you can’t ignore. Enterprise has increased its dividend annually for 25 consecutive years. That period includes the incredibly deep Great Recession and the turbulence around the coronavirus pandemic, which was particularly difficult on the energy industry. Energy Transfer’s distribution history isn’t nearly as good; it materially reduced its distribution during the coronavirus pandemic.

It is hard to live off a distribution that has been cut, even if that cut was only temporary. Basically, just when you would have probably most needed the income from Energy Transfer, the MLP would have let you down.

Energy Transfer’s total returns lag a bit behind

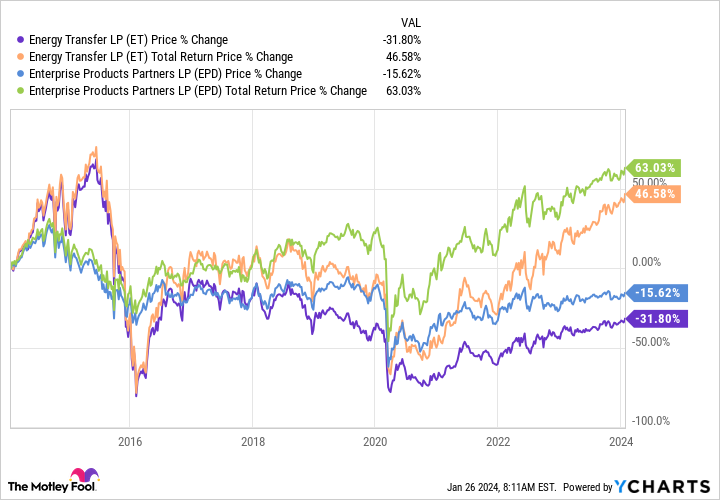

The high yields on offer from Energy Transfer and Enterprise Products Partners are likely to represent the lion’s share of total returns here. This is at least partly because most of the best opportunities in the midstream sector have been exploited at this point. So that distribution cut was a bigger deal than it may at first seem. But the higher yield on offer from Energy Transfer today might give it a leg up in the minds of some investors.

That’s not unreasonable. However, if you take a longer-term view here, the story still favors Enterprise. Looking at the total returns of both Energy Transfer and Enterprise over the past decade, Enterprise comes out on top, as the chart above highlights. Total return assumes that distributions are reinvested. Even if we only consider price change, the comparison still still comes out in favor of Enterprise over that 10-year period.

The past doesn’t predict the future, but add the past performance to Enterprise’s more reliable distribution, and it seems like most investors would be better off than if they owned Energy Transfer.

There’s a trust issue at Energy Transfer

There’s one last nuance here that will be important for conservative income investors to consider. In 2015, Energy Transfer agreed to buy peer Williams Companies (NYSE: WMB). The energy sector started to struggle at about that time, and Energy Transfer got cold feet because going through with the purchase would have required a dividend cut, a material increase in debt, or perhaps both.

It was able to scuttle the deal. But that process included the company issuing convertible securities, a material portion of which were bought by the CEO. The converts would have, effectively, protected the CEO from the impact of a dividend cut if the Williams merger were to have been completed as planned. While that CEO is not the current CEO, he is still the chairman of the board of directors. It would be completely reasonable for investors to have trust issues here. Not that Enterprise Products Partners is perfect, but it doesn’t have that type of trust-damaging event in its history.

There are better choices

High yields are wonderful, but you have to make sure the risk/reward balance makes sense for you. Given Energy Transfer’s less-than-desirable distribution history, historical total returns, and the troubling events around the cancellation of the Williams merger, the risk here seems fairly high. Most investors would probably be better off looking at a lower-yielding peer like Enterprise Products Partners.

Should you invest $1,000 in Energy Transfer right now?

Before you buy stock in Energy Transfer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Energy Transfer: Buy, Sell, or Hold? was originally published by The Motley Fool

Signup bonus from