Billionaire Chris Hohn runs TCI Fund Management, the best performing hedge fund of 2023 and the seventh-most-profitable hedge fund in history, according to LCH Investments. Those credentials make Hohn an interesting case study.

Somewhat surprisingly, Hohn had 31% of his portfolio allocated across two stocks as of the September quarter: Visa (NYSE: V) accounted for 14% of his portfolio, and General Electric (NYSE: GE) accounted for 17% of his portfolio. That capital concentration indicates that Hohn has a great deal of confidence in both businesses.

Visa and General Electric are undoubtedly iconic companies. The former is the most valuable financial services brand in the world, and the latter traces its roots back to Thomas Edison. But iconic companies are not always good stocks. Here’s what investors should know.

1. Visa

Visa operates the largest payments network on the planet. It accounted for 39% of card-based purchase transactions worldwide in 2022, five points more than China-based UnionPay. Visa also powered 61% of purchase transactions in the U.S., more than every other card payments company combined. That scale creates a network effect that engages more merchants and cardholders over time.

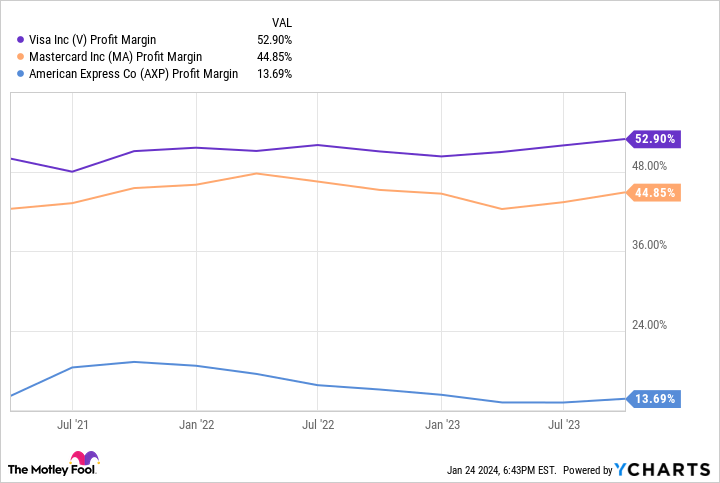

Scale also affords Visa a cost advantage. Payment processing is highly scalable, meaning it becomes incrementally more profitable with each additional transaction. Visa handles more transactions than its peers, so it consistently achieves higher profit margins than competitors like Mastercard and American Express. That advantage is illustrated in the chart below.

With higher profit margins, Visa can outspend its peers as it pursues growth opportunities. For instance, the company is spending money to gain share in emerging markets like Latin America, the Middle East, and Africa. Visa is also investing across its three focus areas: consumers payments, commercial and account-based payments, and value-added services like acceptance, analytics, and consulting solutions.

Looking forward, global payments revenue will increase at 7% annually through 2027, according to research company McKinsey. Visa will undoubtedly benefit from that tailwind, and it should outpace the industry average given its strong market presence.

Indeed, Wall Street expects 11% annual sales growth over the next five years. That consensus estimate makes its current valuation of about 17.4 times sales look tolerable. Investors should strongly consider buying a small position in this blue-chip stock today.

2. General Electric

In 2021 General Electric announced plans to split into three separate businesses. Restructuring started with the separation of GE HealthCare in 2023, and the process will be complete when the energy business GE Vernova separates from the aviation business GE Aerospace later this year. Investors that buy General Electric stock today will end up with shares of GE Vernova and GE Aerospace, but only one of those businesses looks attractive.

GE Vernova will combine General Electric’s Power and Renewable Energy segments. The former provides gas and steam turbines that produce power from fossil fuels, and the latter provides onshore and offshore wind turbines. GE Vernova will face headwinds in both spaces. The transition to renewables will be a source of friction for the Power segment, and intense competition will be a source of friction for the Renewable Energy segment.

Conversely, GE Aerospace is operating from a position of strength. The company is a premier manufacturer of commercial jet engines, and it dominates the market in both manufactured products and maintenance services.

That means GE Aerospace is well positioned to benefit as air travel demand trends higher in the coming years. For context, global airline capacity only recently surpassed pre-COVID levels, according to Bloomberg.

Here is the bottom line: Last year, GE Aerospace grew sales more quickly, earned higher margins, and reported a larger profit than General Electric’s Power and Renewable Energy segments. The makes the aviation business far more attractive than the energy business in my estimation, so I would not consider buying the stock until the separation is complete. At that point, I would reassess the situation based on the valuation of GE Aerospace.

Should you invest $1,000 in Visa right now?

Before you buy stock in Visa, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Visa wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 22, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine has positions in Mastercard and Visa. The Motley Fool has positions in and recommends Mastercard and Visa. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

Billionaire Chris Hohn Has 31% of His Portfolio Invested in 2 Iconic Stocks was originally published by The Motley Fool

Signup bonus from